- Hong Kong

- /

- Semiconductors

- /

- SEHK:3800

GCL Technology Holdings Limited's (HKG:3800) Share Price Is Still Matching Investor Opinion Despite 26% Slump

The GCL Technology Holdings Limited (HKG:3800) share price has fared very poorly over the last month, falling by a substantial 26%. Longer-term shareholders would now have taken a real hit with the stock declining 7.7% in the last year.

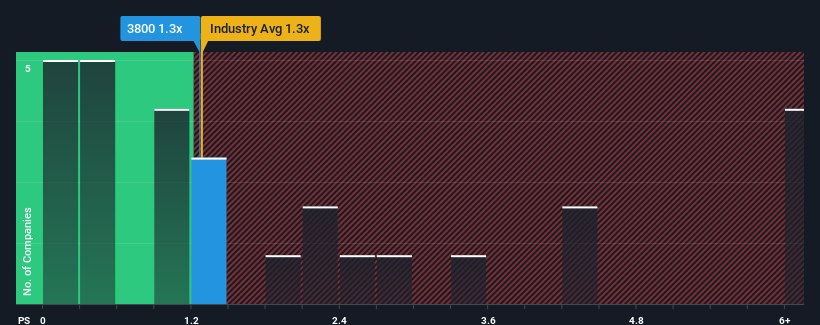

Although its price has dipped substantially, it's still not a stretch to say that GCL Technology Holdings' price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" compared to the Semiconductor industry in Hong Kong, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for GCL Technology Holdings

What Does GCL Technology Holdings' Recent Performance Look Like?

GCL Technology Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on GCL Technology Holdings.How Is GCL Technology Holdings' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like GCL Technology Holdings' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 49% decrease to the company's top line. Still, the latest three year period has seen an excellent 33% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 19% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 17% per year, which is not materially different.

With this information, we can see why GCL Technology Holdings is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Following GCL Technology Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that GCL Technology Holdings maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for GCL Technology Holdings that you should be aware of.

If you're unsure about the strength of GCL Technology Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3800

GCL Technology Holdings

Manufactures and sells polysilicon and wafers products in the People’s Republic of China and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives