- Hong Kong

- /

- Semiconductors

- /

- SEHK:1347

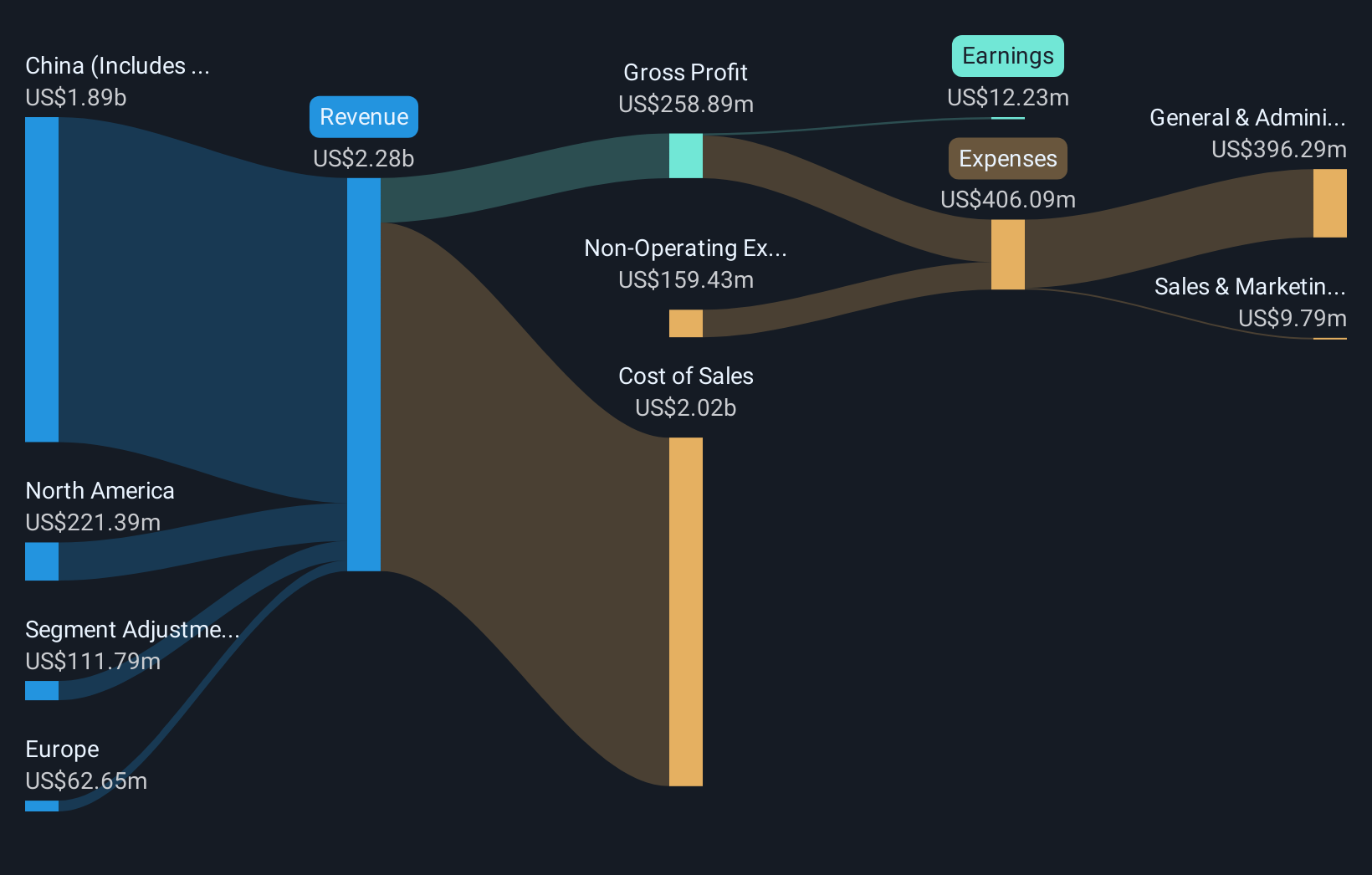

Hua Hong Semiconductor (SEHK:1347) Reports Increased Sales And Net Income In Q2 2025 Earnings

Reviewed by Simply Wall St

Hua Hong Semiconductor (SEHK:1347) reported a price increase of 68%, aligning with the tech sector's rallies echoed in Nasdaq reaching new highs. The August announcement of Q2 2025 earnings showed increased sales and net income, supporting the positive market sentiment. With upcoming board meetings considering interim results and potential dividends, along with maintained projections for Q3 revenue growth, investor confidence is likely bolstered. Meanwhile, broader market conditions such as potential U.S. Federal Reserve rate cuts and positive U.S.-China trade dialogues added to the optimistic outlook, although not directly tied to the company’s performance.

The recent news regarding Hua Hong Semiconductor's substantial price increase aligns closely with the broader tech sector's optimistic trends. Over the past year, the company's total shareholder returns reached 239.96%, illustrating robust performance and significant investor confidence. This notable growth contrasts with its one-year performance against the Hong Kong Semiconductor industry, which also saw impressive gains at 171.2%. These developments have the potential to bolster revenue and earnings forecasts, given the market's positive reaction to Q2 2025 earnings results and expectations for continued sector growth, notably in AI and EV areas.

Despite the current share price of HK$52.15 trading above the analyst consensus price target of HK$44.56 by approximately 14.56%, it reflects a relatively higher market willingness to invest beyond projected valuations. Analysts remain cautious, noting the share price’s deviation from consensus, which could suggest a possible overvaluation if future earnings don’t align with aggressive growth forecasts. Nonetheless, the prospective revenue growth from Fab9's launch and strategic shifts aimed at leveraging increased demand could fuel further optimism. Investors should consider these dynamics when assessing Hua Hong's long-term growth potential and market positioning.

Evaluate Hua Hong Semiconductor's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hua Hong Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1347

Hua Hong Semiconductor

An investment holding company, engages in the manufacture and sale of semiconductor products in China, North America, Asia, Europe, and Japan.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives