AInnovation Technology Group Co., Ltd's (HKG:2121) 28% Share Price Plunge Could Signal Some Risk

AInnovation Technology Group Co., Ltd (HKG:2121) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 41% in that time.

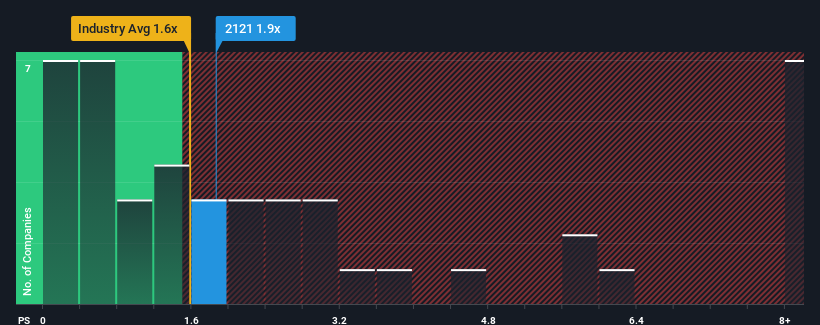

Even after such a large drop in price, there still wouldn't be many who think AInnovation Technology Group's price-to-sales (or "P/S") ratio of 1.9x is worth a mention when the median P/S in Hong Kong's Software industry is similar at about 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for AInnovation Technology Group

What Does AInnovation Technology Group's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, AInnovation Technology Group's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think AInnovation Technology Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is AInnovation Technology Group's Revenue Growth Trending?

AInnovation Technology Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 95% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 5.9% over the next year. With the industry predicted to deliver 23% growth, that's a disappointing outcome.

With this information, we find it concerning that AInnovation Technology Group is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From AInnovation Technology Group's P/S?

AInnovation Technology Group's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

While AInnovation Technology Group's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for AInnovation Technology Group (1 doesn't sit too well with us) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2121

AInnovation Technology Group

Engages in the research, development, and sale of artificial intelligence based software and hardware technology solutions in China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives