- Hong Kong

- /

- Semiconductors

- /

- SEHK:1347

Is the Rally in Hua Hong Shares Justified After China Semiconductor Expansion News?

Reviewed by Bailey Pemberton

- Ever wondered if Hua Hong Semiconductor’s soaring share price really means the stock is a bargain, or if there’s more beneath the surface? Let’s break down what’s happening so you can decide for yourself.

- After climbing a remarkable 261.8% in the past year, the stock has recently cooled off, slipping 7.0% over the last week and 15.8% over the past month. Year-to-date gains still stand at an impressive 259.2%.

- Recent headlines have focused on China’s ongoing push for self-sufficiency in semiconductor technology and Hua Hong’s progress in ramping up new fabrication facilities. Investors took note as the company expanded production capacity, sparking conversations about its role in global supply chains.

- Despite all the buzz, Hua Hong Semiconductor currently scores just 1 out of 6 on our valuation checks. Let’s dig into how that score was determined using classic valuation tools, and why there may be a smarter way to think about value by the end of this article.

Hua Hong Semiconductor scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hua Hong Semiconductor Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today’s value. It is a widely used method for figuring out whether a stock’s current price matches the cash it is expected to generate over time.

For Hua Hong Semiconductor, the latest twelve months (LTM) Free Cash Flow came in at -$1,027.2 Million, reflecting recent investment-heavy years. Looking ahead, analysts see this turning around, with projections of $702 Million in Free Cash Flow by 2029. Simply Wall St extrapolates these projections even further, with Free Cash Flow expected to reach roughly $2.43 Billion by 2035.

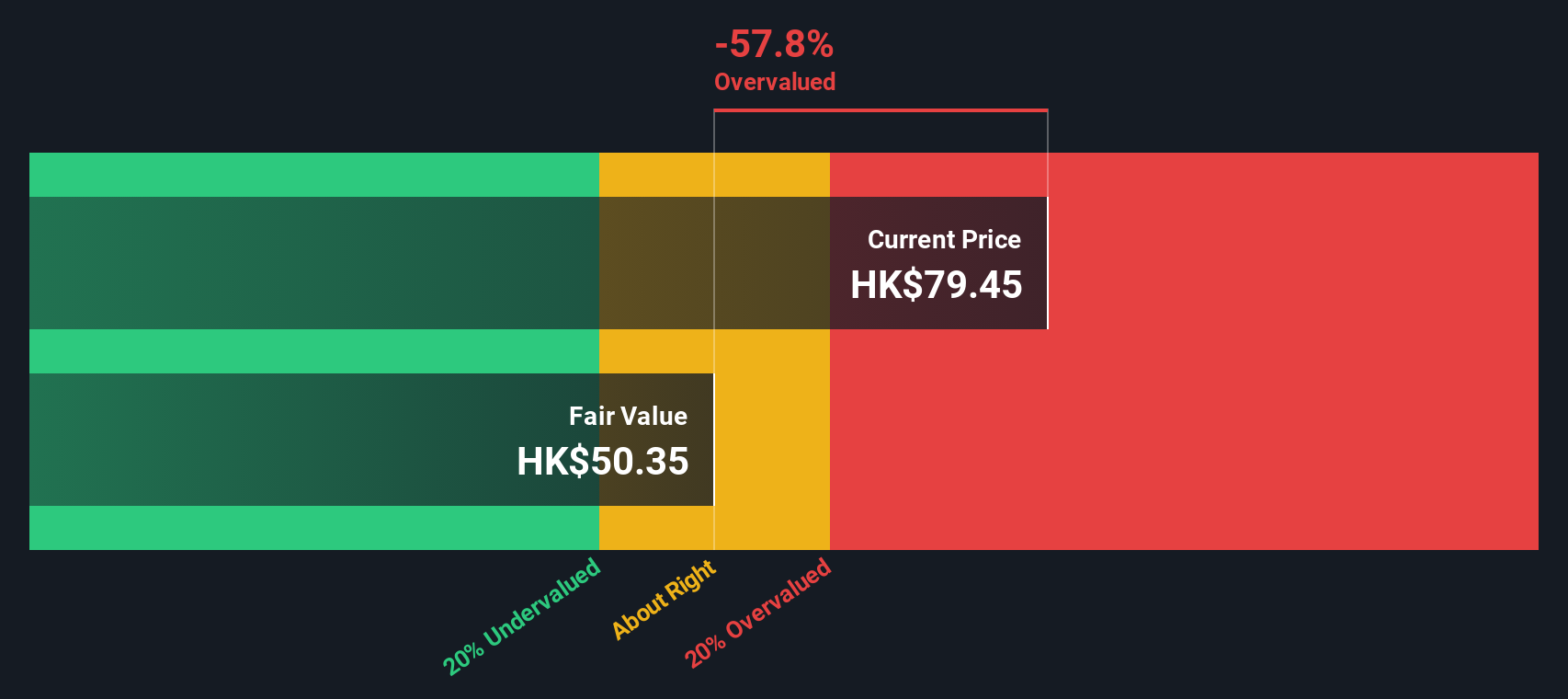

After crunching all these figures, the DCF analysis produces an estimated intrinsic value of $59.79 per share. However, this implies the stock is currently trading at a 21.3% premium to its calculated fair value, making it look overvalued by DCF standards.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hua Hong Semiconductor may be overvalued by 21.3%. Discover 928 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Hua Hong Semiconductor Price vs Sales

The price-to-sales (P/S) ratio is often a go-to valuation metric for semiconductor companies like Hua Hong Semiconductor, especially when profitability is volatile or expanding rapidly. It gives investors a sense of how much they are paying for every dollar of the company’s revenue, which is especially relevant for growth-oriented firms reinvesting heavily in new capacity.

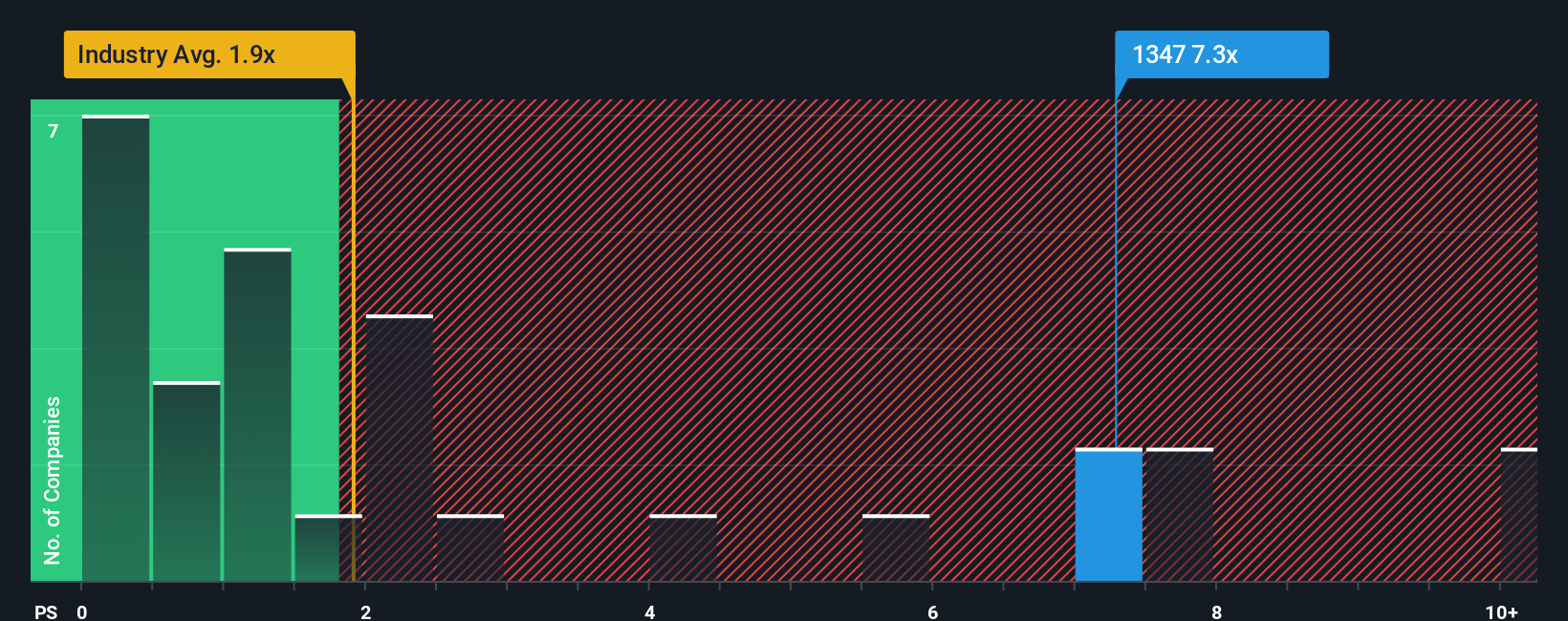

While higher growth expectations can justify elevated multiples and greater risks should lower them, a “normal” P/S ratio is always best interpreted in the context of industry standards and company-specific prospects. Hua Hong currently trades at a P/S ratio of 7.1x, which comes in well above the semiconductor industry average of 1.87x and also exceeds the peer average of 22.94x.

To cut through the noise of simple benchmark comparisons, Simply Wall St uses a proprietary “Fair Ratio” metric. This calculated multiple adjusts for how fast the company is growing, its risk factors, profit margins, industry tag, and market size. This approach delivers a more tailored assessment than plain industry or peer multiples.

For Hua Hong, the Fair P/S Ratio stands at 4.82x, suggesting the market price is outpacing what fundamentals justify at this stage. Because the actual P/S ratio differs from the Fair Ratio by more than 0.10, the stock appears to be trading above its optimal range.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hua Hong Semiconductor Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative transforms complex numbers into a story you believe about Hua Hong Semiconductor, tying your view of its future revenue, profit margins, and fair value together. This feature lets you ground your investment decisions in the company’s real-world progress and risks, connecting facts and forecasts into a single, powerful perspective.

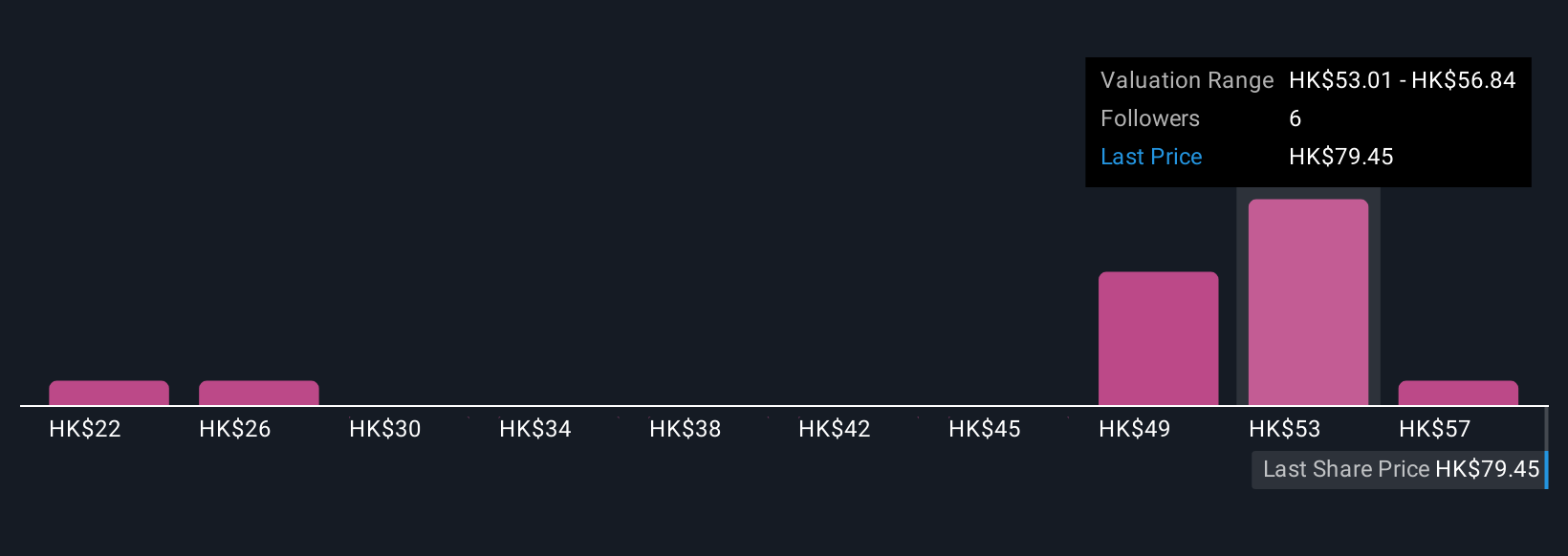

Narratives act as your financial story built on assumptions you choose, all visualized and calculated within the Simply Wall St Community page used by millions of investors. By creating a Narrative, you can see how your unique outlook on things like AI demand, domestic policy support, or margin trends translates into an updated fair value, and then compare it directly to the current share price to spot investment opportunities or risks.

Every Narrative is automatically updated as news or earnings are released, so your fair value remains dynamic and data-driven. For Hua Hong Semiconductor, some investors build bullish Narratives based on aggressive AI-fueled demand and price targets as high as HK$68.25, while cautious users focus on execution and competition risks, anchoring their fair value closer to HK$22.38. No matter where you stand, Narratives empower you to make decisions that fit your convictions and react confidently as the story evolves.

Do you think there's more to the story for Hua Hong Semiconductor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hua Hong Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1347

Hua Hong Semiconductor

An investment holding company, engages in the manufacture and sale of semiconductor products in China, North America, Asia, Europe, and Japan.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success