- Hong Kong

- /

- Semiconductors

- /

- SEHK:981

Why Semiconductor Manufacturing International (SEHK:981) Is Down 6.4% After Reporting Strong Q3 Earnings Growth

Reviewed by Sasha Jovanovic

- On November 13, 2025, Semiconductor Manufacturing International Corporation reported earnings for the nine months ended September 30, 2025, with sales rising to CNY 49.51 billion and net income improving to CNY 3.82 billion compared to the previous year.

- This marks a period of clear profitability growth for the company, with basic and diluted earnings per share from continuing operations each increasing to CNY 0.48, reflecting operational momentum.

- We'll explore how this strong revenue and net income growth may influence SMIC's investment narrative and expectations for sustained earnings resilience.

The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

Semiconductor Manufacturing International Investment Narrative Recap

To be a shareholder in Semiconductor Manufacturing International, you’ll need to believe the company can maintain growth through domestic demand and capacity expansion, despite heavy sector competition and pricing pressure. The strong nine-month earnings release underscores recent operational momentum, but it does not significantly change the main near-term catalyst: sustainable volume growth driven by high factory utilization, nor does it eliminate the most pressing risk, overcapacity amid persistent capital expenditure and soft international demand.

One announcement especially relevant to the latest earnings is the company’s recent guidance from August, maintaining a cautious gross margin outlook (18% to 20%) for the third quarter. This context reminds investors that, while sales and profit continue to improve, management is closely watching margin pressure as SMIC ramps up production and balances higher capacity with market demand.

However, investors should also be aware that, in contrast to these strong headline figures, margin pressure and large capital commitments could still present...

Read the full narrative on Semiconductor Manufacturing International (it's free!)

Semiconductor Manufacturing International's outlook anticipates $12.6 billion in revenue and $1.5 billion in earnings by 2028. This is based on a 12.7% annual revenue growth rate and reflects an increase in earnings of approximately $923 million from current earnings of $576.9 million.

Uncover how Semiconductor Manufacturing International's forecasts yield a HK$69.38 fair value, in line with its current price.

Exploring Other Perspectives

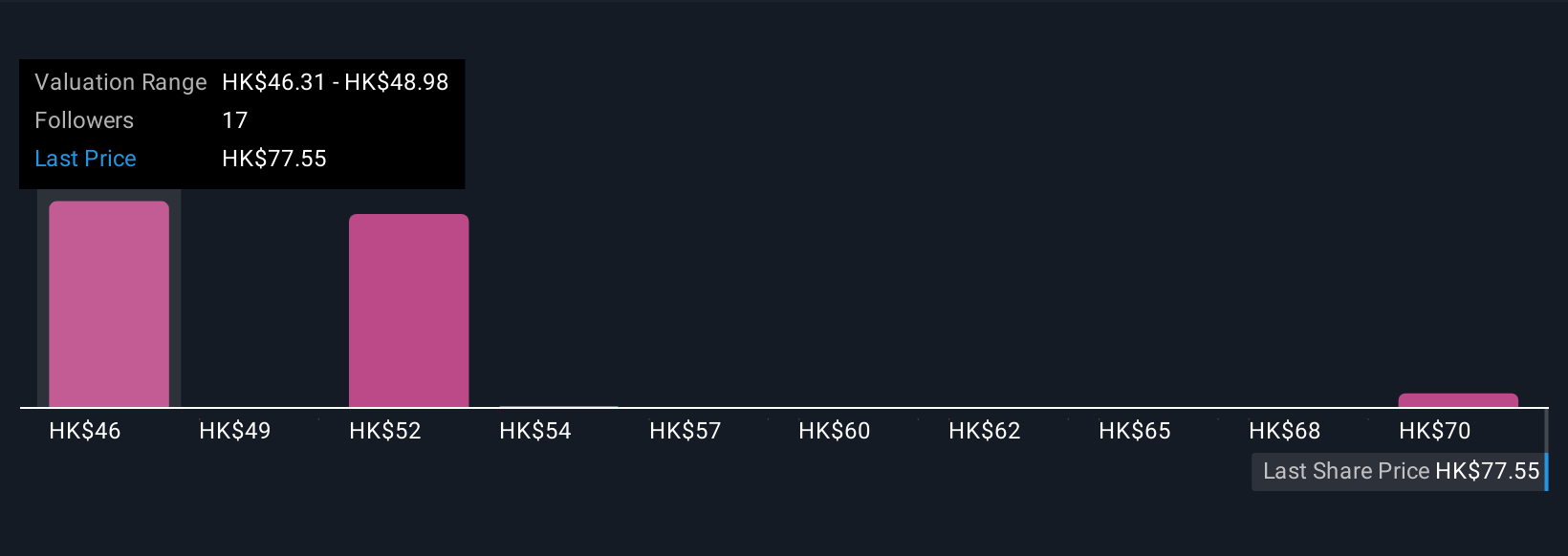

Seven recent fair value estimates from the Simply Wall St Community range between HK$35.51 and HK$89.97 per share. With this diversity, keep in mind that margin compression and high expenditures remain concerns for many market participants, so examine several viewpoints before deciding.

Explore 7 other fair value estimates on Semiconductor Manufacturing International - why the stock might be worth 48% less than the current price!

Build Your Own Semiconductor Manufacturing International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Semiconductor Manufacturing International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Semiconductor Manufacturing International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Semiconductor Manufacturing International's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:981

Semiconductor Manufacturing International

An investment holding company, engages in the manufacture, testing, and sale of integrated circuits wafer and various compound semiconductors in the United States, China, and Eurasia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives