- Hong Kong

- /

- Semiconductors

- /

- SEHK:1347

How Investors May Respond To Hua Hong Semiconductor (SEHK:1347) Leadership Consolidation and Strategic Overhaul

Reviewed by Sasha Jovanovic

- Hua Hong Semiconductor recently announced significant leadership changes, with Mr. Peng Bai, the current president, appointed as chairman of the Board and chairman of the nomination committee, while Mr. Junjun Tang resigned from his roles as executive director and chairman, effective October 31, 2025.

- The consolidation of leadership under Mr. Bai is intended to leverage his semiconductor sector expertise, streamline decision-making, and enhance execution of company strategies during a period of ongoing industry transformation.

- We'll explore how the leadership consolidation at Hua Hong might affect its investment outlook, particularly in the context of its expansion plans.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Hua Hong Semiconductor Investment Narrative Recap

To be a shareholder of Hua Hong Semiconductor, you need confidence in the company's ability to deliver on aggressive expansion plans and maintain high demand utilization, especially as new capacity like Fab9 ramps up. The recent leadership consolidation under Mr. Bai appears unlikely to materially impact the most immediate catalyst, efficient capacity expansion and end-market adoption, but could help address execution risk, which remains the single biggest threat if market demand slows or margins come under pressure.

Of the company's recent announcements, the private placement plan disclosed on August 31, 2025 has the most relevance. Such fundraising often signals a focus on financing future capacity and technology upgrades, directly tying into the near-term catalysts and capital intensity risks discussed above. Short-term, this move could support aggressive expansion, but also amplifies the need for disciplined cost and capital management as market conditions shift.

By contrast, investors should be aware that if demand growth does not keep pace with the rapid build-out of new fabs, overcapacity could quickly weigh on...

Read the full narrative on Hua Hong Semiconductor (it's free!)

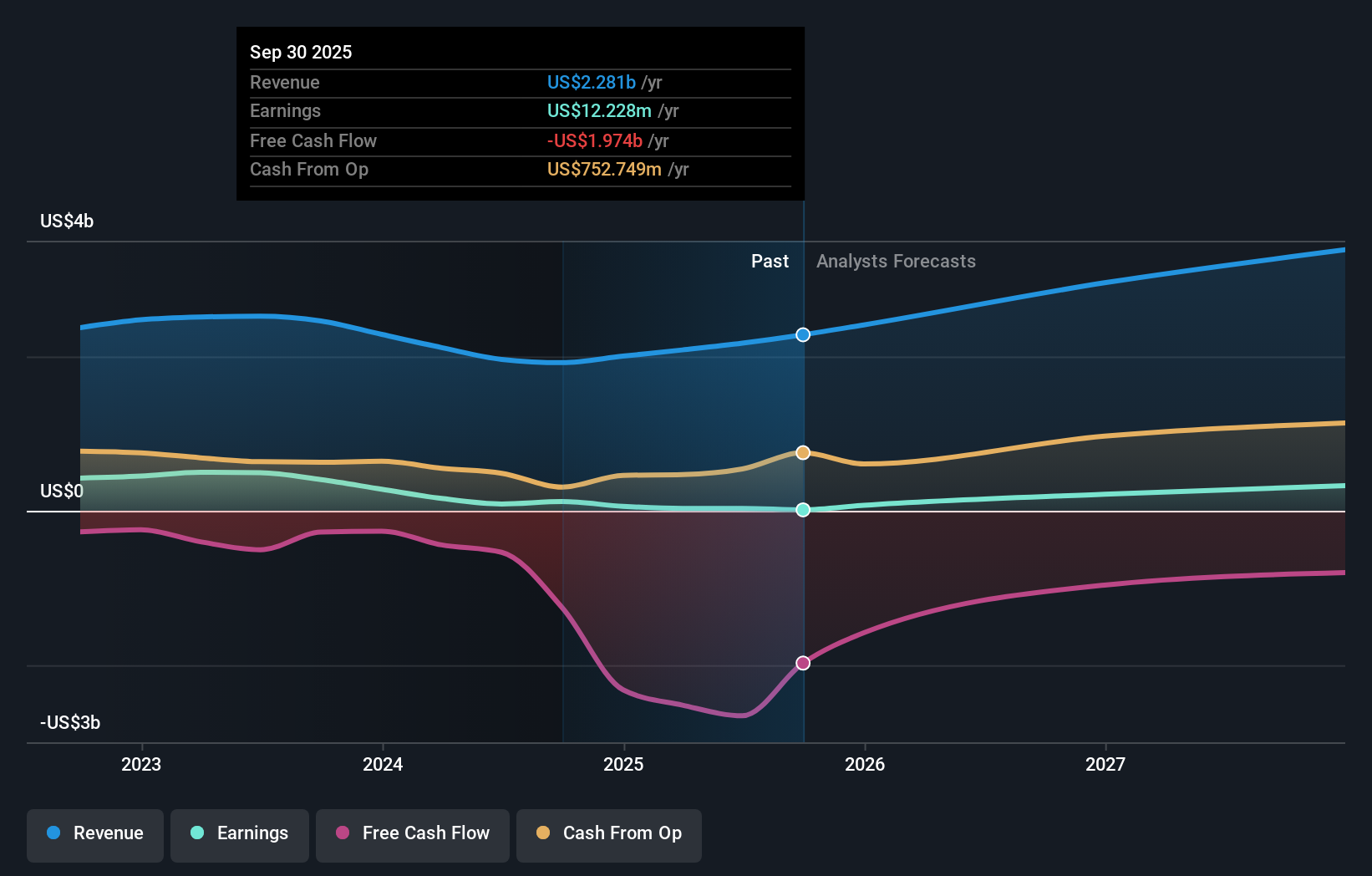

Hua Hong Semiconductor's outlook forecasts CN¥25.4 billion in revenue and CN¥2.6 billion in earnings by 2028. This implies a 17.5% annual revenue growth rate and an earnings increase of about CN¥2.37 billion from current earnings of CN¥225.7 million.

Uncover how Hua Hong Semiconductor's forecasts yield a HK$53.96 fair value, a 31% downside to its current price.

Exploring Other Perspectives

Six different fair value estimates from the Simply Wall St Community range from HK$22.38 to HK$67.18 per share. With near-term earnings growth hinging on absorbing new capacity, these diverse views highlight how investor opinion differs on Hua Hong’s ability to deliver on long-term revenue and margin goals.

Explore 6 other fair value estimates on Hua Hong Semiconductor - why the stock might be worth less than half the current price!

Build Your Own Hua Hong Semiconductor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hua Hong Semiconductor research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Hua Hong Semiconductor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hua Hong Semiconductor's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hua Hong Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1347

Hua Hong Semiconductor

An investment holding company, engages in the manufacture and sale of semiconductor products in China, North America, Asia, Europe, and Japan.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives