Top 3 SEHK Stocks Trading Below Estimated Value In August 2024

Reviewed by Simply Wall St

As the Hong Kong market navigates through a period of economic uncertainty, investors are increasingly on the lookout for opportunities to capitalize on undervalued stocks. In this article, we will explore three SEHK stocks that are currently trading below their estimated value in August 2024. Identifying such stocks often involves looking at companies with strong fundamentals and growth potential that may not yet be fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Best Pacific International Holdings (SEHK:2111) | HK$2.19 | HK$4.36 | 49.8% |

| Bosideng International Holdings (SEHK:3998) | HK$3.96 | HK$6.75 | 41.3% |

| BYD Electronic (International) (SEHK:285) | HK$29.70 | HK$53.17 | 44.1% |

| Inspur Digital Enterprise Technology (SEHK:596) | HK$3.31 | HK$5.69 | 41.9% |

| Pacific Textiles Holdings (SEHK:1382) | HK$1.54 | HK$2.85 | 46.1% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$28.55 | HK$56.18 | 49.2% |

| WuXi XDC Cayman (SEHK:2268) | HK$19.78 | HK$37.53 | 47.3% |

| iDreamSky Technology Holdings (SEHK:1119) | HK$2.24 | HK$4.18 | 46.4% |

| Weimob (SEHK:2013) | HK$1.32 | HK$2.24 | 41.2% |

| Vobile Group (SEHK:3738) | HK$1.40 | HK$2.67 | 47.6% |

Let's review some notable picks from our screened stocks.

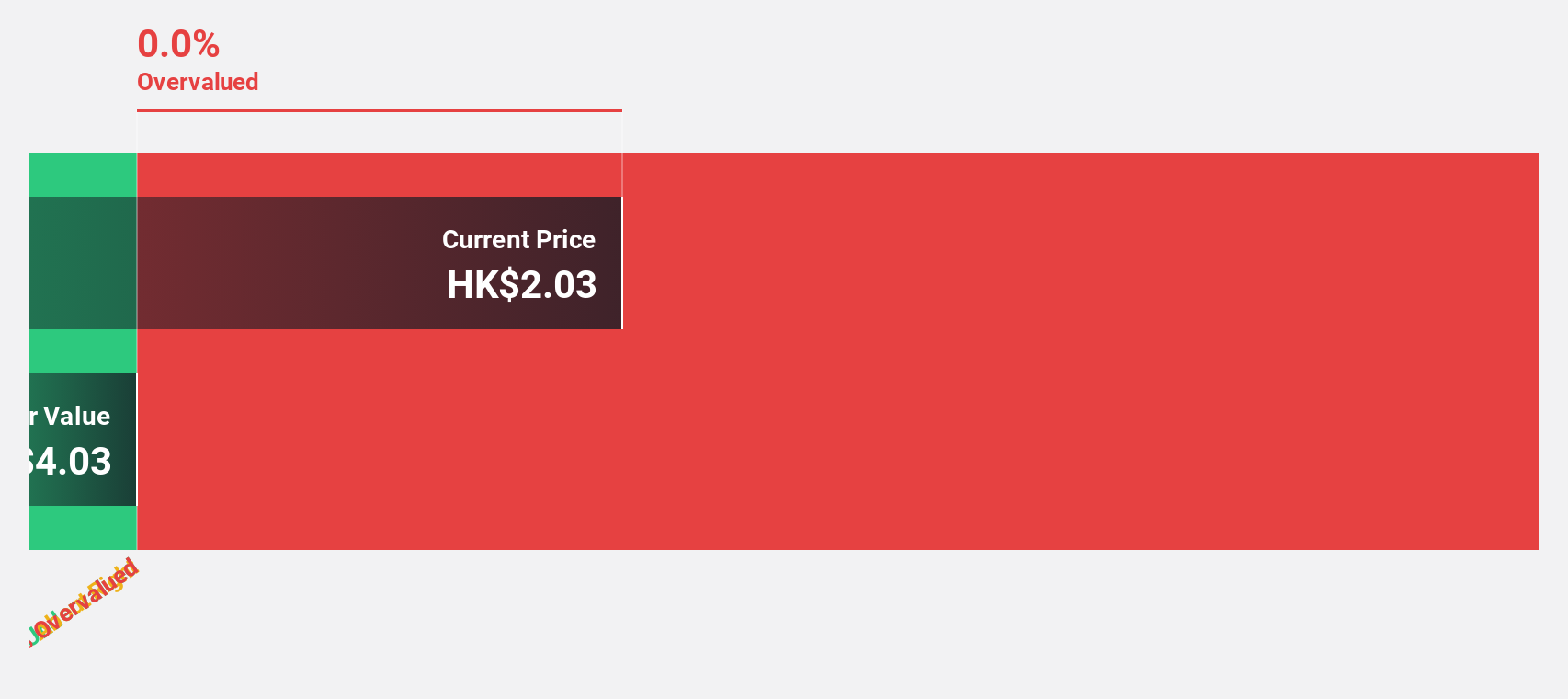

Weimob (SEHK:2013)

Overview: Weimob Inc., an investment holding company with a market cap of HK$4.03 billion, provides digital commerce and media services in the People’s Republic of China.

Operations: The company's revenue segments include Merchant Solutions at CN¥878.28 million and Subscription Solutions at CN¥1.35 billion.

Estimated Discount To Fair Value: 41.2%

Weimob (HK$1.32) is trading at 41.2% below its estimated fair value of HK$2.24, making it highly undervalued based on cash flows. The company's revenue is forecast to grow at 12.2% per year, outpacing the Hong Kong market's average growth of 7.4%. Despite recent shareholder dilution, Weimob is expected to become profitable within the next three years with earnings projected to grow by 109.68% annually, though its Return on Equity is forecasted to be low at 7.4%.

- Upon reviewing our latest growth report, Weimob's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Weimob's balance sheet by reading our health report here.

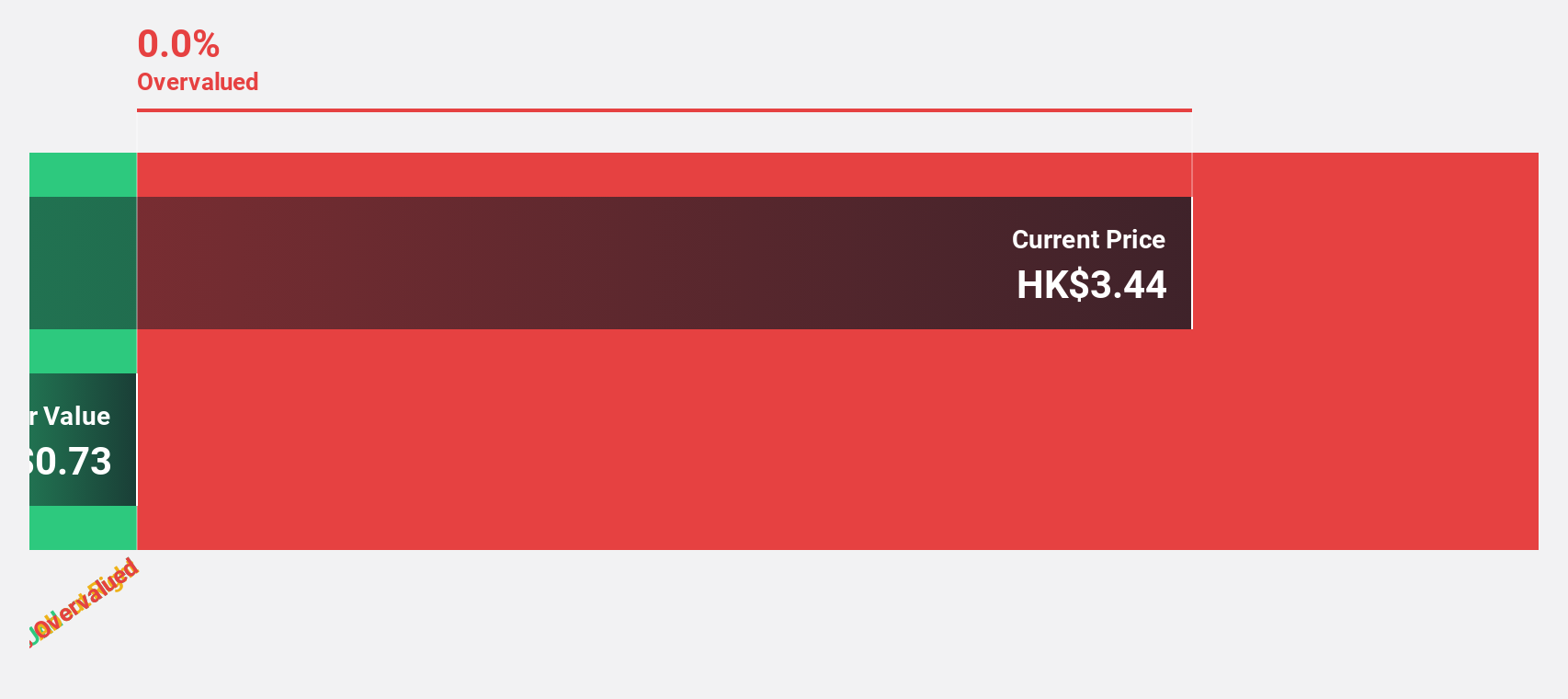

Vobile Group (SEHK:3738)

Overview: Vobile Group Limited, with a market cap of HK$3.16 billion, offers software as a service for digital content assets protection and transactions across the United States, Japan, Mainland China, and internationally.

Operations: The company's revenue segment includes HK$2 billion from offering SaaS for digital content assets protection and transactions.

Estimated Discount To Fair Value: 47.6%

Vobile Group (HK$1.4) is trading at 47.6% below its estimated fair value of HK$2.67, suggesting significant undervaluation based on cash flows. Revenue is forecast to grow at 21.7% annually, outpacing the Hong Kong market's average growth of 7.4%. The company is expected to become profitable within three years with earnings projected to grow by 66.62% annually, though its Return on Equity is forecasted to be low at 6.6%. Recent amendments to the Articles of Association were approved in June 2024.

- The analysis detailed in our Vobile Group growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Vobile Group.

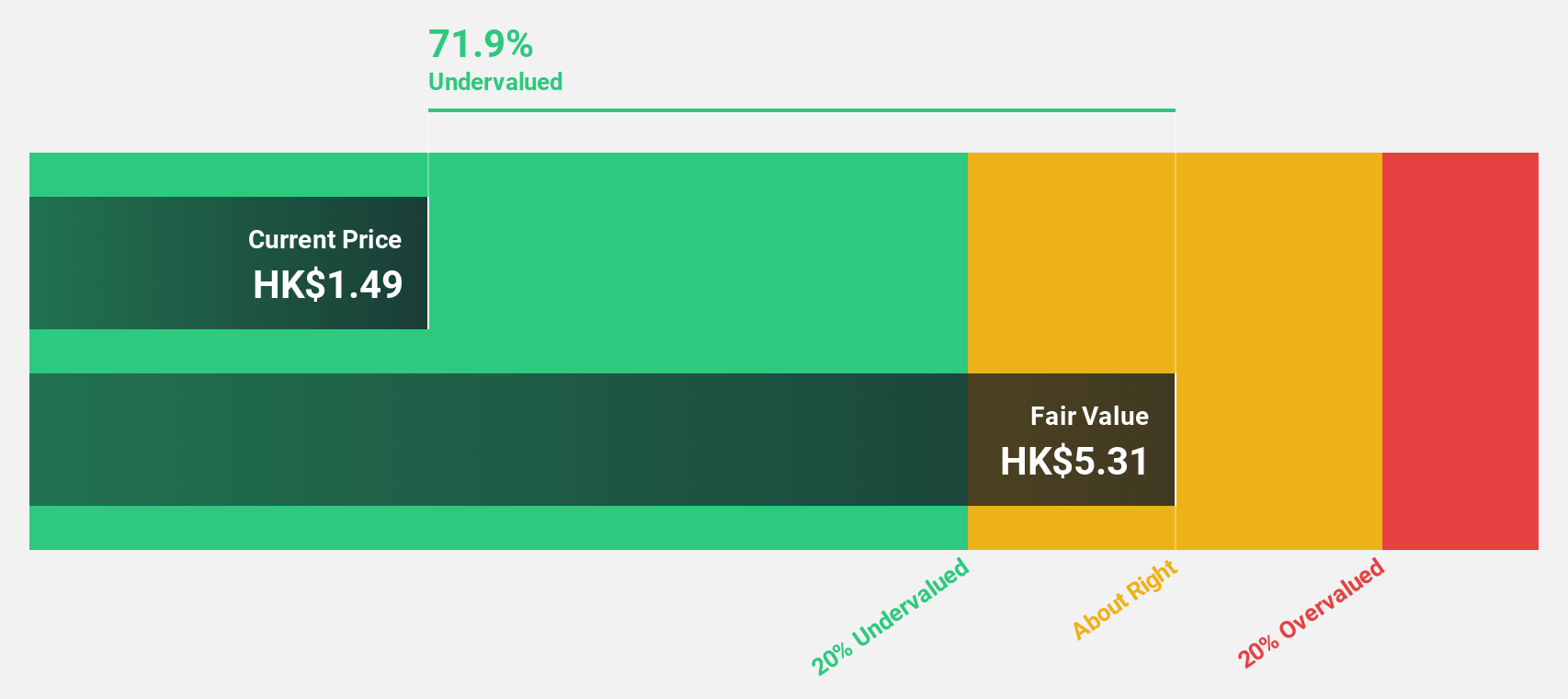

China State Construction Development Holdings (SEHK:830)

Overview: China State Construction Development Holdings Limited, with a market cap of HK$4.56 billion, is an investment holding company involved in general contracting both in Hong Kong and internationally.

Operations: The company's revenue segments include Segment Adjustment at HK$7.77 billion and Operating Management at HK$900.89 million.

Estimated Discount To Fair Value: 15.2%

China State Construction Development Holdings (HK$2.02) is trading at 15.2% below its estimated fair value of HK$2.38, indicating some undervaluation based on cash flows. Earnings are forecast to grow by 23.33% annually, outpacing the Hong Kong market's average growth of 11%. Recent earnings showed a net income increase to HK$550.47 million from HK$436.66 million year-over-year, but the dividend yield of 4.31% is not well covered by free cash flows.

- The growth report we've compiled suggests that China State Construction Development Holdings' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of China State Construction Development Holdings.

Where To Now?

- Embark on your investment journey to our 31 Undervalued SEHK Stocks Based On Cash Flows selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:830

China State Construction Development Holdings

An investment holding company, engages in the general contracting business in Hong Kong and internationally.

Very undervalued with outstanding track record.