- Hong Kong

- /

- Specialty Stores

- /

- SEHK:9992

Pop Mart (SEHK:9992): Assessing Valuation After Exceptional Q3 Global Revenue Growth

Reviewed by Simply Wall St

Pop Mart International Group (SEHK:9992) delivered impressive third-quarter 2025 results, with sales surging 245% to 250% from a year earlier. Gains were strong in both China and overseas markets.

See our latest analysis for Pop Mart International Group.

Despite the impressive 245% to 250% third-quarter revenue surge, Pop Mart International Group’s shares have recently pulled back, falling nearly 12% over the past month. That said, momentum remains remarkable in the bigger picture, with a 153% share price gain year-to-date and an extraordinary 2270% total shareholder return over three years. This is proof that long-term believers have been richly rewarded as growth accelerates globally.

If Pop Mart’s international momentum has you thinking about what other fast movers are out there, why not broaden your search and discover fast growing stocks with high insider ownership

With shares having cooled off after an extraordinary run, the question now is whether Pop Mart is trading at a bargain amid continued strong fundamentals, or if the market is already factoring in years of future growth.

Price-to-Earnings of 41.4x: Is it justified?

Pop Mart International Group’s shares currently trade at a price-to-earnings (P/E) ratio of 41.4x, placing them at a rich valuation relative to peers and industry averages. While the lofty P/E signals that investors have high expectations for future growth, it raises the question of whether this premium is backed up by fundamentals.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of earnings. For consumer-focused growth companies like Pop Mart, fast-expanding profits and ongoing global momentum can support elevated multiples in the market, especially when growth rates far outpace the sector norm. In this case, a P/E of 41.4x reflects investors’ willingness to pay a sizeable premium for continued expansion and profitability.

However, Pop Mart’s 41.4x P/E stands substantially above the Hong Kong Specialty Retail industry average of 13.2x and the estimated fair P/E ratio of 30.9x. This suggests current valuations are stretched, and future share price movement could be influenced by how profit growth plays out relative to these heightened expectations. If earnings continue to scale rapidly, the market may maintain a higher multiple. If momentum fades, valuations could compress toward the fair ratio.

Explore the SWS fair ratio for Pop Mart International Group

Result: Price-to-Earnings of 41.4x (OVERVALUED)

However, slowing momentum or a pullback in consumer demand could put pressure on valuations and threaten additional share price gains for Pop Mart International Group.

Find out about the key risks to this Pop Mart International Group narrative.

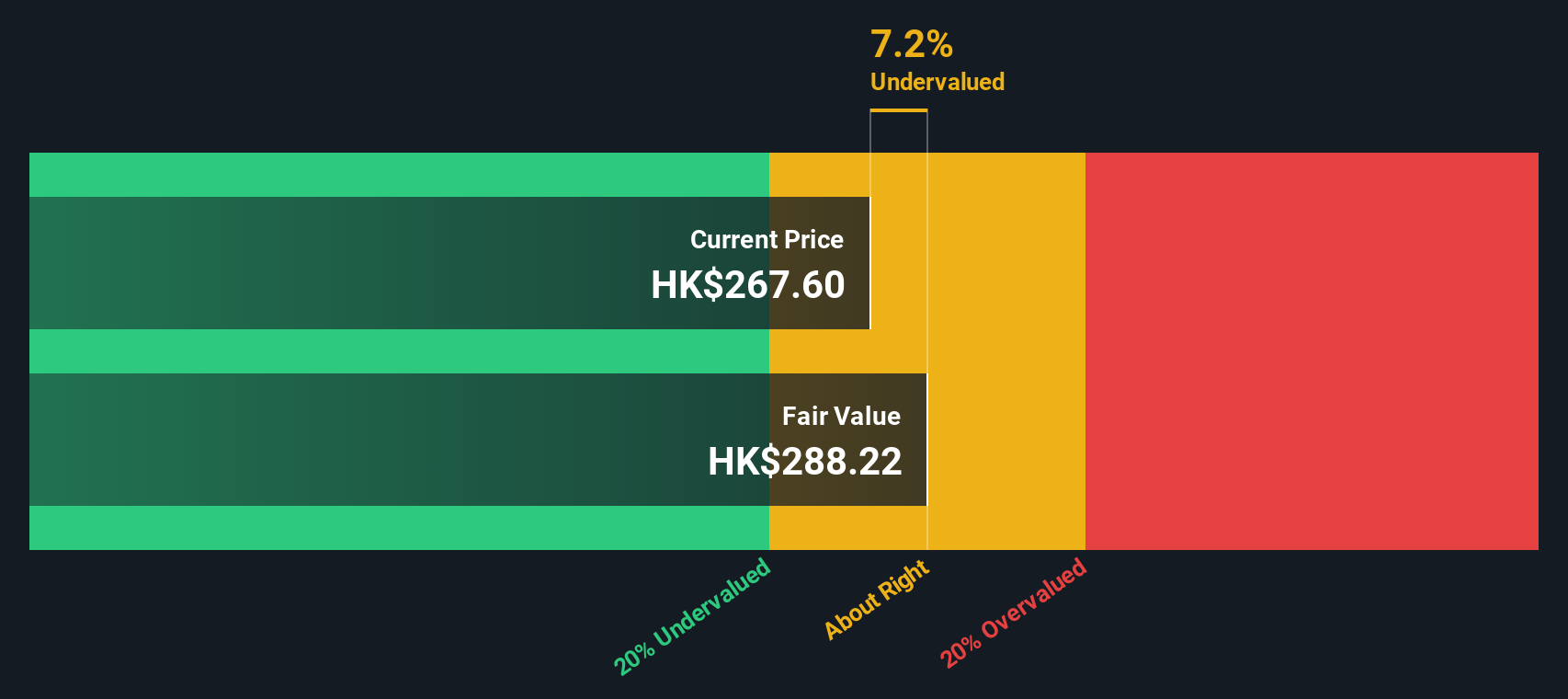

Another View: Discounted Cash Flow Suggests Undervaluation

While Pop Mart International Group appears expensive based on its price-to-earnings ratio, the SWS DCF model presents a different perspective. According to this approach, the current share price trades about 20% below its estimated fair value of HK$287.64. Does this undervaluation indicate overlooked potential, or does it point to hidden risks for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pop Mart International Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pop Mart International Group Narrative

If you have a different perspective or want to explore your own investment thesis, you can dive into the numbers and create a narrative of your own in just a few minutes, Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Pop Mart International Group.

Looking for More Investment Ideas?

Smart investors always stay ahead of the curve. Don’t miss your chance to uncover new opportunities for growth and income that could transform your portfolio.

- Uncover reliable payouts by scanning markets for these 17 dividend stocks with yields > 3% with high yields that consistently reward shareholders.

- Spot tomorrow's breakthroughs and ride the AI wave by researching these 27 AI penny stocks shaping smarter industries and tech innovation.

- Tap into under-the-radar value by checking out these 880 undervalued stocks based on cash flows that offer strong fundamentals at attractive prices before the crowd catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9992

Pop Mart International Group

An investment holding company, engages in the design, development, and sale of pop toys in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives