Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies China Best Group Holding Limited (HKG:370) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for China Best Group Holding

How Much Debt Does China Best Group Holding Carry?

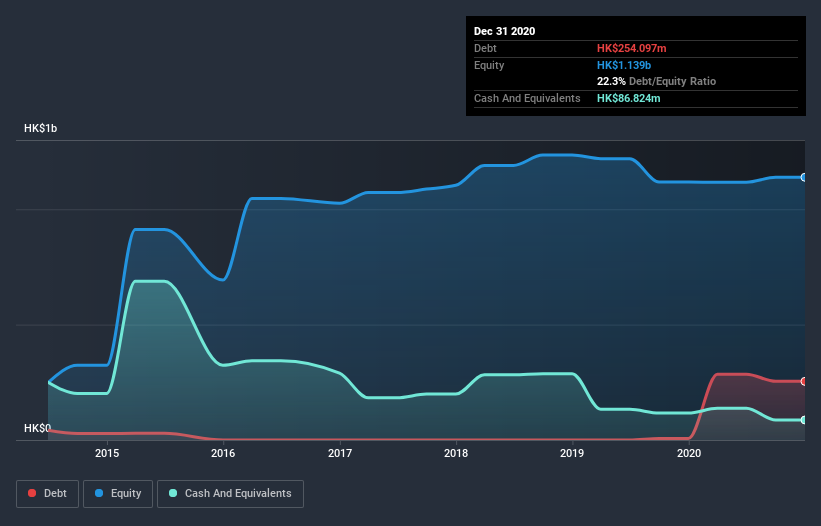

You can click the graphic below for the historical numbers, but it shows that as of December 2020 China Best Group Holding had HK$254.1m of debt, an increase on HK$6.52m, over one year. However, it does have HK$86.8m in cash offsetting this, leading to net debt of about HK$167.3m.

A Look At China Best Group Holding's Liabilities

Zooming in on the latest balance sheet data, we can see that China Best Group Holding had liabilities of HK$700.2m due within 12 months and liabilities of HK$266.1m due beyond that. On the other hand, it had cash of HK$86.8m and HK$1.11b worth of receivables due within a year. So it actually has HK$230.0m more liquid assets than total liabilities.

This luscious liquidity implies that China Best Group Holding's balance sheet is sturdy like a giant sequoia tree. On this view, lenders should feel as safe as the beloved of a black-belt karate master. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since China Best Group Holding will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year China Best Group Holding wasn't profitable at an EBIT level, but managed to grow its revenue by 190%, to HK$1.1b. So there's no doubt that shareholders are cheering for growth

Caveat Emptor

Despite the top line growth, China Best Group Holding still had an earnings before interest and tax (EBIT) loss over the last year. Its EBIT loss was a whopping HK$43m. Having said that, the balance sheet has plenty of liquid assets for now. That should give the business time to grow its cashflow. The revenue taking off like a rocket and that would make it easier to raise capital if the company considered it prudent to do so. While it may show some promise this one could still be considered risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for China Best Group Holding (1 doesn't sit too well with us) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading China Best Group Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong Robotics Group Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:370

Hong Kong Robotics Group Holding

An investment holding company, trades in electronic appliances in the People’s Republic of China, Singapore, and Hong Kong.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives