- Hong Kong

- /

- Semiconductors

- /

- SEHK:1665

Announcing: Pentamaster International (HKG:1665) Stock Increased An Energizing 111% In The Last Year

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Pentamaster International Limited (HKG:1665) share price has soared 111% return in just a single year. It's also good to see the share price up 11% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 11% in 90 days). And shareholders have also done well over the long term, with an increase of 58% in the last three years.

See our latest analysis for Pentamaster International

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year, Pentamaster International actually saw its earnings per share drop 13%.

So we don't think that investors are paying too much attention to EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We doubt the modest 1.1% dividend yield is doing much to support the share price. Unfortunately Pentamaster International's fell 14% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

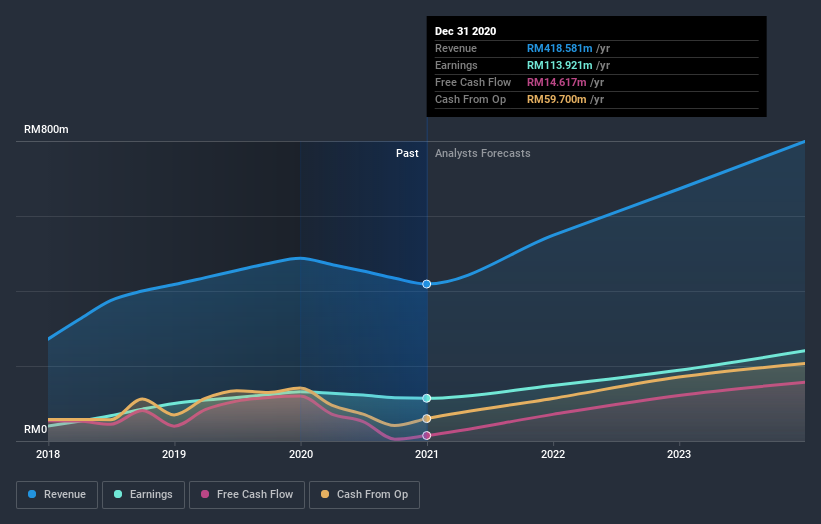

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Pentamaster International has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Pentamaster International stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Pleasingly, Pentamaster International's total shareholder return last year was 113%. And yes, that does include the dividend. That's better than the annualized TSR of 17% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting Pentamaster International on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Pentamaster International is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Pentamaster International or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1665

Pentamaster International

An investment holding company, provides automation manufacturing and technology solutions in Malaysia and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives