In a week marked by record highs in U.S. stock indices and robust stimulus measures from China, global markets have shown renewed optimism. Amidst this buoyant environment, dividend stocks stand out as a reliable option for investors seeking steady income. A good dividend stock not only offers attractive yields but also demonstrates resilience and stability in fluctuating market conditions. Here are three such reliable dividend stocks with yields up to 9.7%.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.71% | ★★★★★★ |

| Globeride (TSE:7990) | 4.33% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.88% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.46% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.10% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.60% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.23% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.71% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.55% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.94% | ★★★★★★ |

Click here to see the full list of 2036 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Beijing Urban Construction Design & Development Group (SEHK:1599)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Urban Construction Design & Development Group Co., Limited, along with its subsidiaries, offers infrastructure construction services both in China and internationally, with a market cap of HK$2.31 billion.

Operations: Beijing Urban Construction Design & Development Group Co., Limited generates revenue primarily from two segments: Construction Contracting (CN¥5.42 billion) and Design, Survey, and Consultancy (CN¥4.64 billion).

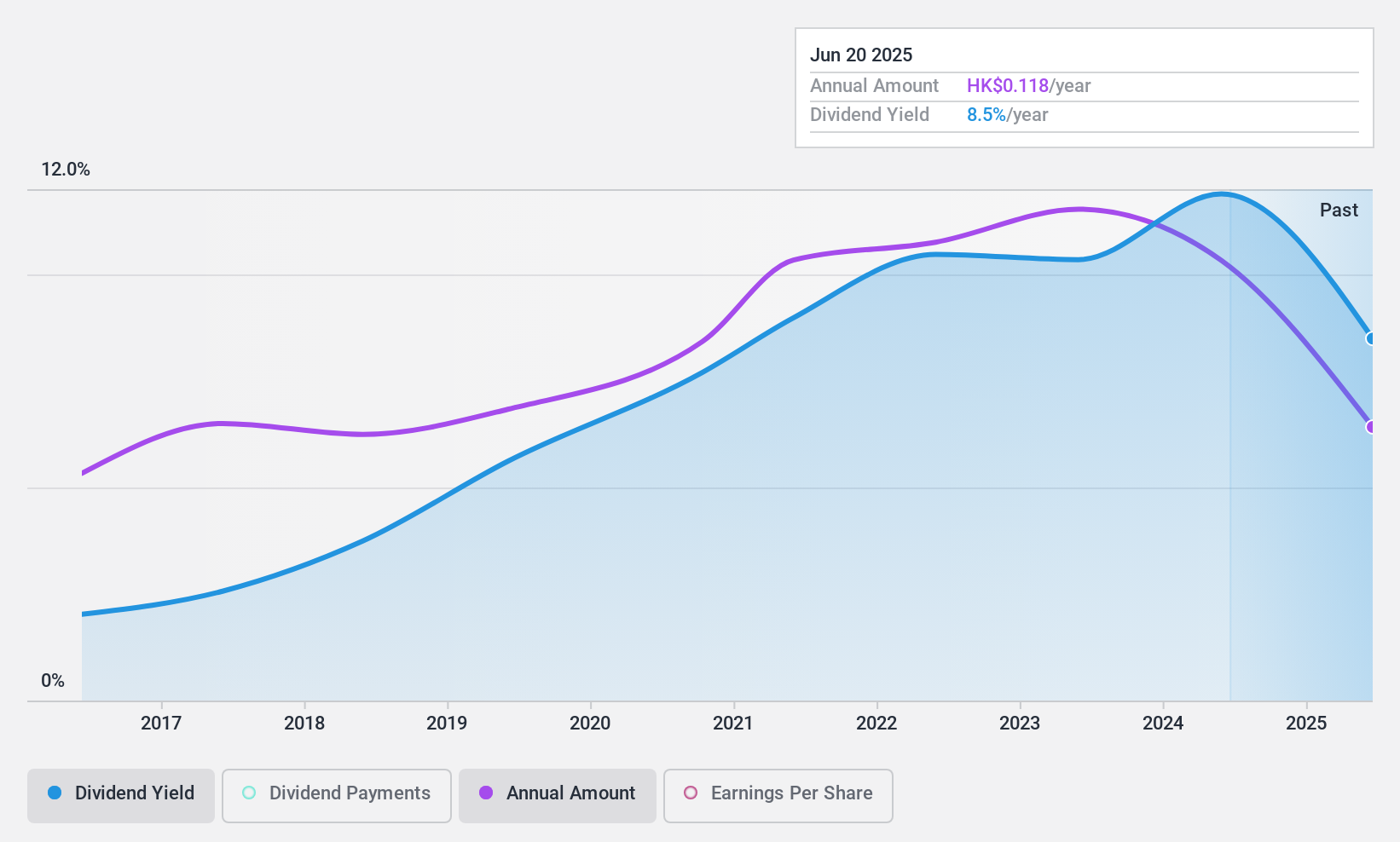

Dividend Yield: 9.8%

Beijing Urban Construction Design & Development Group (1599) offers a compelling dividend profile with a low payout ratio of 27.5%, ensuring dividends are well covered by earnings and cash flows (54.3%). Despite only paying dividends for nine years, the payments have been stable and growing. However, recent financial results show declining sales (CNY 4.18 billion) and net income (CNY 366.03 million), which may impact future dividend sustainability.

- Take a closer look at Beijing Urban Construction Design & Development Group's potential here in our dividend report.

- According our valuation report, there's an indication that Beijing Urban Construction Design & Development Group's share price might be on the cheaper side.

Tong Ren Tang Technologies (SEHK:1666)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Ren Tang Technologies Co. Ltd. manufactures and sells Chinese medicine products in Mainland China and internationally, with a market cap of approximately HK$7.40 billion.

Operations: Tong Ren Tang Technologies Co. Ltd.'s revenue segments include The Company at CN¥4.29 billion and Tong Ren Tang Chinese Medicine at CN¥1.26 billion.

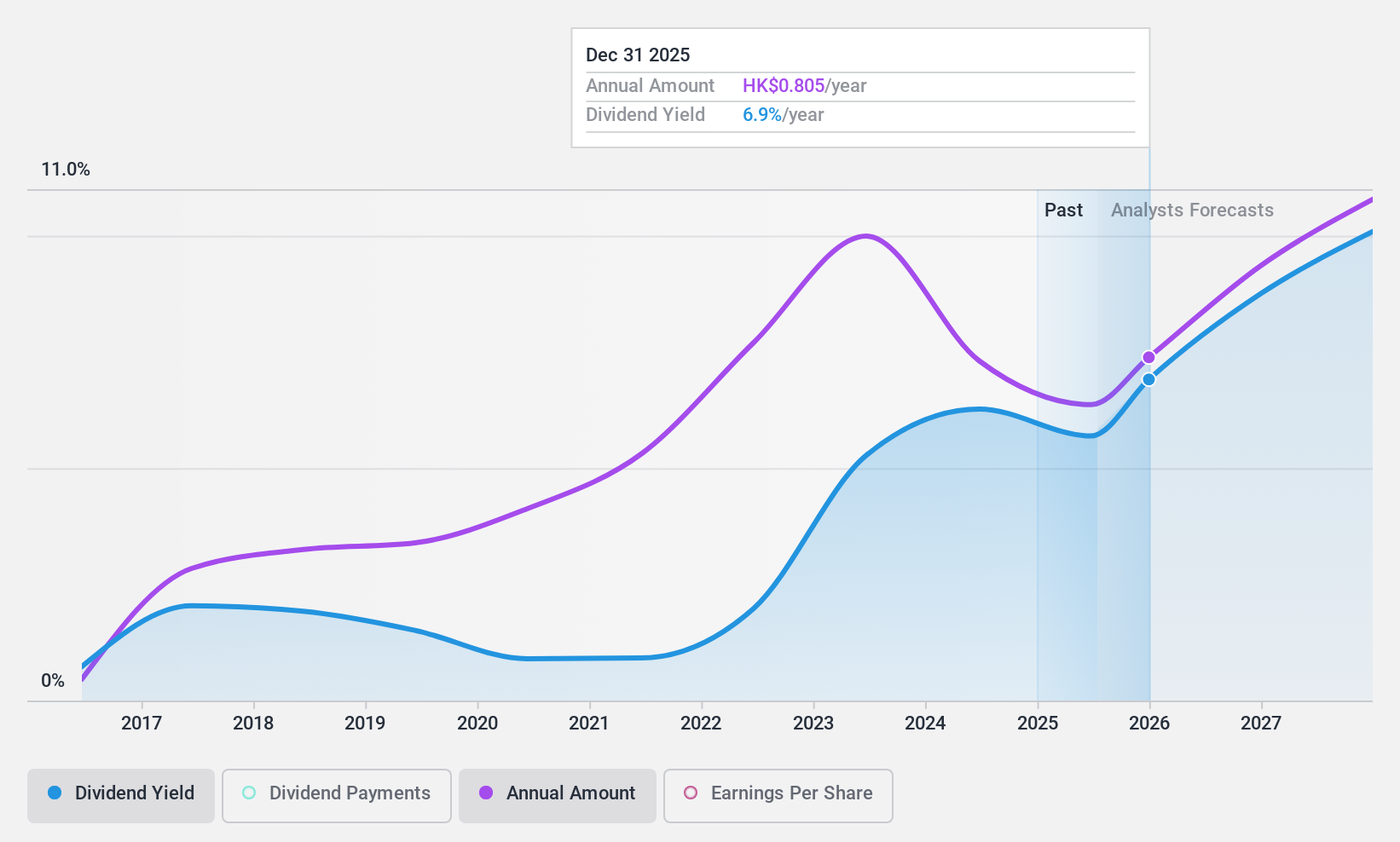

Dividend Yield: 3.1%

Tong Ren Tang Technologies' dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 35.4%. However, the dividend yield of 3.15% is below the top tier in Hong Kong. Recent earnings for H1 2024 showed increased sales (CNY 4.05 billion) and net income (CNY 428.75 million), but dividends are not well covered by free cash flows, raising concerns about long-term sustainability.

- Navigate through the intricacies of Tong Ren Tang Technologies with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Tong Ren Tang Technologies' current price could be inflated.

Zhongsheng Group Holdings (SEHK:881)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhongsheng Group Holdings Limited, an investment holding company, focuses on the sale and service of motor vehicles in the People’s Republic of China and has a market cap of HK$34.13 billion.

Operations: The company's revenue segments include the sale of motor vehicles and the provision of related services, generating CN¥179.81 billion.

Dividend Yield: 5.1%

Zhongsheng Group Holdings' dividend payments have been volatile over the past decade, despite being covered by earnings (49% payout ratio) and cash flows (51.6% cash payout ratio). Recent H1 2024 earnings showed a decline in net income to CNY 1.58 billion from CNY 3 billion last year, raising concerns about future dividend stability. The company is trading at a significant discount to estimated fair value, but profit margins have decreased from 3.6% to 2%.

- Get an in-depth perspective on Zhongsheng Group Holdings' performance by reading our dividend report here.

- Our expertly prepared valuation report Zhongsheng Group Holdings implies its share price may be lower than expected.

Summing It All Up

- Get an in-depth perspective on all 2036 Top Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tong Ren Tang Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1666

Tong Ren Tang Technologies

Produces and distributes Chinese medicine products in Mainland China and Hong Kong.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives