- Hong Kong

- /

- Semiconductors

- /

- SEHK:1385

Fudan Microelectronics (SEHK:1385) Margin Decline Challenges Bullish Narratives Despite Strong Growth Forecasts

Reviewed by Simply Wall St

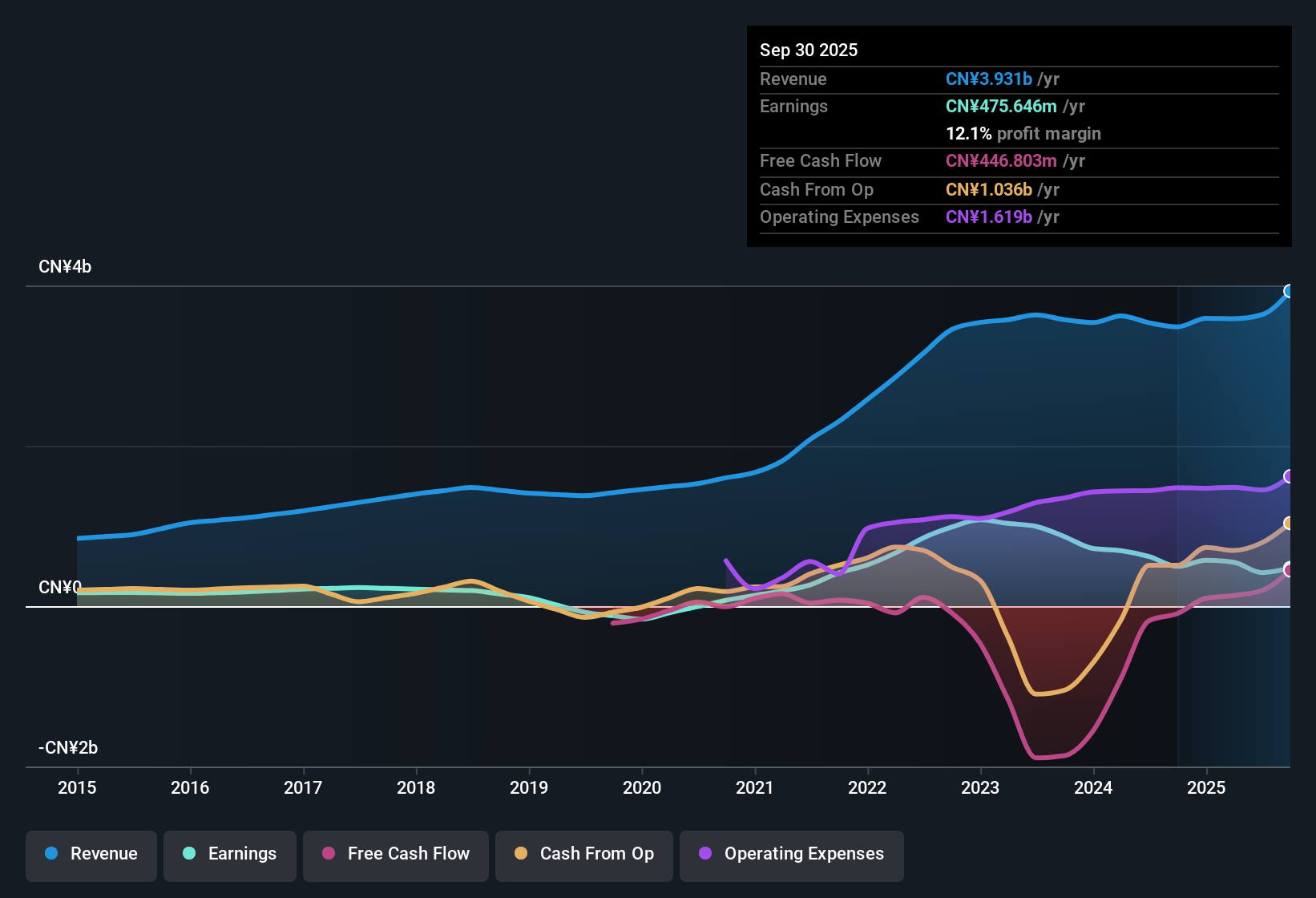

Shanghai Fudan Microelectronics Group (SEHK:1385) posted average annual earnings growth of 10.4% over the past five years, but its net profit margin declined to 12.1% from 14.3% the previous year. With earnings forecast to accelerate at 32.6% per year and revenue expected to rise 10.8% annually, the company is set to outpace Hong Kong market averages of 12.3% and 8.6% respectively. However, recent negative earnings growth and compressed margins highlight the challenges ahead as investors weigh high expectations against premium valuation levels.

See our full analysis for Shanghai Fudan Microelectronics Group.The next step is to see how these figures stack up against the most widely followed narratives. Some may be confirmed, while others could be upended.

Curious how numbers become stories that shape markets? Explore Community Narratives

P/E Multiple Stands Well Above Peers

- The price-to-earnings (P/E) ratio sits at 67.6x. Shanghai Fudan Microelectronics, therefore, trades at a much steeper multiple than the Asian semiconductor industry average of 39.6x and above the peer group’s 60.5x.

- Prevailing market optimism highlights the company’s unique positioning and strong sector momentum as reasons for the premium. However, the sharp valuation difference compared to peers raises questions about whether growth potential alone justifies the higher price.

- Industry averages indicate most competitors command lower multiples, so Fudan’s outlier status may increase investor sensitivity to any underperformance.

- Bulls point to the sector’s rapid expansion and government backing, but the company’s current valuation suggests that exceptional execution is already priced in, setting a very high bar for future results.

Net Profit Margin Still Under Pressure

- Net profit margin dropped to 12.1% from 14.3% a year ago, despite revenue being projected to rise faster than the Hong Kong market average.

- The most recent filings challenge the belief that margins will recover quickly simply due to strong topline growth, as expanding revenue has not yet translated into improved profitability.

- Ongoing margin compression is notable given the industry’s supportive conditions and shows that scale or sector momentum do not guarantee near-term margin improvement.

- Investors expecting a swift turnaround in profitability will be looking for evidence that margin slippage is temporary rather than a structural trend.

Current Share Price Far Above DCF Fair Value

- The share price of HK$42.86 is far above the DCF fair value estimate of HK$3.96. This leads to a market valuation that greatly exceeds fundamental estimates regardless of sector tailwinds.

- Market views indicate that optimism about future growth and China’s domestic chip ambitions is already reflected in pricing, making the stock highly vulnerable to disappointment on growth or profitability.

- This wide gap between share price and intrinsic valuation suggests that even sector-wide gains or policy support may not protect against potential downside if expectations are not met.

- The history of negative earnings growth last year, despite earlier strong averages, underscores that stretched valuations are sensitive to execution risks.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Shanghai Fudan Microelectronics Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Shanghai Fudan Microelectronics faces high valuation risks, compressing profit margins, and a share price far above intrinsic value. This situation leaves investors exposed to downside.

Want to target stronger value opportunities? Consider these 854 undervalued stocks based on cash flows to find companies trading well below their fair value with more room for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1385

Shanghai Fudan Microelectronics Group

Engages in the design, development, and sale of integrated circuit products and total solutions in Mainland China and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion