- Hong Kong

- /

- Specialty Stores

- /

- SEHK:8222

If You Had Bought E Lighting Group Holdings (HKG:8222) Stock Three Years Ago, You'd Be Sitting On A 66% Loss, Today

E Lighting Group Holdings Limited (HKG:8222) shareholders should be happy to see the share price up 12% in the last quarter. But over the last three years we've seen a quite serious decline. Indeed, the share price is down a tragic 66% in the last three years. So the improvement may be a real relief to some. While many would remain nervous, there could be further gains if the business can put its best foot forward.

See our latest analysis for E Lighting Group Holdings

Given that E Lighting Group Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years E Lighting Group Holdings saw its revenue shrink by 10% per year. That's not what investors generally want to see. The share price decline of 30% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

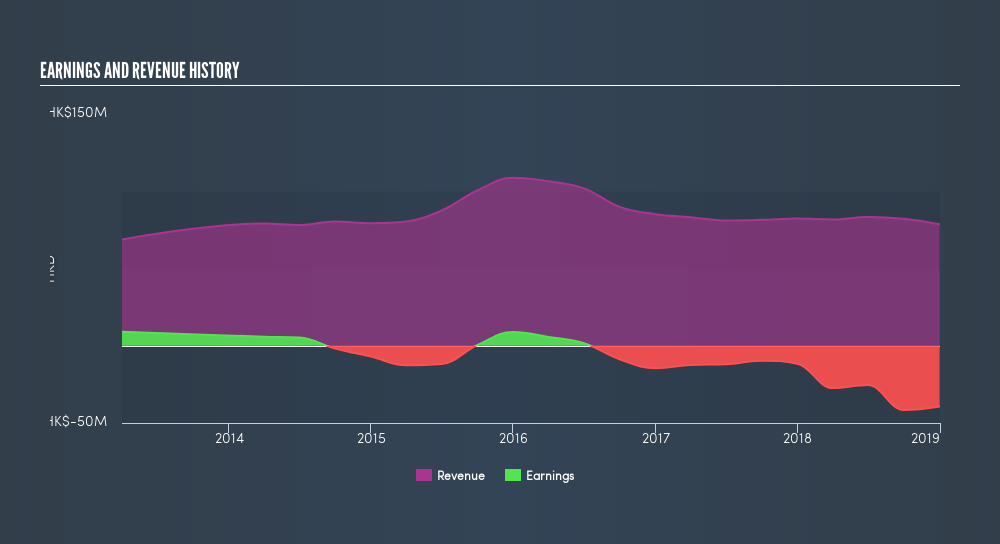

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

If you are thinking of buying or selling E Lighting Group Holdings stock, you should check out this FREEdetailed report on its balance sheet.

A Different Perspective

E Lighting Group Holdings shareholders are down 38% for the year, falling short of the market return. Meanwhile, the broader market slid about 2.9%, likely weighing on the stock. Shareholders have lost 30% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:8222

E Lighting Group Holdings

Engages in the retail sale of lighting, designer label furniture, and household products in Hong Kong.

Flawless balance sheet and good value.

Market Insights

Community Narratives