Stock Analysis

- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1929

What Can We Conclude About Chow Tai Fook Jewellery Group's (HKG:1929) CEO Pay?

Kent Wong became the CEO of Chow Tai Fook Jewellery Group Limited (HKG:1929) in 2011, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Chow Tai Fook Jewellery Group

Comparing Chow Tai Fook Jewellery Group Limited's CEO Compensation With the industry

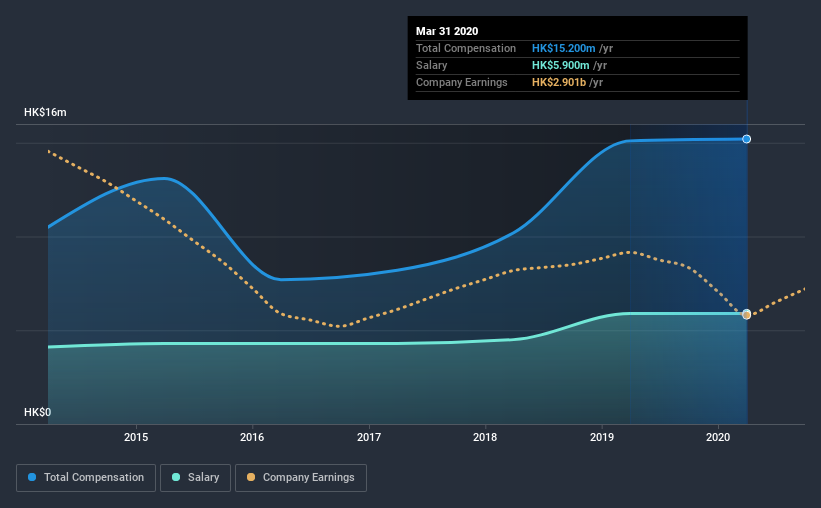

According to our data, Chow Tai Fook Jewellery Group Limited has a market capitalization of HK$98b, and paid its CEO total annual compensation worth HK$15m over the year to March 2020. That's mostly flat as compared to the prior year's compensation. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at HK$5.9m.

For comparison, other companies in the industry with market capitalizations above HK$62b, reported a median total CEO compensation of HK$51m. Accordingly, Chow Tai Fook Jewellery Group pays its CEO under the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$5.9m | HK$5.9m | 39% |

| Other | HK$9.3m | HK$9.2m | 61% |

| Total Compensation | HK$15m | HK$15m | 100% |

Talking in terms of the industry, salary represented approximately 91% of total compensation out of all the companies we analyzed, while other remuneration made up 9.2% of the pie. It's interesting to note that Chow Tai Fook Jewellery Group allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Chow Tai Fook Jewellery Group Limited's Growth

Chow Tai Fook Jewellery Group Limited saw earnings per share stay pretty flat over the last three years. In the last year, its revenue is down 22%.

Its a bit disappointing to see that the company has failed to grow its EPS. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Chow Tai Fook Jewellery Group Limited Been A Good Investment?

We think that the total shareholder return of 39%, over three years, would leave most Chow Tai Fook Jewellery Group Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As we noted earlier, Chow Tai Fook Jewellery Group pays its CEO lower than the norm for similar-sized companies belonging to the same industry. And although the company is suffering from declining EPS growth over the past three years, shareholder returns remain strong. Although we'd like to see positive EPS growth, we'd argue the remuneration is modest, based on our observations.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 2 warning signs for Chow Tai Fook Jewellery Group that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Chow Tai Fook Jewellery Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Chow Tai Fook Jewellery Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1929

Chow Tai Fook Jewellery Group

An investment holding company, manufactures and sells jewelry products in Mainland China, Hong Kong, Macau, and internationally.

Solid track record with adequate balance sheet and pays a dividend.