Should You Be Impressed By Vixtel Technologies Holdings' (HKG:1782) Returns on Capital?

What are the early trends we should look for to identify a stock that could multiply in value over the long term? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. However, after briefly looking over the numbers, we don't think Vixtel Technologies Holdings (HKG:1782) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Vixtel Technologies Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.014 = CN¥2.6m ÷ (CN¥219m - CN¥36m) (Based on the trailing twelve months to June 2020).

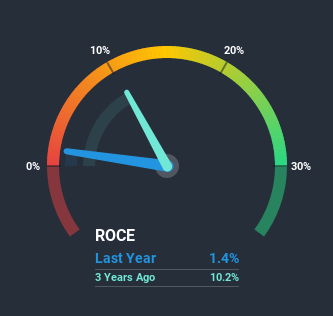

So, Vixtel Technologies Holdings has an ROCE of 1.4%. In absolute terms, that's a low return and it also under-performs the IT industry average of 8.6%.

See our latest analysis for Vixtel Technologies Holdings

Historical performance is a great place to start when researching a stock so above you can see the gauge for Vixtel Technologies Holdings' ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Vixtel Technologies Holdings, check out these free graphs here.

What The Trend Of ROCE Can Tell Us

On the surface, the trend of ROCE at Vixtel Technologies Holdings doesn't inspire confidence. Over the last five years, returns on capital have decreased to 1.4% from 50% five years ago. However it looks like Vixtel Technologies Holdings might be reinvesting for long term growth because while capital employed has increased, the company's sales haven't changed much in the last 12 months. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

On a related note, Vixtel Technologies Holdings has decreased its current liabilities to 16% of total assets. So we could link some of this to the decrease in ROCE. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.

Our Take On Vixtel Technologies Holdings' ROCE

In summary, Vixtel Technologies Holdings is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. Since the stock has declined 66% over the last three years, investors may not be too optimistic on this trend improving either. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

One more thing, we've spotted 2 warning signs facing Vixtel Technologies Holdings that you might find interesting.

While Vixtel Technologies Holdings may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you decide to trade Vixtel Technologies Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1782

International Business Digital Technology

An investment holding company, provides Internet and Web application performance management (APM) products and services to telecommunication operators and large enterprises in Mainland China, Taiwan, and Hong Kong.

Excellent balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives