Investors Aren't Entirely Convinced By TI Cloud Inc.'s (HKG:2167) Revenues

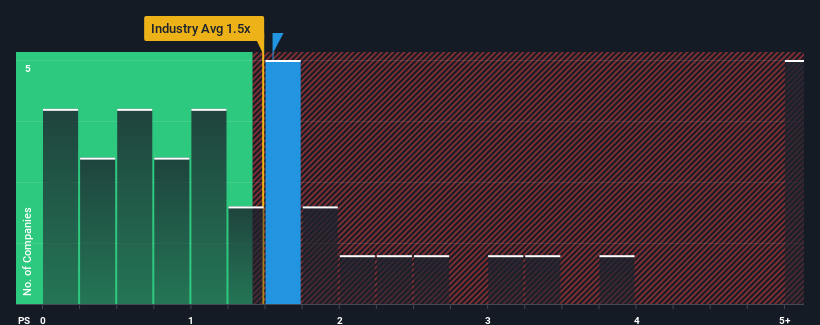

There wouldn't be many who think TI Cloud Inc.'s (HKG:2167) price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S for the Software industry in Hong Kong is very similar. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for TI Cloud

How Has TI Cloud Performed Recently?

Recent times have been advantageous for TI Cloud as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on TI Cloud.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, TI Cloud would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 17% last year. As a result, it also grew revenue by 26% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 25% as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 19% growth forecast for the broader industry.

With this in consideration, we find it intriguing that TI Cloud's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On TI Cloud's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that TI Cloud currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You should always think about risks. Case in point, we've spotted 3 warning signs for TI Cloud you should be aware of, and 2 of them are significant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if TI Cloud might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2167

TI Cloud

Provides cloud-native customer contact solutions that enables enterprises to engage in multi-channel customer interactions in the People's Republic of China and Hong Kong.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives