As global markets react to cooling inflation and strong earnings, major U.S. stock indexes have been propelled higher, with value stocks outperforming growth shares significantly. Amid this backdrop of economic optimism and potential rate adjustments, investors often turn to dividend stocks as a reliable source of income, especially those offering yields between 4.5% and 8.2%. In such a dynamic market environment, selecting dividend stocks that not only provide attractive yields but also demonstrate stability can be an effective strategy for income-focused investors seeking to navigate the current financial landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.74% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.17% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.09% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1997 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

China Electronics Huada Technology (SEHK:85)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Electronics Huada Technology Company Limited is an investment holding company focused on the design, development, and sale of integrated circuit chips in the People’s Republic of China, with a market cap of approximately HK$2.60 billion.

Operations: The company's revenue segment is primarily derived from the design and sale of integrated circuit chips, amounting to HK$2.57 billion.

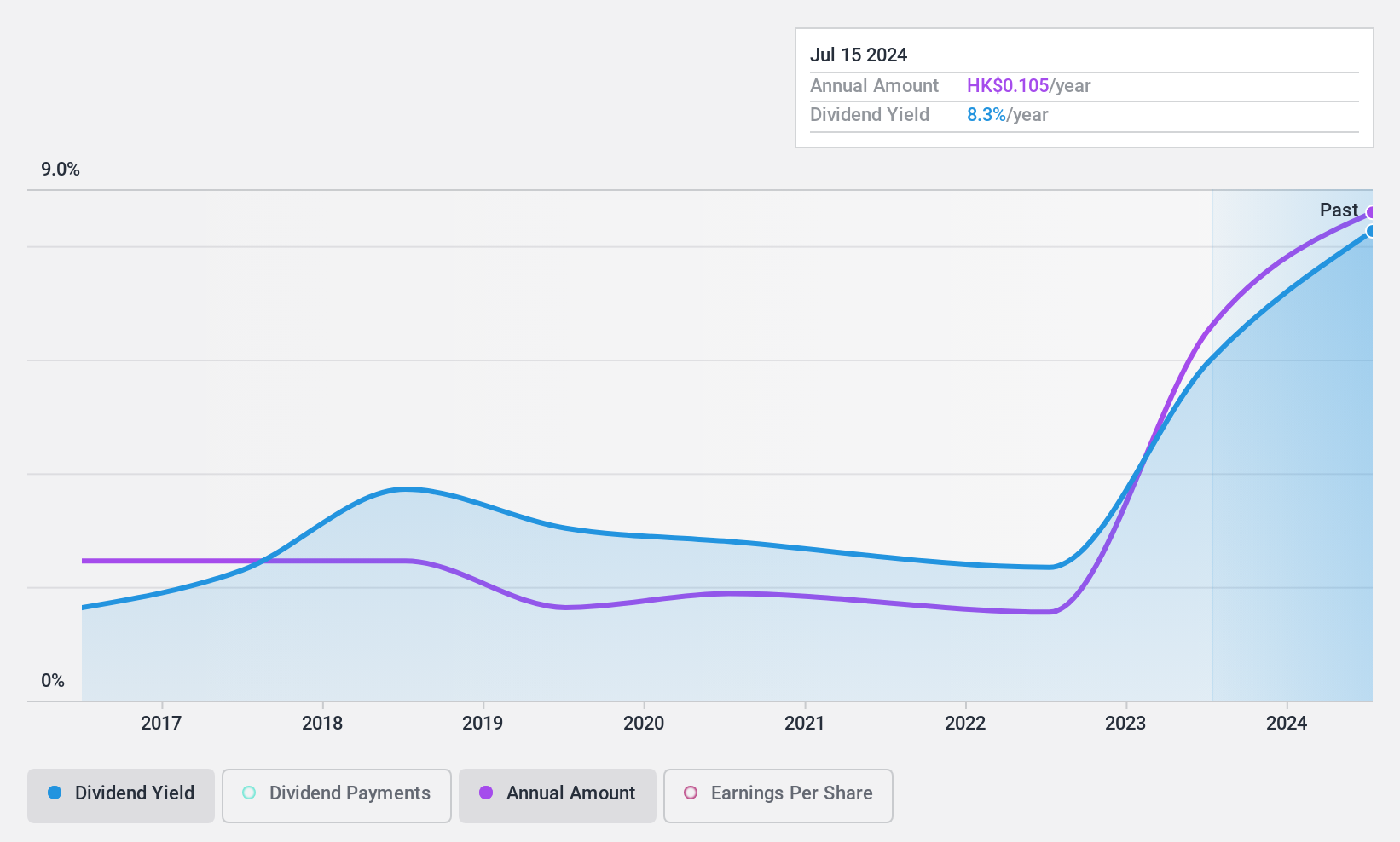

Dividend Yield: 8.2%

China Electronics Huada Technology offers a dividend yield in the top 25% of Hong Kong market payers, with a payout ratio of 48.1%, indicating good earnings coverage. The price-to-earnings ratio is favorable at 5.9x compared to the market average. However, its dividend history has been volatile and unreliable over the past decade despite recent growth, and profit margins have decreased from last year. Recent board changes may influence future strategy and stability.

- Take a closer look at China Electronics Huada Technology's potential here in our dividend report.

- According our valuation report, there's an indication that China Electronics Huada Technology's share price might be on the expensive side.

Boai NKY Medical Holdings (SZSE:300109)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boai NKY Medical Holdings Ltd. operates in the fine chemical and medical care sectors both in China and internationally, with a market cap of CN¥7.12 billion.

Operations: Boai NKY Medical Holdings Ltd. generates revenue through its operations in the fine chemical and medical care sectors, serving both domestic and international markets.

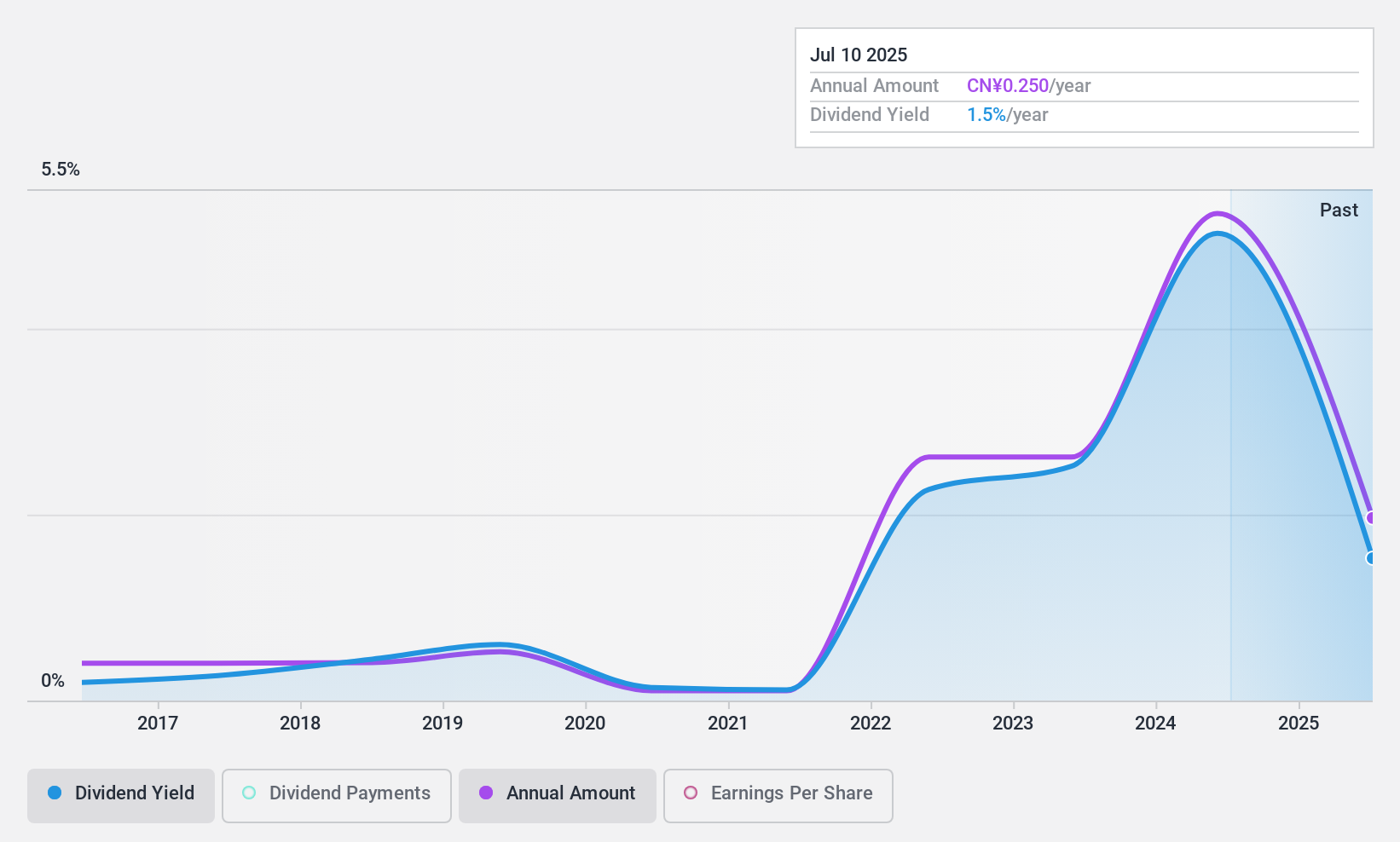

Dividend Yield: 4.5%

Boai NKY Medical Holdings' dividend yield is among the top 25% in China, yet its history shows volatility and unreliability over the past decade. The current payout ratio of 77% suggests earnings coverage, but a high cash payout ratio of 258.4% indicates poor coverage by free cash flows. Despite a favorable price-to-earnings ratio of 17.8x against the market average, recent earnings have declined, with net income dropping to CNY 311.24 million from CNY 404.92 million last year.

- Navigate through the intricacies of Boai NKY Medical Holdings with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Boai NKY Medical Holdings is trading beyond its estimated value.

TSI HoldingsLtd (TSE:3608)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TSI Holdings Co., Ltd. is involved in the planning, manufacturing, and sale of clothing both in Japan and internationally, with a market cap of ¥90.13 billion.

Operations: TSI Holdings Ltd. generates revenue primarily from its Apparel Related segment, which accounts for ¥150.80 billion.

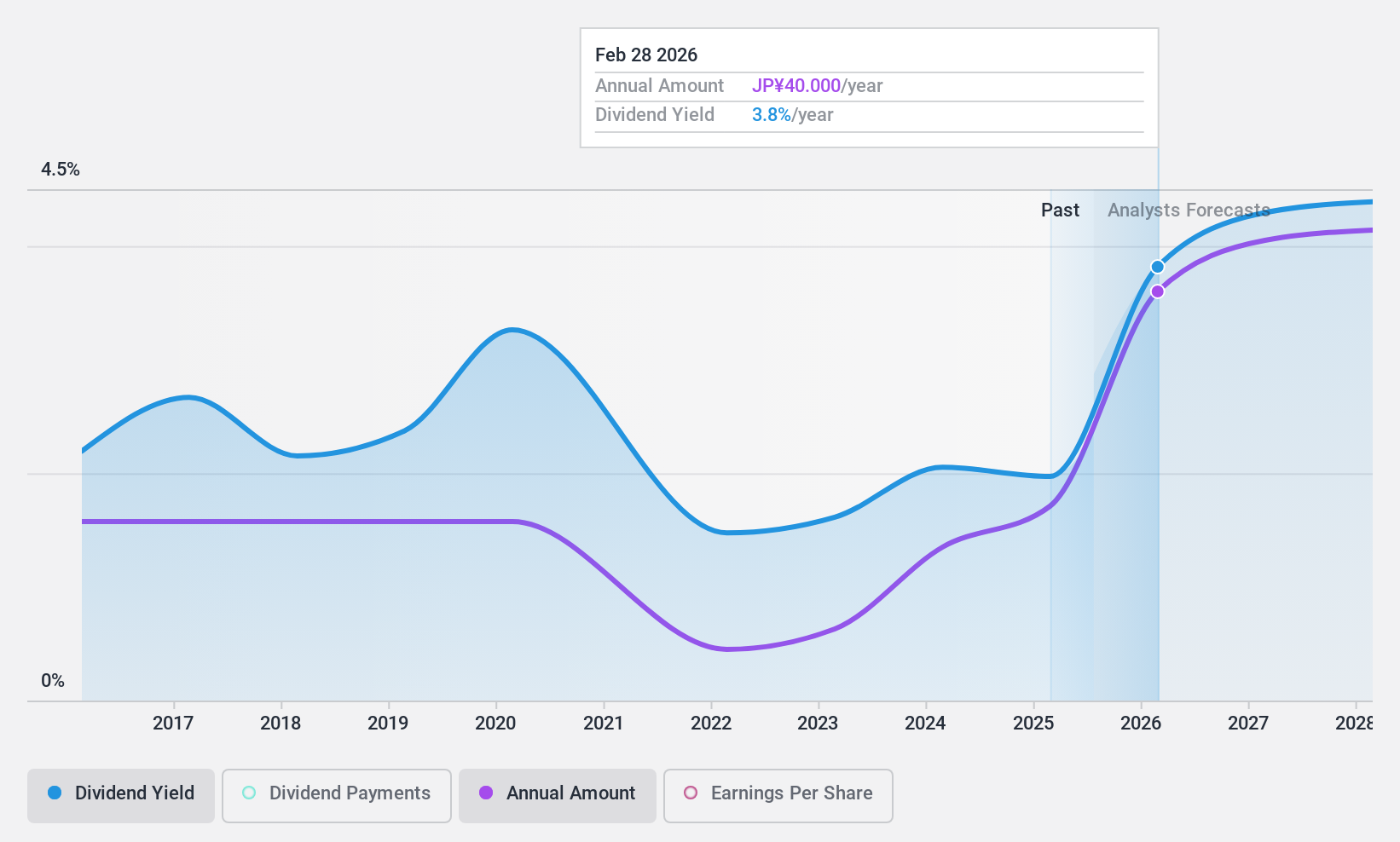

Dividend Yield: 5.1%

TSI Holdings recently announced a significant special dividend, raising its year-end forecast to ¥65 per share. Despite this increase, the company's dividends are not well covered by free cash flows due to a high cash payout ratio of 472.6%. While the dividend yield is in Japan's top 25%, historical volatility and unreliability persist. The stock trades at a notable discount to its estimated fair value but has experienced considerable share price volatility recently.

- Click here to discover the nuances of TSI HoldingsLtd with our detailed analytical dividend report.

- The valuation report we've compiled suggests that TSI HoldingsLtd's current price could be inflated.

Where To Now?

- Dive into all 1997 of the Top Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TSI HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3608

TSI HoldingsLtd

Engages in the planning, manufacture, and sale of clothing in Japan and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives