Despite shrinking by HK$127m in the past week, Enterprise Development Holdings (HKG:1808) shareholders are still up 300% over 1 year

It's been a soft week for Enterprise Development Holdings Limited (HKG:1808) shares, which are down 10%. Despite this, the stock is a strong performer over the last year, no doubt about that. Indeed, the share price is up an impressive 300% in that time. So it is important to view the recent reduction in price through that lense. The real question is whether the business is trending in the right direction.

While the stock has fallen 10% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Enterprise Development Holdings

We don't think that Enterprise Development Holdings' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Enterprise Development Holdings grew its revenue by 27% last year. That's a fairly respectable growth rate. While that revenue growth is pretty good the share price performance outshone it, with a lift of 300% as mentioned above. If the profitability is on the horizon then now could be a very exciting time to be a shareholder. Of course, we are always cautious about succumbing to 'fear of missing out' when a stock has shot up strongly.

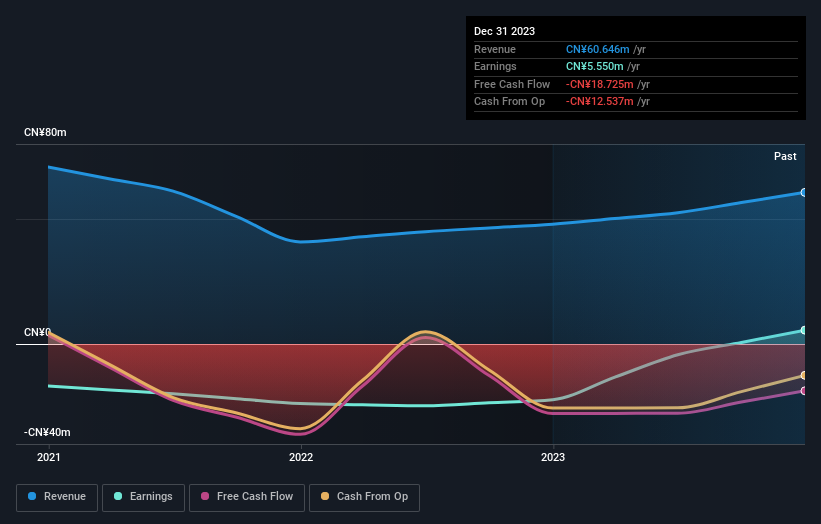

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Dive deeper into the earnings by checking this interactive graph of Enterprise Development Holdings' earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Enterprise Development Holdings shareholders have received a total shareholder return of 300% over the last year. That gain is better than the annual TSR over five years, which is 5%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Enterprise Development Holdings better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Enterprise Development Holdings (of which 1 makes us a bit uncomfortable!) you should know about.

Enterprise Development Holdings is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Development Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1808

Enterprise Development Holdings

An investment holding company, provides integrated business software solutions in the People’s Republic of China and Hong Kong.

Adequate balance sheet with questionable track record.