- Hong Kong

- /

- Semiconductors

- /

- SEHK:1385

After Leaping 38% Shanghai Fudan Microelectronics Group Company Limited (HKG:1385) Shares Are Not Flying Under The Radar

Shanghai Fudan Microelectronics Group Company Limited (HKG:1385) shareholders are no doubt pleased to see that the share price has bounced 38% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 57% share price drop in the last twelve months.

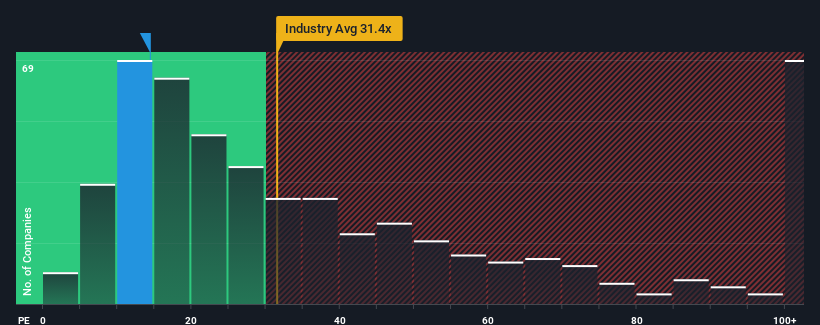

Since its price has surged higher, Shanghai Fudan Microelectronics Group's price-to-earnings (or "P/E") ratio of 14.4x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 8x and even P/E's below 4x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

As an illustration, earnings have deteriorated at Shanghai Fudan Microelectronics Group over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Shanghai Fudan Microelectronics Group

How Is Shanghai Fudan Microelectronics Group's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Shanghai Fudan Microelectronics Group's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 11%. Still, the latest three year period has seen an excellent 363% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 23% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that Shanghai Fudan Microelectronics Group's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Shanghai Fudan Microelectronics Group's P/E

The strong share price surge has got Shanghai Fudan Microelectronics Group's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Shanghai Fudan Microelectronics Group maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Shanghai Fudan Microelectronics Group that we have uncovered.

If you're unsure about the strength of Shanghai Fudan Microelectronics Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1385

Shanghai Fudan Microelectronics Group

Engages in the design, development, and sale of integrated circuit products and total solutions in Mainland China and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives