Stock Analysis

- Hong Kong

- /

- Specialty Stores

- /

- SEHK:3669

Is China Yongda Automobiles Services Holdings Limited (HKG:3669) A Smart Pick For Income Investors?

Today we'll take a closer look at China Yongda Automobiles Services Holdings Limited (HKG:3669) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

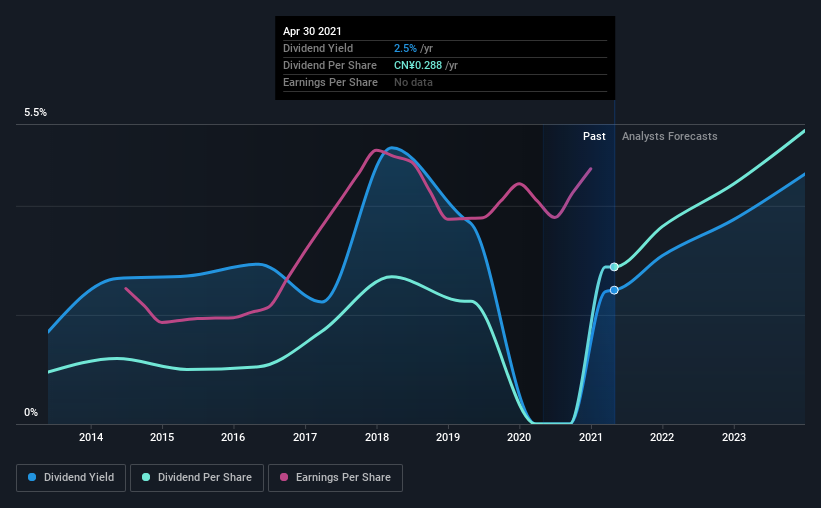

With a 2.5% yield and a eight-year payment history, investors probably think China Yongda Automobiles Services Holdings looks like a reliable dividend stock. While the yield may not look too great, the relatively long payment history is interesting. Some simple research can reduce the risk of buying China Yongda Automobiles Services Holdings for its dividend - read on to learn more.

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. China Yongda Automobiles Services Holdings paid out 34% of its profit as dividends, over the trailing twelve month period. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

We update our data on China Yongda Automobiles Services Holdings every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the last decade of data, we can see that China Yongda Automobiles Services Holdings paid its first dividend at least eight years ago. It's good to see that China Yongda Automobiles Services Holdings has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past eight-year period, the first annual payment was CN¥0.1 in 2013, compared to CN¥0.3 last year. Dividends per share have grown at approximately 15% per year over this time. The dividends haven't grown at precisely 15% every year, but this is a useful way to average out the historical rate of growth.

So, its dividends have grown at a rapid rate over this time, but payments have been cut in the past. The stock may still be worth considering as part of a diversified dividend portfolio.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? It's good to see China Yongda Automobiles Services Holdings has been growing its earnings per share at 19% a year over the past five years. A company paying out less than a quarter of its earnings as dividends, and growing earnings at more than 10% per annum, looks to be right in the cusp of its growth phase. At the right price, we might be interested.

We'd also point out that China Yongda Automobiles Services Holdings issued a meaningful number of new shares in the past year. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Conclusion

To summarise, shareholders should always check that China Yongda Automobiles Services Holdings' dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Firstly, we like that China Yongda Automobiles Services Holdings has a low and conservative payout ratio. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. China Yongda Automobiles Services Holdings fits all of our criteria, and we think it's an attractive dividend idea that would warrant further investigation.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 5 warning signs for China Yongda Automobiles Services Holdings that investors need to be conscious of moving forward.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether China Yongda Automobiles Services Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3669

China Yongda Automobiles Services Holdings

An investment holding company, operates as a passenger vehicle retailer and service provider for luxury and ultra-luxury brands in the People’s Republic of China.

Undervalued with excellent balance sheet and pays a dividend.