The Hong Kong market has recently experienced a mix of performance, with the Hang Seng Index declining slightly by 0.45%, reflecting broader concerns about weak manufacturing data and persistent economic challenges. Despite these headwinds, opportunities for discerning investors remain, particularly in identifying undervalued stocks that may offer significant upside potential. In the current market environment, a good stock is often characterized by strong fundamentals and resilience amidst economic uncertainties. Here we explore three SEHK stocks that are estimated to be undervalued by up to 46.6%.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$6.79 | 43.3% |

| Wasion Holdings (SEHK:3393) | HK$5.77 | HK$10.71 | 46.1% |

| BYD Electronic (International) (SEHK:285) | HK$27.70 | HK$53.11 | 47.8% |

| Inspur Digital Enterprise Technology (SEHK:596) | HK$2.89 | HK$5.70 | 49.3% |

| Pacific Textiles Holdings (SEHK:1382) | HK$1.61 | HK$2.99 | 46.1% |

| iDreamSky Technology Holdings (SEHK:1119) | HK$2.18 | HK$4.20 | 48.1% |

| Weimob (SEHK:2013) | HK$1.16 | HK$2.17 | 46.6% |

| MicroPort CardioFlow Medtech (SEHK:2160) | HK$0.72 | HK$1.39 | 48.1% |

| Innovent Biologics (SEHK:1801) | HK$39.95 | HK$73.85 | 45.9% |

| L'Occitane International (SEHK:973) | HK$33.95 | HK$58.44 | 41.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Weimob (SEHK:2013)

Overview: Weimob Inc., an investment holding company with a market cap of HK$3.57 billion, provides digital commerce and media services in the People’s Republic of China.

Operations: The company generates revenue from two main segments: Merchant Solutions (CN¥878.28 million) and Subscription Solutions (CN¥1.35 billion).

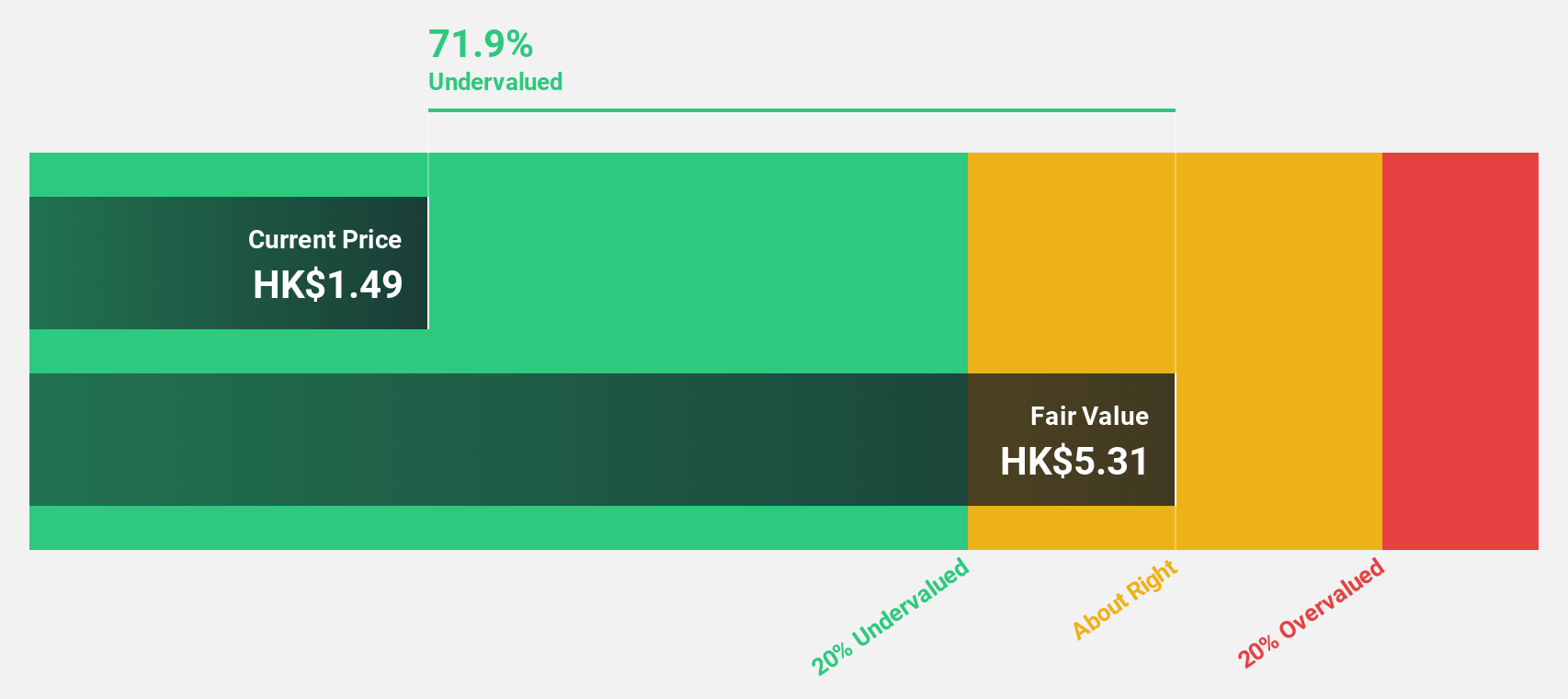

Estimated Discount To Fair Value: 46.6%

Weimob is trading at HK$1.16, significantly below its estimated fair value of HK$2.17, indicating it is highly undervalued based on discounted cash flow (DCF) analysis. Despite recent shareholder dilution, the company’s revenue is forecast to grow 12.2% annually, outpacing the Hong Kong market's growth rate of 7.4%. Additionally, Weimob is expected to achieve profitability within three years with earnings projected to grow substantially at 109.92% per year.

- Insights from our recent growth report point to a promising forecast for Weimob's business outlook.

- Dive into the specifics of Weimob here with our thorough financial health report.

ASMPT (SEHK:522)

Overview: ASMPT Limited, with a market cap of HK$30.32 billion, designs, manufactures, and markets machines, tools, and materials for the semiconductor and electronics assembly industries globally.

Operations: The company's revenue segments include Semiconductor Solutions, generating HK$6.21 billion, and Surface Mount Technology (SMT) Solutions, contributing HK$7.15 billion.

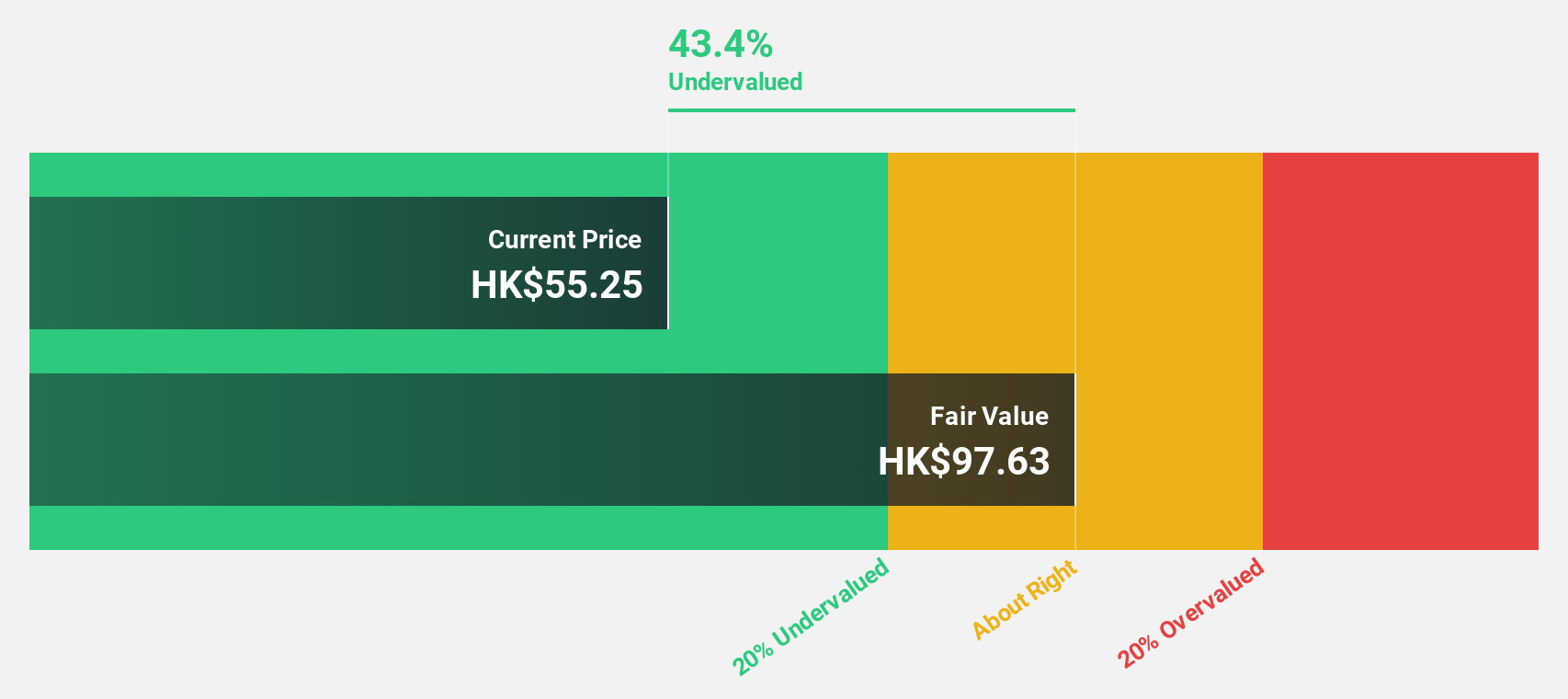

Estimated Discount To Fair Value: 13.9%

ASMPT is trading at HK$73.15, below its estimated fair value of HK$84.95, indicating it is undervalued based on discounted cash flow analysis. Despite a decline in recent earnings and lower profit margins, the company’s revenue and earnings are forecast to grow annually by 13.8% and 42.4%, respectively, outpacing the Hong Kong market averages. However, recent guidance suggests a potential short-term revenue dip due to lower SMT sales for Q3 2024.

- The analysis detailed in our ASMPT growth report hints at robust future financial performance.

- Get an in-depth perspective on ASMPT's balance sheet by reading our health report here.

China State Construction Development Holdings (SEHK:830)

Overview: China State Construction Development Holdings Limited (SEHK:830) is an investment holding company involved in general contracting operations in Hong Kong and internationally, with a market cap of HK$4.40 billion.

Operations: The company's revenue segments include Operating Management (HK$947.12 million), Facade Contracting Works (HK$6.66 billion), and General Contracting Works (HK$1.05 billion).

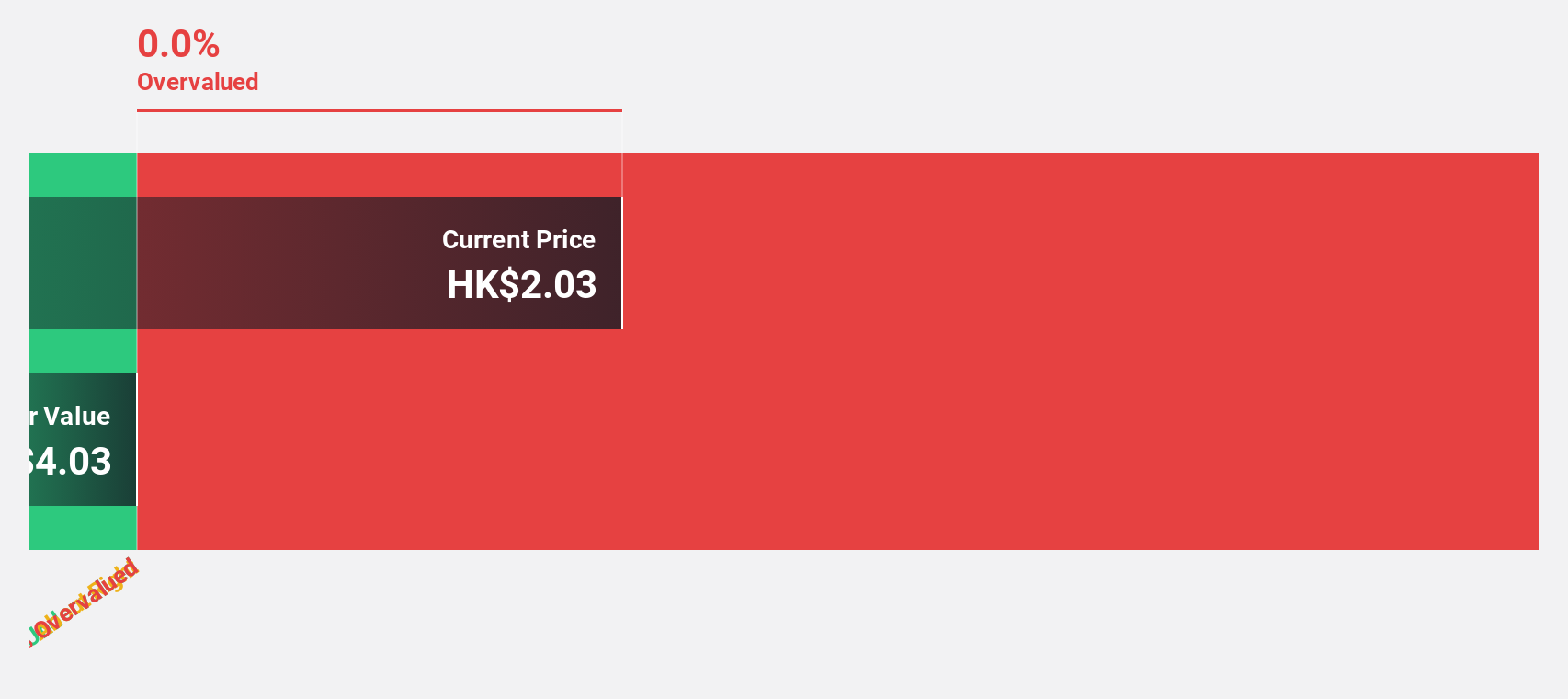

Estimated Discount To Fair Value: 14.5%

China State Construction Development Holdings is trading at HK$1.95, below its estimated fair value of HK$2.28, making it undervalued based on discounted cash flow analysis. The company’s earnings grew by 37.6% last year and are forecast to grow 25.33% annually over the next three years, outpacing market averages. However, its dividend yield of 4.46% isn't well covered by free cash flows, and recent executive changes may impact strategic direction in the short term.

- Our earnings growth report unveils the potential for significant increases in China State Construction Development Holdings' future results.

- Navigate through the intricacies of China State Construction Development Holdings with our comprehensive financial health report here.

Summing It All Up

- Unlock more gems! Our Undervalued SEHK Stocks Based On Cash Flows screener has unearthed 27 more companies for you to explore.Click here to unveil our expertly curated list of 30 Undervalued SEHK Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weimob might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2013

Weimob

An investment holding company, provides digital commerce and media services in the People’s Republic of China.

Excellent balance sheet and good value.