The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Paladin Limited (HKG:495) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Paladin

How Much Debt Does Paladin Carry?

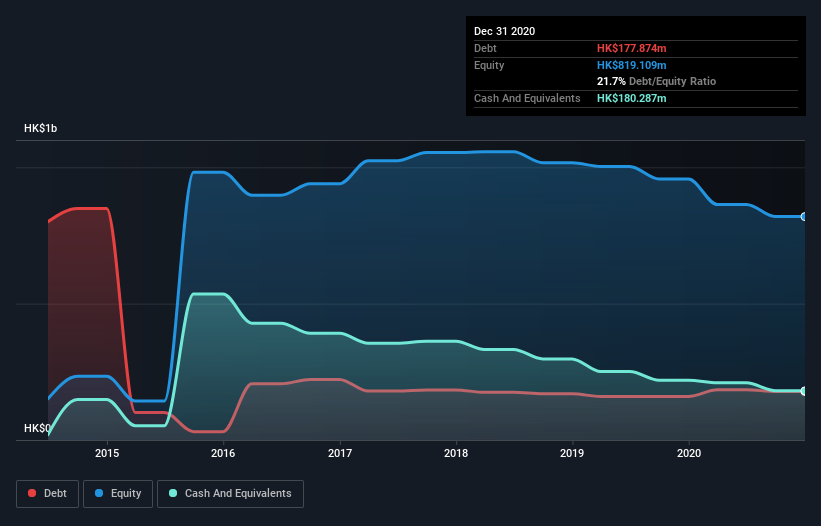

The image below, which you can click on for greater detail, shows that at December 2020 Paladin had debt of HK$177.9m, up from HK$159.5m in one year. But it also has HK$180.3m in cash to offset that, meaning it has HK$2.41m net cash.

A Look At Paladin's Liabilities

Zooming in on the latest balance sheet data, we can see that Paladin had liabilities of HK$169.1m due within 12 months and liabilities of HK$25.6m due beyond that. Offsetting these obligations, it had cash of HK$180.3m as well as receivables valued at HK$3.80m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$10.6m.

Given Paladin has a market capitalization of HK$196.2m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Despite its noteworthy liabilities, Paladin boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is Paladin's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Paladin reported revenue of HK$16m, which is a gain of 309%, although it did not report any earnings before interest and tax. That's virtually the hole-in-one of revenue growth!

So How Risky Is Paladin?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Paladin had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of HK$58m and booked a HK$127m accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of HK$2.41m. That means it could keep spending at its current rate for more than two years. The good news for shareholders is that Paladin has dazzling revenue growth, so there's a very good chance it can boost its free cash flow in the years to come. While unprofitable companies can be risky, they can also grow hard and fast in those pre-profit years. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Paladin (of which 1 is a bit concerning!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:495

Paladin

An investment holding company, engages in the property investment, and research and development of high technology system and applications in Hong Kong, Finland, and internationally.

Slight with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026