There's Reason For Concern Over Weimob Inc.'s (HKG:2013) Massive 46% Price Jump

Despite an already strong run, Weimob Inc. (HKG:2013) shares have been powering on, with a gain of 46% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.5% in the last twelve months.

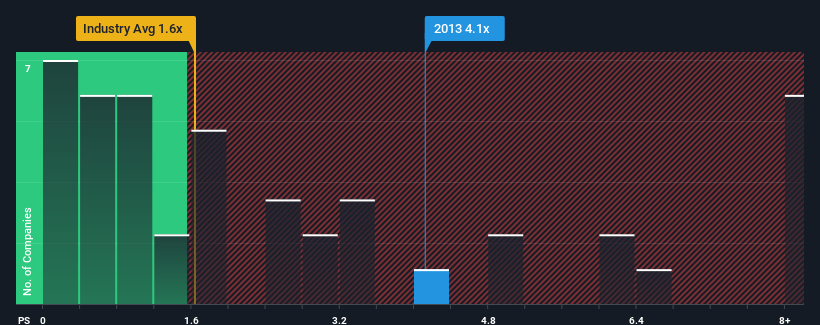

Since its price has surged higher, when almost half of the companies in Hong Kong's Software industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Weimob as a stock not worth researching with its 4.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Weimob

How Weimob Has Been Performing

While the industry has experienced revenue growth lately, Weimob's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Weimob.Is There Enough Revenue Growth Forecasted For Weimob?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Weimob's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. This means it has also seen a slide in revenue over the longer-term as revenue is down 4.3% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 3.3% during the coming year according to the eleven analysts following the company. With the industry predicted to deliver 23% growth, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Weimob's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Weimob's P/S Mean For Investors?

Shares in Weimob have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Weimob, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Weimob is showing 3 warning signs in our investment analysis, and 1 of those can't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Weimob might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2013

Weimob

An investment holding company, provides digital commerce and media services in the People’s Republic of China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives