- Hong Kong

- /

- Specialty Stores

- /

- SEHK:9992

Assessing Pop Mart (SEHK:9992) Valuation as Steady Gains Draw Investor Attention

Reviewed by Simply Wall St

Price-to-Earnings of 51.6x: Is it justified?

By the price-to-earnings (P/E) ratio, Pop Mart International Group appears expensive compared to its specialty retail peers and the broader Hong Kong industry average. Pop Mart's P/E is sitting at 51.6x, while the sector's average is just 14x.

The P/E ratio is a common valuation metric that illustrates how much investors are willing to pay for each dollar of a company’s earnings. In specialty retail, where growth can be rapid but competition is fierce, a high multiple often signals that investors expect outstanding future growth or profitability.

Pop Mart's elevated P/E suggests that the market is pricing in future expansion and ongoing momentum, possibly based on the company’s strong revenue and profit growth. However, compared to industry norms, the current multiple may be tough to justify unless the company's high growth rates can be sustained over the long term.

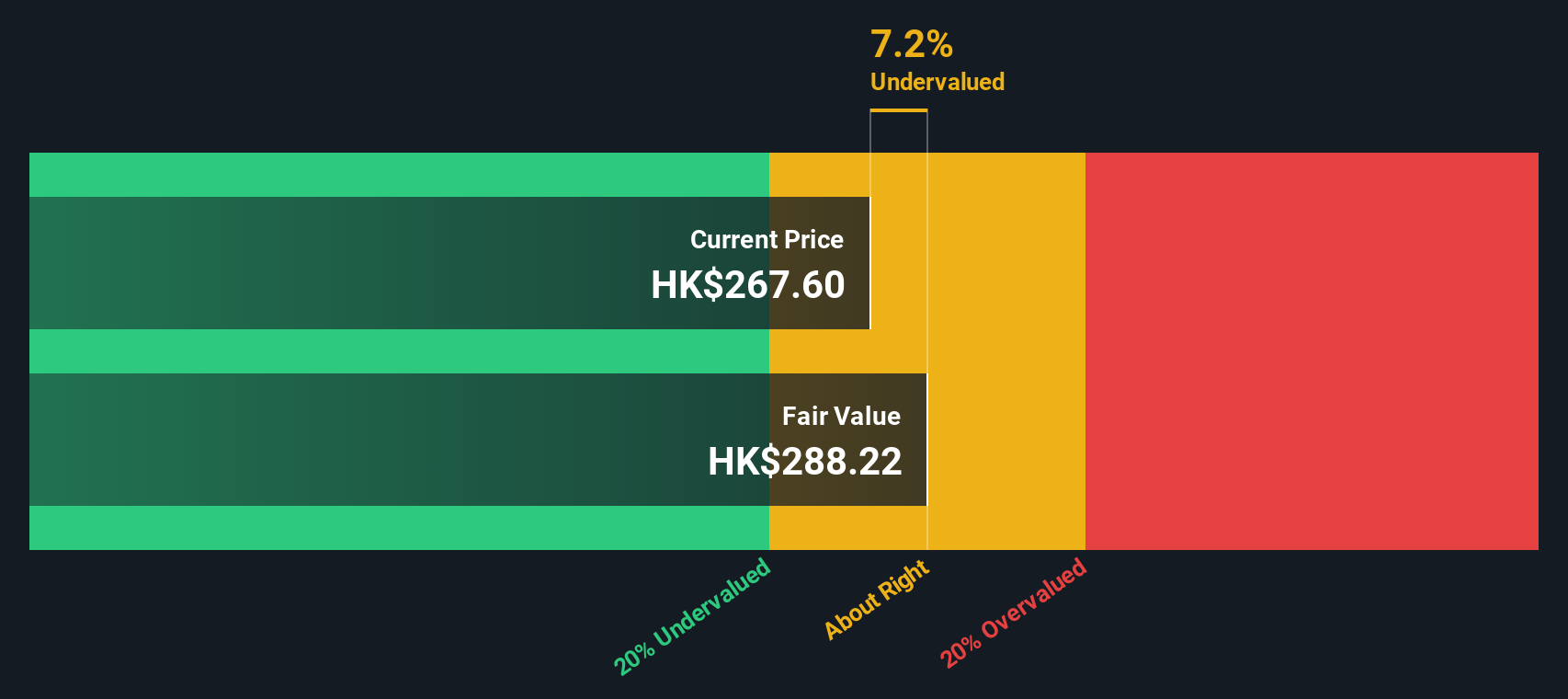

Result: Fair Value of HK$289.99 (ABOUT RIGHT)

See our latest analysis for Pop Mart International Group.However, risks such as intensifying competition or unexpected shifts in consumer demand could challenge Pop Mart’s growth narrative and could potentially impact future expectations.

Find out about the key risks to this Pop Mart International Group narrative.Another View: SWS DCF Model Offers a Second Opinion

Looking at Pop Mart International Group through the lens of our SWS DCF model provides another angle on its valuation. This method suggests the shares are almost in line with their estimated fair value. Does this support the market’s optimism, or is there more beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Pop Mart International Group Narrative

If you have your own viewpoint or want to dive deeper into the numbers, it takes less than three minutes to craft your own perspective. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Pop Mart International Group.

Looking for More Investment Ideas?

Don't let great opportunities pass you by. Take the next step and find stocks that could transform your portfolio, using Simply Wall Street’s powerful screener tools designed for smart investors like you.

- Unlock higher returns with undervalued stocks based on cash flows to see which companies stand out for their genuine growth potential at a compelling price.

- Capitalize on the future of medicine by tapping into healthcare AI stocks, where innovative healthcare meets artificial intelligence.

- Jump on emerging trends in digital innovation with cryptocurrency and blockchain stocks to spot trailblazers shaping tomorrow’s financial landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:9992

Pop Mart International Group

An investment holding company, engages in the design, development, and sale of pop toys in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives