SUNeVision Holdings' (HKG:1686) Dividend Will Be Increased To HK$0.19

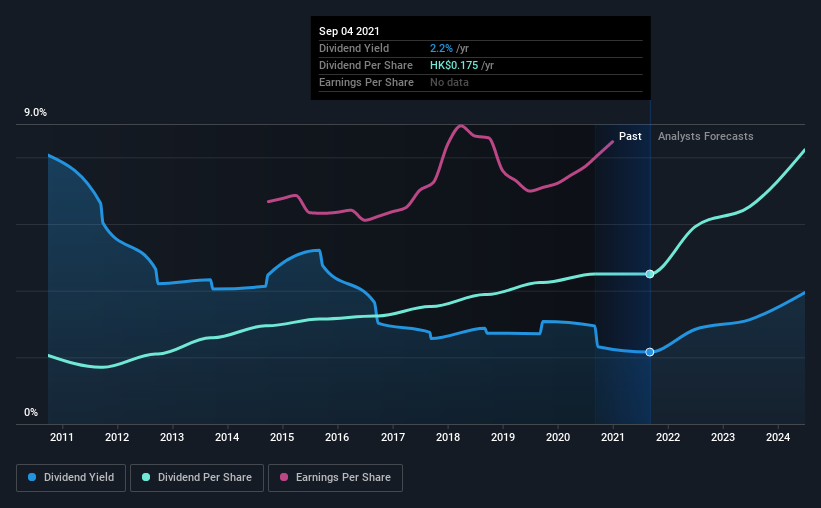

SUNeVision Holdings Ltd.'s (HKG:1686) dividend will be increasing on the 25th of November to HK$0.19, with investors receiving 11% more than last year. This will take the annual payment from 2.2% to 2.4% of the stock price, which is above what most companies in the industry pay.

View our latest analysis for SUNeVision Holdings

SUNeVision Holdings Is Paying Out More Than It Is Earning

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. At the time of the last dividend payment, SUNeVision Holdings was paying out a very large proportion of what it was earning and 448% of cash flows. Paying out such a high proportion of cash flows certainly exposes the company to cutting the dividend if cash flows were to reduce.

Over the next year, EPS is forecast to expand by 13.9%. However, if the dividend continues growing along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 97% over the next year.

SUNeVision Holdings Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2011, the first annual payment was HK$0.08, compared to the most recent full-year payment of HK$0.17. This implies that the company grew its distributions at a yearly rate of about 8.1% over that duration. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

We Could See SUNeVision Holdings' Dividend Growing

The company's investors will be pleased to have been receiving dividend income for some time. SUNeVision Holdings has seen EPS rising for the last five years, at 6.7% per annum. EPS has been growing at a reasonable rate, although with most of the profits being paid out to shareholders, growth prospects could be more limited in the future.

The Dividend Could Prove To Be Unreliable

In summary, while it's always good to see the dividend being raised, we don't think SUNeVision Holdings' payments are rock solid. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 1 warning sign for SUNeVision Holdings that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1686

SUNeVision Holdings

An investment holding company, provides data centre and information technology (IT) facility services in Hong Kong.

Reasonable growth potential and fair value.

Market Insights

Community Narratives