International Business Digital Technology Limited's (HKG:1782) 26% Jump Shows Its Popularity With Investors

Those holding International Business Digital Technology Limited (HKG:1782) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 43% in the last twelve months.

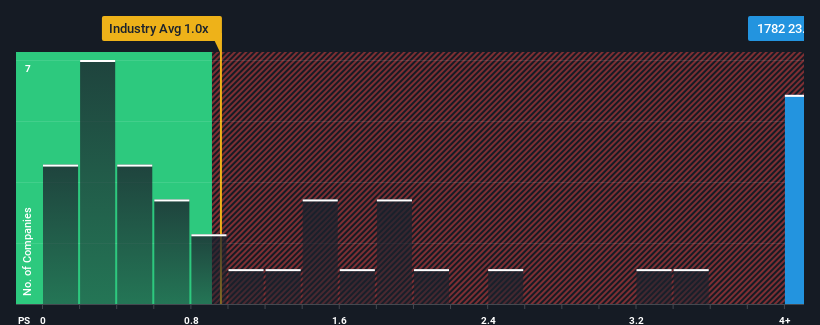

Since its price has surged higher, when almost half of the companies in Hong Kong's IT industry have price-to-sales ratios (or "P/S") below 1x, you may consider International Business Digital Technology as a stock not worth researching with its 23.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for International Business Digital Technology

What Does International Business Digital Technology's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, International Business Digital Technology has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on International Business Digital Technology's earnings, revenue and cash flow.How Is International Business Digital Technology's Revenue Growth Trending?

In order to justify its P/S ratio, International Business Digital Technology would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 32% last year. Pleasingly, revenue has also lifted 44% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 9.5% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we can see why International Business Digital Technology is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Shares in International Business Digital Technology have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that International Business Digital Technology can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with International Business Digital Technology, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on International Business Digital Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1782

International Business Digital Technology

An investment holding company, provides Internet and Web application performance management (APM) products and services to telecommunication operators and large enterprises in Mainland China, Taiwan, and Hong Kong.

Excellent balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives