- Hong Kong

- /

- Retail Distributors

- /

- SEHK:370

If You Had Bought China Best Group Holding's (HKG:370) Shares Five Years Ago You Would Be Down 79%

Some stocks are best avoided. We don't wish catastrophic capital loss on anyone. Imagine if you held China Best Group Holding Limited (HKG:370) for half a decade as the share price tanked 79%. We also note that the stock has performed poorly over the last year, with the share price down 50%. But it's up 7.9% in the last week.

Check out our latest analysis for China Best Group Holding

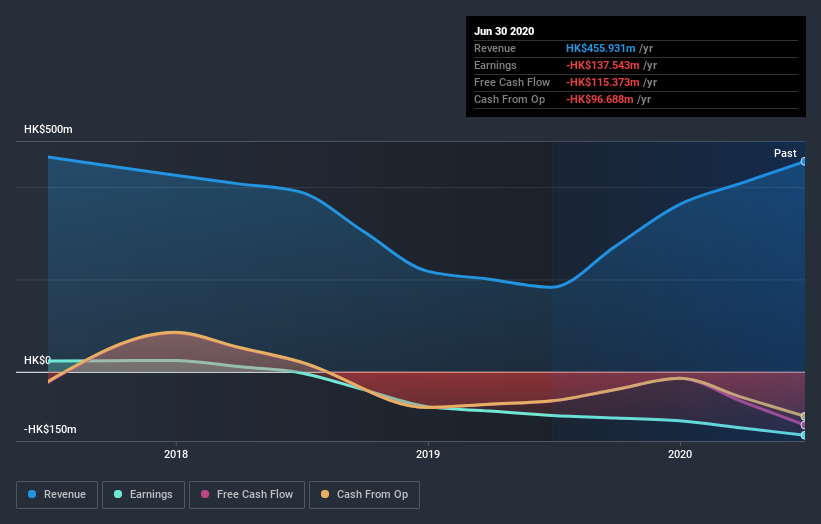

Because China Best Group Holding made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years China Best Group Holding saw its revenue shrink by 6.7% per year. While far from catastrophic that is not good. If a business loses money, you want it to grow, so no surprises that the share price has dropped 12% each year in that time. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. That is not really what the successful investors we know aim for.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on China Best Group Holding's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

China Best Group Holding shareholders are down 50% for the year, but the market itself is up 6.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for China Best Group Holding (of which 1 is significant!) you should know about.

China Best Group Holding is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade China Best Group Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong Robotics Group Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:370

Hong Kong Robotics Group Holding

An investment holding company, trades in electronic appliances in the People’s Republic of China, Singapore, and Hong Kong.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives