- Hong Kong

- /

- Semiconductors

- /

- SEHK:1385

Shanghai Fudan Microelectronics Group (SEHK:1385) Reports Decline In Net Income

Reviewed by Simply Wall St

Shanghai Fudan Microelectronics Group (SEHK:1385) reported a 32.66% increase in its share price over the past quarter. Recent events for the company include a modest rise in sales despite a decline in net income, and planned shareholder meetings. A reduction in dividends, adjustments in corporate governance, and competitive challenges due to market pressures have been notable. Amid broader market trends, which saw significant gains and new records, these company-specific factors, including earnings adjustments and shareholder meetings, might have played a role in shaping investor sentiment, contributing weight to the upward trajectory observed in their stock performance.

Shanghai Fudan Microelectronics Group has 2 possible red flags we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past year, Shanghai Fudan Microelectronics Group has achieved a significant total return of 283.77%, capturing attention beyond its recent 32.66% quarterly share price increase. This impressive annual performance outpaced both the Hong Kong market, which returned 54.4%, and the semiconductor industry, which saw dramatic growth of over 160.9%.

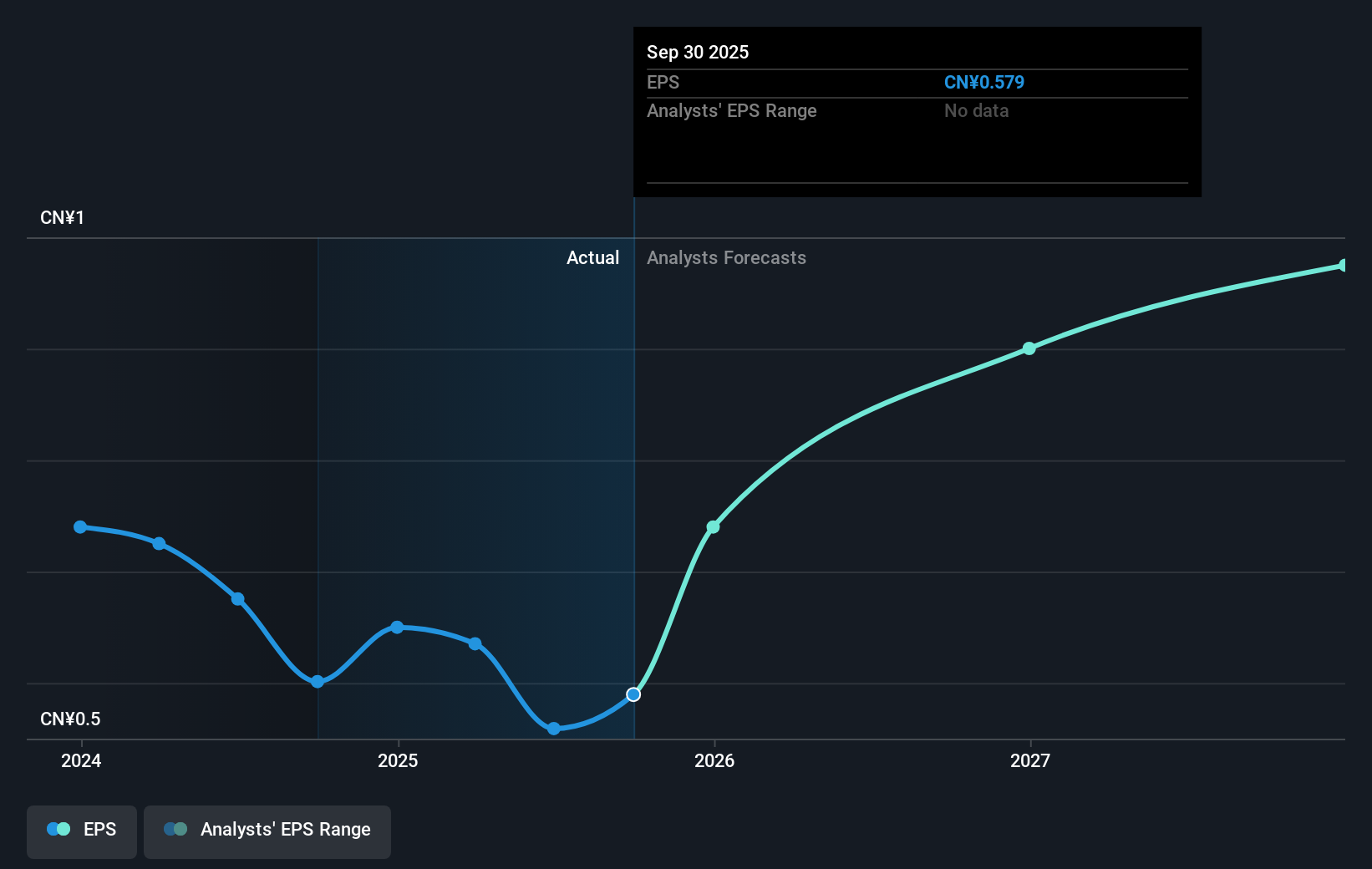

The company's announcement of increased revenue yet reduced net income, alongside strategic shifts such as dividend decreases and management changes, may impact future revenue and earnings forecasts. Despite facing strong competition, these factors might influence investor sentiment moving forward. Additionally, the share price closely aligns with the current price target of HK$36.88, indicating limited market surprise anticipated by analysts. These elements underscore the intricate balance of operational changes and market dynamics shaping Shanghai Fudan Microelectronics Group's valuation and outlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1385

Shanghai Fudan Microelectronics Group

Engages in the design, development, and sale of integrated circuit products and total solutions in Mainland China and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives