- Hong Kong

- /

- Semiconductors

- /

- SEHK:522

A Look at ASMPT (SEHK:522) Valuation Following Upbeat Q4 Revenue Guidance and Q3 Loss

Reviewed by Simply Wall St

ASMPT (SEHK:522) drew attention today following its announcement of fourth-quarter revenue guidance that tops market consensus. Solid growth is expected both quarter-on-quarter and year-on-year, fueled by performance in both SEMI and SMT divisions.

See our latest analysis for ASMPT.

ASMPT shares have recently experienced some volatility, with a 7-day share price return of -6.4% as the market weighs its upbeat Q4 outlook alongside last quarter’s loss. Still, the stock’s 20.7% share price return over the past three months suggests that momentum has been rebuilding. Its 1-year total shareholder return is still modestly negative. Longer-term investors who bought three years ago are sitting on an impressive 77% total shareholder return, which highlights the stock’s rebound potential as market sentiment shifts on growth prospects.

If ASMPT’s latest momentum makes you wonder what other fast-moving opportunities are out there, now is a great time to explore fast growing stocks with high insider ownership.

With ASMPT coming off a loss but projecting strong revenue growth ahead, the big question is whether its rebound story leaves room for upside or if the current share price already factors in the company’s new momentum.

Most Popular Narrative: 13.3% Undervalued

According to the most widely followed narrative, ASMPT’s projected fair value stands at HK$94.13, which is notably above the latest close of HK$81.65. This valuation reflects analyst expectations for a powerful earnings turnaround and stronger profitability ahead, despite the company’s current unprofitability and sector competition.

ASMPT's differentiated technologies (notably Active Oxide Removal and next-gen hybrid bonding) and engagements with top AI players, leading foundries, OSATs, and IDMs position the company to capture a growing share of future technology upgrades, supporting higher average selling prices and improved gross margins.

Want to see the bold predictions driving this valuation? There is a set of aggressive earnings and margin forecasts behind the target that most will find surprising. Discover what analysts believe could transform ASMPT’s financial profile and where they see the next big leap coming. Do not miss the detailed assumptions that shape this upbeat projection.

Result: Fair Value of $94.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ASMPT’s growth remains exposed due to its heavy reliance on a small cluster of advanced packaging customers and persistent pricing pressure in the China market.

Find out about the key risks to this ASMPT narrative.

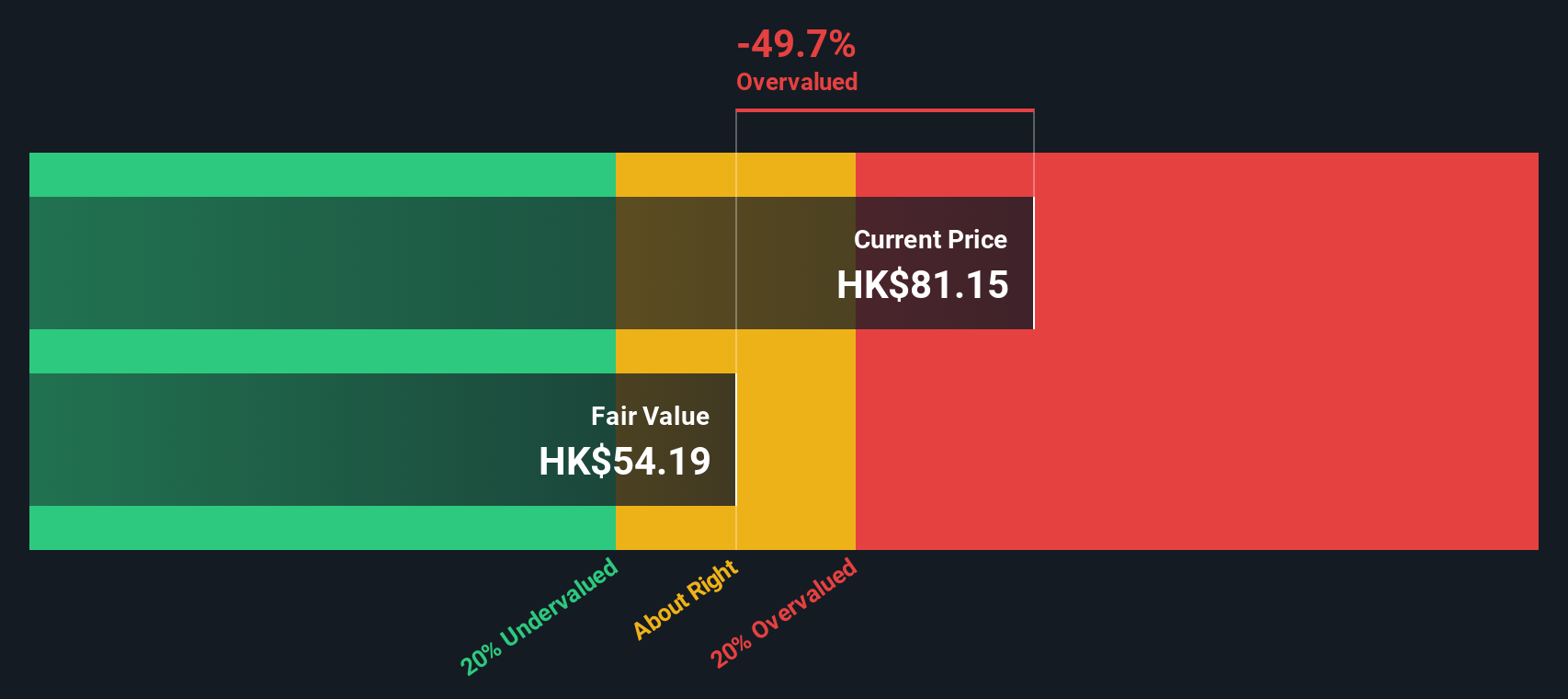

Another View: DCF Model Offers a Cautious Perspective

While the fair value narrative points to ASMPT being undervalued, our SWS DCF model provides a different perspective. According to its cash flow projections, ASMPT’s shares (at HK$81.65) are actually trading above the estimated fair value (HK$73.89), which may suggest less room for upside than optimistic forecasts imply. How should investors reconcile this stark difference between approaches?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ASMPT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ASMPT Narrative

If you have different insights or want to reach your own conclusions, you can quickly build your own ASMPT story in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding ASMPT.

Looking for More Investment Ideas?

Put yourself ahead of the market curve and handpick standout opportunities today using the Simply Wall Street Screener’s tailored filters. These focused strategies can help surface tomorrow’s winners.

- Capture rapid growth potential and unearth the next big thing with these 3598 penny stocks with strong financials before the crowd takes notice.

- Start building steady income streams by tapping into these 18 dividend stocks with yields > 3% with competitive yields and robust financials.

- Join the technology revolution by targeting these 26 AI penny stocks poised for leadership in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:522

ASMPT

An investment holding company, engages in the design, manufacture, and marketing of machines, tools, and materials used in the semiconductor and electronics assembly industries internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion