- Hong Kong

- /

- Real Estate

- /

- SEHK:6968

A Closer Look At Ganglong China Property Group Limited's (HKG:6968) Impressive ROE

Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is for those who would like to learn about Return On Equity (ROE). By way of learning-by-doing, we'll look at ROE to gain a better understanding of Ganglong China Property Group Limited (HKG:6968).

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Ganglong China Property Group

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Ganglong China Property Group is:

32% = CN¥721m ÷ CN¥2.2b (Based on the trailing twelve months to June 2020).

The 'return' refers to a company's earnings over the last year. That means that for every HK$1 worth of shareholders' equity, the company generated HK$0.32 in profit.

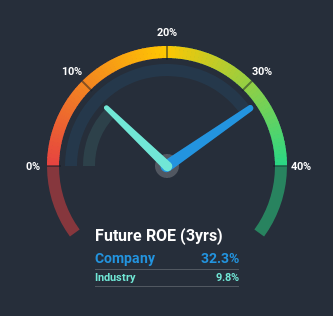

Does Ganglong China Property Group Have A Good Return On Equity?

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. Pleasingly, Ganglong China Property Group has a superior ROE than the average (9.8%) in the Real Estate industry.

That's clearly a positive. With that said, a high ROE doesn't always indicate high profitability. A higher proportion of debt in a company's capital structure may also result in a high ROE, where the high debt levels could be a huge risk . To know the 2 risks we have identified for Ganglong China Property Group visit our risks dashboard for free.

Why You Should Consider Debt When Looking At ROE

Most companies need money -- from somewhere -- to grow their profits. The cash for investment can come from prior year profits (retained earnings), issuing new shares, or borrowing. In the case of the first and second options, the ROE will reflect this use of cash, for growth. In the latter case, the use of debt will improve the returns, but will not change the equity. In this manner the use of debt will boost ROE, even though the core economics of the business stay the same.

Combining Ganglong China Property Group's Debt And Its 32% Return On Equity

It seems that Ganglong China Property Group uses a huge volume of debt to fund the business, since it has an extremely high debt to equity ratio of 5.17. So although the company has an impressive ROE, the company might not have been able to achieve this without the significant use of debt.

Summary

Return on equity is one way we can compare its business quality of different companies. In our books, the highest quality companies have high return on equity, despite low debt. If two companies have around the same level of debt to equity, and one has a higher ROE, I'd generally prefer the one with higher ROE.

Having said that, while ROE is a useful indicator of business quality, you'll have to look at a whole range of factors to determine the right price to buy a stock. It is important to consider other factors, such as future profit growth -- and how much investment is required going forward. Check the past profit growth by Ganglong China Property Group by looking at this visualization of past earnings, revenue and cash flow.

Of course Ganglong China Property Group may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

If you’re looking to trade Ganglong China Property Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6968

Ganglong China Property Group

An investment holding company, engages in the development of real estate projects in the People’s Republic of China.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives