- Hong Kong

- /

- Specialty Stores

- /

- SEHK:9992

Pop Mart (SEHK:9992) Valuation Check After Labubu Slowdown Concerns and New Diversification Push

Reviewed by Simply Wall St

Pop Mart’s Labubu Hangover Puts Diversification Strategy Under the Microscope

Pop Mart International Group (SEHK:9992) is back in the spotlight after a steep share price slide, as investors question how long the Labubu craze can last and whether management’s diversification plans will arrive in time.

See our latest analysis for Pop Mart International Group.

Despite the recent pullback, including a sharp drop after the December selloff, Pop Mart’s 111.96 percent year to date share price return and three year total shareholder return of 890.91 percent still signal powerful but increasingly volatile momentum.

If Pop Mart’s rollercoaster ride has you thinking more broadly about where growth and conviction overlap, this could be a smart moment to explore fast growing stocks with high insider ownership.

With revenue and earnings still growing briskly and the share price now trading at a steep discount to analyst targets, the key question is whether this correction offers a fresh entry point or if the market already reflects Pop Mart’s future growth.

Price to Earnings of 34.3x: Is it justified?

On a price to earnings basis, Pop Mart’s HK$193.2 share price reflects a 34.3 times multiple that looks rich against key benchmarks.

The price to earnings ratio compares what investors pay today with each unit of current earnings. It is a common yardstick for high growth consumer and retail names where profits are scaling quickly. For Pop Mart, the combination of rapid earnings expansion and a forecast return on equity of 42.7 percent helps explain why the market is willing to pay far more per dollar of profit than for slower growing peers.

However, that premium is striking. The company’s 34.3 times earnings multiple is more than double the Hong Kong Specialty Retail average of 11.3 times. It also sits well above the estimated fair price to earnings ratio of 27.2 times that our models suggest the market could gravitate toward as expectations normalize.

Explore the SWS fair ratio for Pop Mart International Group

Result: Price to Earnings of 34.3x (OVERVALUED)

However, sustained multiple compression or a faster than expected Labubu sales deceleration could signal that the market is reassessing Pop Mart’s long term growth profile.

Find out about the key risks to this Pop Mart International Group narrative.

Another View: DCF Points the Other Way

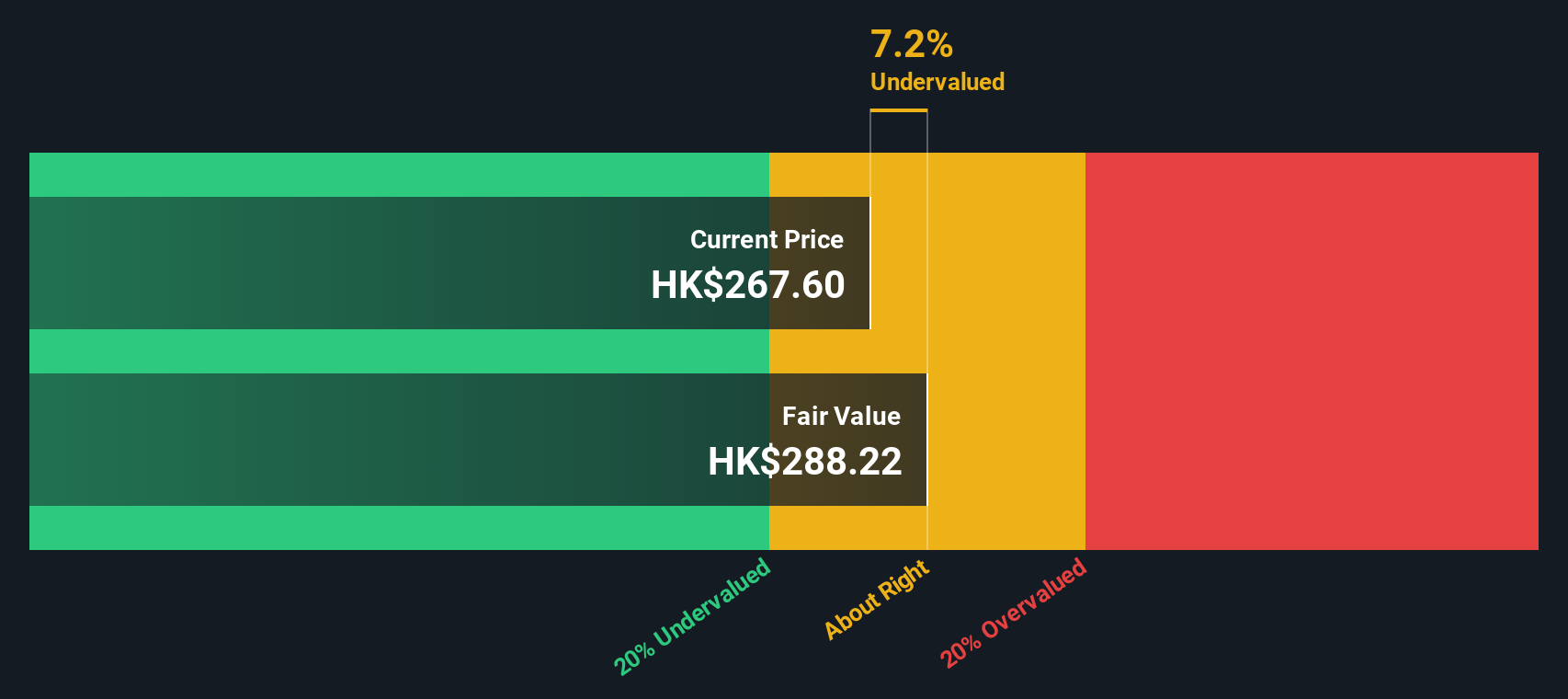

While the current price to earnings ratio makes Pop Mart look expensive, our DCF model suggests the shares trade around 32 percent below a fair value of roughly HK$284, which implies they could be undervalued. Is this a temporary mispricing, or a warning that the growth story is harder to model than it looks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pop Mart International Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pop Mart International Group Narrative

If you interpret the numbers differently or want to stress test your own assumptions, you can build a personalized view in minutes using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Pop Mart International Group.

Ready for your next investing move?

Pop Mart might be front of mind today, but some of the most rewarding opportunities emerge when you scan the market with fresh, targeted ideas in mind.

- Lock in potential compounding income by scanning for these 13 dividend stocks with yields > 3% that combine reliable payouts with solid fundamentals and could strengthen your portfolio’s cash flow.

- Ride structural technology tailwinds by targeting these 24 AI penny stocks that harness artificial intelligence to reshape industries and potentially support long term growth.

- Capture mispriced opportunities by focusing on these 916 undervalued stocks based on cash flows where market expectations still lag behind robust cash flow potential and improving business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9992

Pop Mart International Group

An investment holding company, engages in the design, development, and sale of pop toys in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion