- Hong Kong

- /

- Retail Distributors

- /

- SEHK:8451

Shareholders May Find It Hard To Justify A Pay Rise For Sunlight (1977) Holdings Limited's (HKG:8451) CEO This Year

Key Insights

- Sunlight (1977) Holdings will host its Annual General Meeting on 14th of February

- Total pay for CEO Liang Sie Chua includes S$294.0k salary

- Total compensation is similar to the industry average

- Sunlight (1977) Holdings' total shareholder return over the past three years was 1.7% while its EPS grew by 44% over the past three years

Under the guidance of CEO Liang Sie Chua, Sunlight (1977) Holdings Limited (HKG:8451) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 14th of February. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

View our latest analysis for Sunlight (1977) Holdings

How Does Total Compensation For Liang Sie Chua Compare With Other Companies In The Industry?

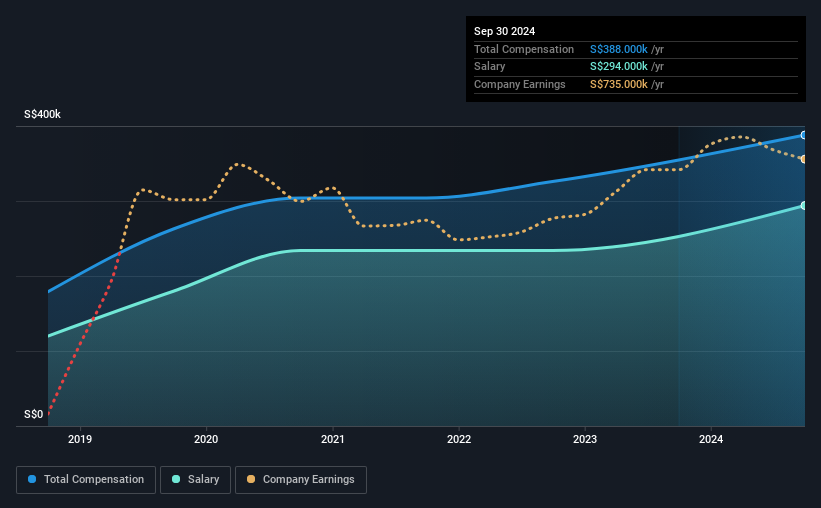

Our data indicates that Sunlight (1977) Holdings Limited has a market capitalization of HK$48m, and total annual CEO compensation was reported as S$388k for the year to September 2024. This was the same as last year. Notably, the salary which is S$294.0k, represents most of the total compensation being paid.

For comparison, other companies in the Hong Kong Retail Distributors industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of S$339k. From this we gather that Liang Sie Chua is paid around the median for CEOs in the industry.

| Component | 2024 | 2024 | Proportion (2024) |

| Salary | S$294k | S$294k | 76% |

| Other | S$94k | S$94k | 24% |

| Total Compensation | S$388k | S$388k | 100% |

On an industry level, roughly 93% of total compensation represents salary and 7% is other remuneration. Sunlight (1977) Holdings pays a modest slice of remuneration through salary, as compared to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Sunlight (1977) Holdings Limited's Growth Numbers

Sunlight (1977) Holdings Limited's earnings per share (EPS) grew 44% per year over the last three years. In the last year, its revenue is down 3.7%.

Shareholders would be glad to know that the company has improved itself over the last few years. While it would be good to see revenue growth, profits matter more in the end. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Sunlight (1977) Holdings Limited Been A Good Investment?

Sunlight (1977) Holdings Limited has not done too badly by shareholders, with a total return of 1.7%, over three years. It would be nice to see that metric improve in the future. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for Sunlight (1977) Holdings you should be aware of, and 1 of them is concerning.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8451

Sunlight (1977) Holdings

An investment holding company, supplies tissue products and hygiene related products for corporate customers in Singapore.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives