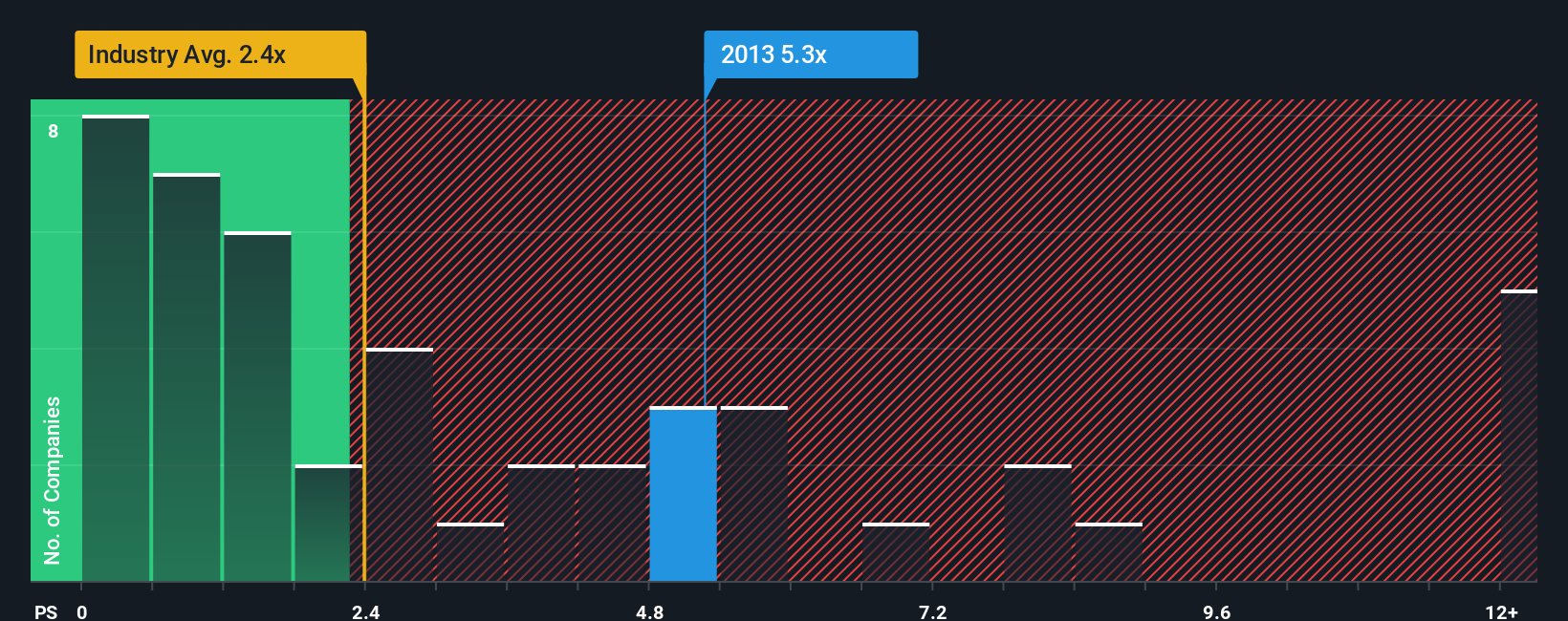

Weimob Inc.'s (HKG:2013) price-to-sales (or "P/S") ratio of 5.3x may look like a poor investment opportunity when you consider close to half the companies in the Software industry in Hong Kong have P/S ratios below 2.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Weimob

How Weimob Has Been Performing

While the industry has experienced revenue growth lately, Weimob's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Weimob's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Weimob?

In order to justify its P/S ratio, Weimob would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 40%. As a result, revenue from three years ago have also fallen 32% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 16% per annum over the next three years. That's shaping up to be materially lower than the 33% per year growth forecast for the broader industry.

With this information, we find it concerning that Weimob is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Weimob trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Weimob is showing 2 warning signs in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Weimob might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2013

Weimob

An investment holding company, provides digital commerce and media services in the People’s Republic of China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives