- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1268

Some Confidence Is Lacking In China MeiDong Auto Holdings Limited (HKG:1268) As Shares Slide 26%

China MeiDong Auto Holdings Limited (HKG:1268) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 26% share price drop.

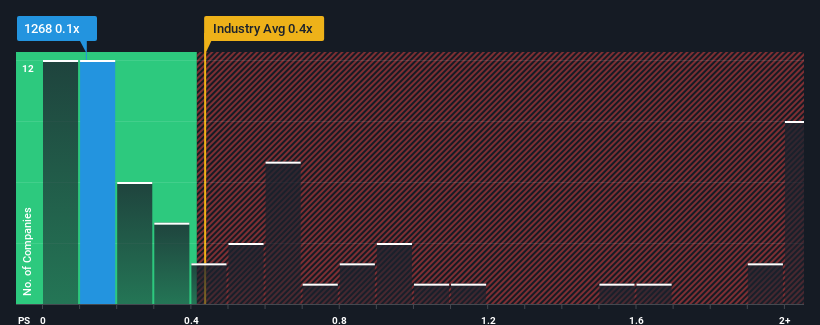

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about China MeiDong Auto Holdings' P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Specialty Retail industry in Hong Kong is also close to 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

We check all companies for important risks. See what we found for China MeiDong Auto Holdings in our free report.Check out our latest analysis for China MeiDong Auto Holdings

What Does China MeiDong Auto Holdings' Recent Performance Look Like?

China MeiDong Auto Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on China MeiDong Auto Holdings.How Is China MeiDong Auto Holdings' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like China MeiDong Auto Holdings' is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 22%. The last three years don't look nice either as the company has shrunk revenue by 6.0% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 4.8% per annum as estimated by the six analysts watching the company. That's not great when the rest of the industry is expected to grow by 32% each year.

In light of this, it's somewhat alarming that China MeiDong Auto Holdings' P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On China MeiDong Auto Holdings' P/S

China MeiDong Auto Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our check of China MeiDong Auto Holdings' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for China MeiDong Auto Holdings with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1268

China MeiDong Auto Holdings

An investment holding company, operates as an automobile dealer in the People’s Republic of China.

Adequate balance sheet and fair value.

Market Insights

Community Narratives