John Lee has been the CEO of Hongkong Chinese Limited (HKG:655) since 2011, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Hongkong Chinese.

View our latest analysis for Hongkong Chinese

Comparing Hongkong Chinese Limited's CEO Compensation With the industry

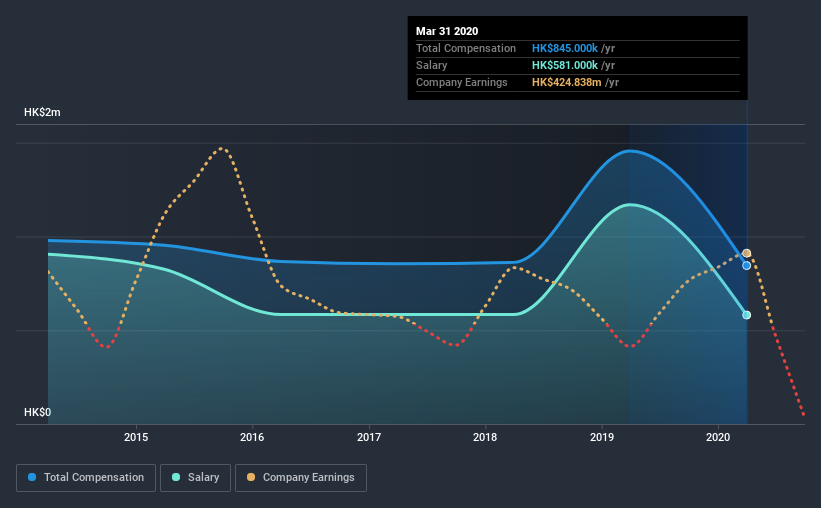

Our data indicates that Hongkong Chinese Limited has a market capitalization of HK$1.3b, and total annual CEO compensation was reported as HK$845k for the year to March 2020. That's a notable decrease of 42% on last year. We note that the salary portion, which stands at HK$581.0k constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between HK$776m and HK$3.1b, we discovered that the median CEO total compensation of that group was HK$3.2m. In other words, Hongkong Chinese pays its CEO lower than the industry median. Furthermore, John Lee directly owns HK$1.3m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$581k | HK$1.2m | 69% |

| Other | HK$264k | HK$287k | 31% |

| Total Compensation | HK$845k | HK$1.5m | 100% |

Talking in terms of the industry, salary represented approximately 70% of total compensation out of all the companies we analyzed, while other remuneration made up 30% of the pie. Our data reveals that Hongkong Chinese allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Hongkong Chinese Limited's Growth Numbers

Hongkong Chinese Limited has reduced its earnings per share by 28% a year over the last three years. It achieved revenue growth of 41% over the last year.

The reduction in EPS, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Hongkong Chinese Limited Been A Good Investment?

Since shareholders would have lost about 51% over three years, some Hongkong Chinese Limited investors would surely be feeling negative emotions. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As previously discussed, John is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. But Hongkong Chinese has recorded negative shareholder returns and EPS growth over the last three years. Conversely, revenues are increasing at a healthy pace, recently. Although it's fair to say CEO compensation is modest, shareholders might want to see healthier investor returns before thinking John deserves a raise.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 2 warning signs (and 1 which is a bit concerning) in Hongkong Chinese we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Hongkong Chinese or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hongkong Chinese might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:655

Hongkong Chinese

An investment holding company, engages in property investment and development, project management, securities and treasury investment, healthcare services, and hotel operations in Hong Kong, Mainland China, Republic of Singapore, Indonesia, and internationally.

Imperfect balance sheet with very low risk.

Market Insights

Community Narratives