- Philippines

- /

- Construction

- /

- PSE:HI

Asian Market Highlights: Top Penny Stocks For November 2025

Reviewed by Simply Wall St

As the Asian markets navigate a landscape marked by economic shifts and policy adjustments, investors are keenly observing how these changes influence various sectors. Despite the vintage connotation of "penny stocks," they remain a relevant investment area, offering potential growth opportunities at lower price points. This article explores three penny stocks in Asia that combine robust financials with promising prospects, highlighting their potential to uncover hidden value amidst current market conditions.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.76 | THB1.16B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.50 | HK$2.07B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.06 | SGD429.61M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.92 | THB2.95B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.099 | SGD51.83M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.35 | SGD13.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.96 | HK$2.57B | ✅ 3 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.04 | NZ$148.04M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.86 | NZ$237.89M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 938 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

House of Investments (PSE:HI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: House of Investments, Inc. is an investment holding company involved in automotive, property and property services, financial services, and education sectors in the Philippines and internationally, with a market cap of ₱5.88 billion.

Operations: There are no reported revenue segments for this company.

Market Cap: ₱5.88B

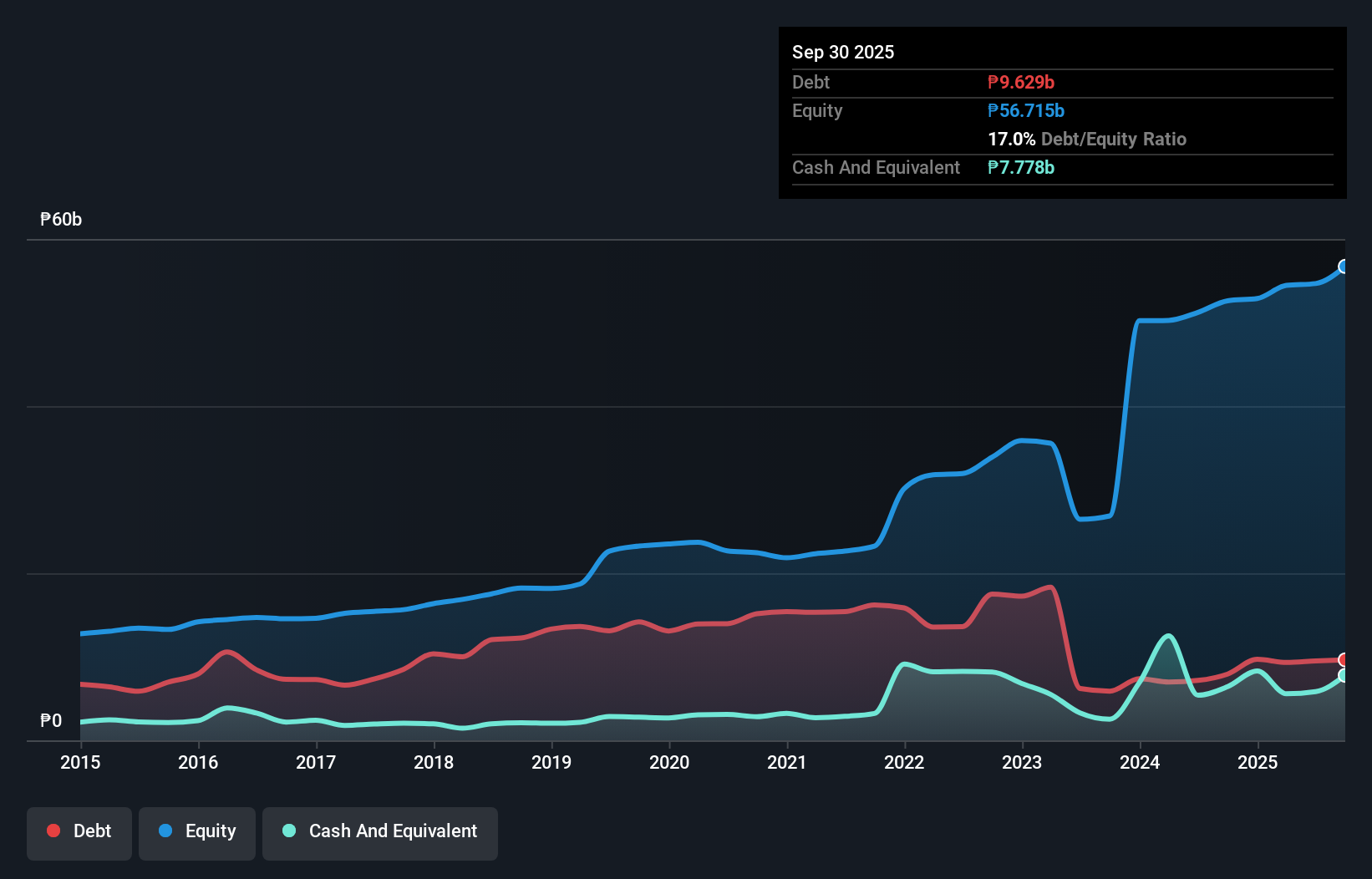

House of Investments, Inc. has demonstrated significant financial stability and growth potential despite a decrease in sales for the third quarter compared to last year. The company's net income showed substantial improvement, rising from ₱352.06 million to ₱1,278.39 million year-over-year for the same period, indicating strong profitability growth over recent years with earnings increasing by 31% last year alone. Its debt management is commendable with a reduced debt to equity ratio and sufficient interest coverage through earnings before interest and taxes (EBIT). However, short-term liabilities exceed short-term assets slightly, presenting a potential risk factor for investors.

- Unlock comprehensive insights into our analysis of House of Investments stock in this financial health report.

- Assess House of Investments' previous results with our detailed historical performance reports.

New Focus Auto Tech Holdings (SEHK:360)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: New Focus Auto Tech Holdings Limited is an investment holding company that manufactures and sells electronic and power-related automotive parts and accessories across the People’s Republic of China, the United States, Europe, and the Asia Pacific with a market cap of HK$860.85 million.

Operations: The company's revenue is derived from two main segments: CN¥395.25 million from the Manufacturing and Trading Business and CN¥155.81 million from the Automobile Dealership and Service Business.

Market Cap: HK$860.85M

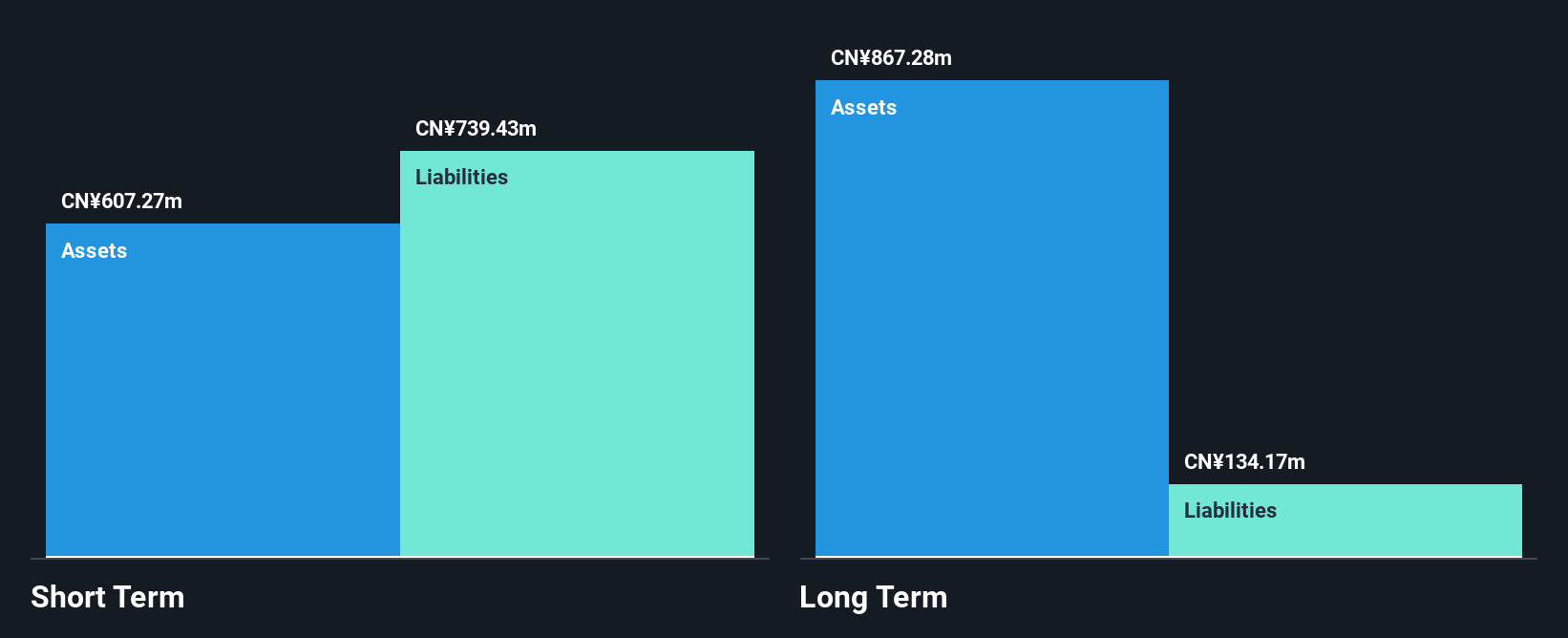

New Focus Auto Tech Holdings Limited, while unprofitable, has managed to reduce its losses by a noteworthy rate over the past five years. The company's short-term assets fall short of covering its liabilities, indicating potential liquidity concerns despite having more cash than debt. Its revenue streams from manufacturing and trading alongside automobile dealership services highlight operational breadth but are overshadowed by increased net losses recently reported. Regulatory challenges have also surfaced with disciplinary actions taken against directors for listing rule breaches, though compliance steps have been completed. The board's inexperience may impact strategic direction and governance stability moving forward.

- Navigate through the intricacies of New Focus Auto Tech Holdings with our comprehensive balance sheet health report here.

- Learn about New Focus Auto Tech Holdings' historical performance here.

Genes Tech Group Holdings (SEHK:8257)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Genes Tech Group Holdings Company Limited is an investment holding company that offers turnkey solutions and trades in used semiconductor manufacturing equipment and parts, with a market cap of HK$229 million.

Operations: The company's revenue is derived from two main segments: NT$305.54 million from providing turnkey solutions and NT$676.72 million from trading parts and used semiconductor manufacturing equipment.

Market Cap: HK$229M

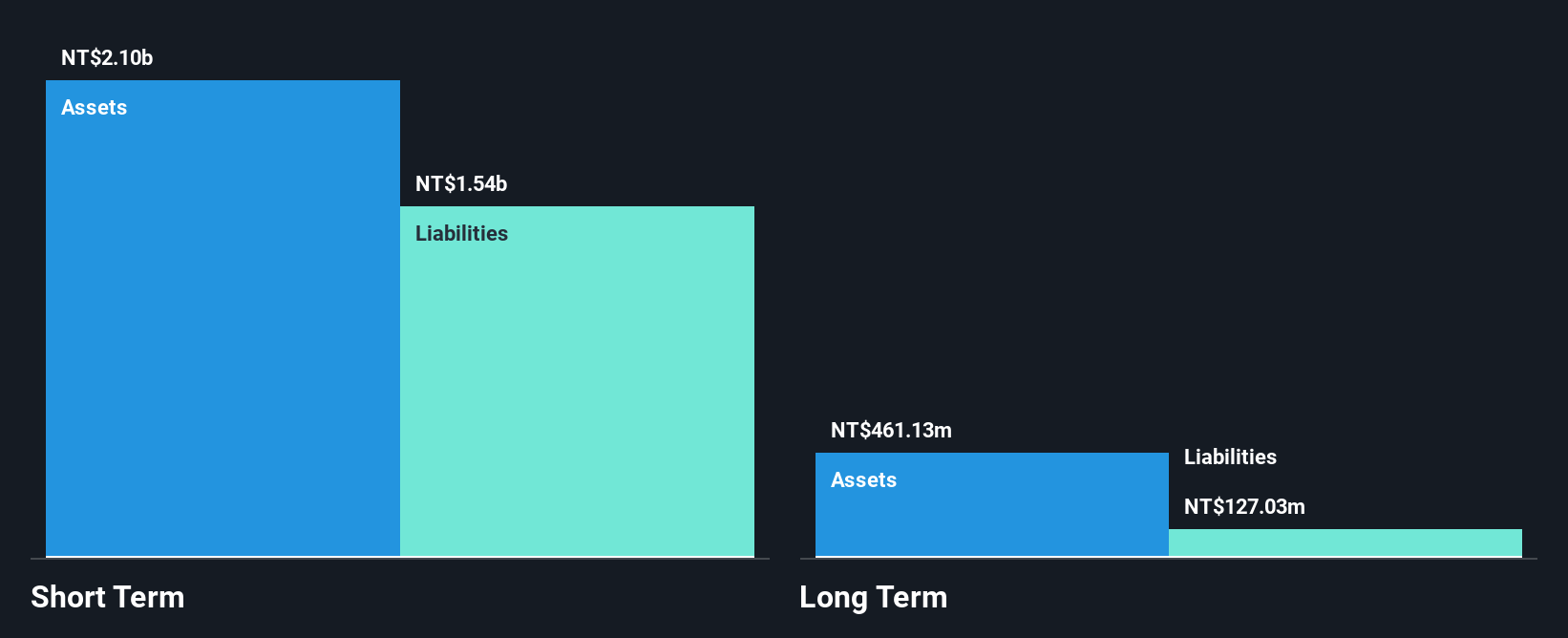

Genes Tech Group Holdings has shown resilience with a market cap of HK$229 million, reporting sales of TWD 585.31 million for the half year ended June 2025. The company benefits from a seasoned management team and board, with average tenures exceeding industry norms. Despite negative earnings growth over the past year, its debt is well managed and covered by operating cash flow and EBIT, indicating financial stability. However, high share price volatility and declining profit margins present challenges. The company's short-term assets comfortably cover both short- and long-term liabilities, underscoring solid asset management practices despite low return on equity.

- Dive into the specifics of Genes Tech Group Holdings here with our thorough balance sheet health report.

- Gain insights into Genes Tech Group Holdings' historical outcomes by reviewing our past performance report.

Make It Happen

- Gain an insight into the universe of 938 Asian Penny Stocks by clicking here.

- Looking For Alternative Opportunities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if House of Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:HI

House of Investments

An investment holding company, engages in the automotive, property and property services, financial services, and education businesses in the Philippines and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives