- Hong Kong

- /

- Real Estate

- /

- SEHK:41

We Think Shareholders May Want To Consider A Review Of Great Eagle Holdings Limited's (HKG:41) CEO Compensation Package

Shareholders will probably not be too impressed with the underwhelming results at Great Eagle Holdings Limited (HKG:41) recently. At the upcoming AGM on 06 May 2021, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

View our latest analysis for Great Eagle Holdings

How Does Total Compensation For Ka Shui Lo Compare With Other Companies In The Industry?

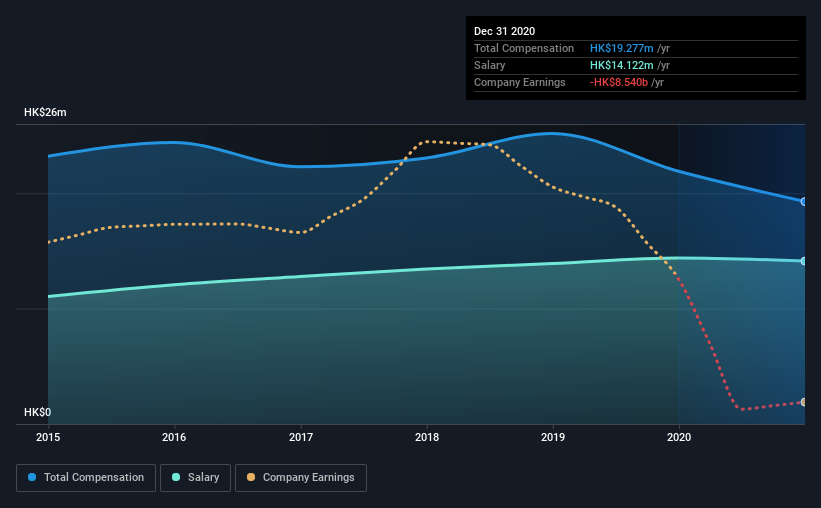

According to our data, Great Eagle Holdings Limited has a market capitalization of HK$20b, and paid its CEO total annual compensation worth HK$19m over the year to December 2020. Notably, that's a decrease of 12% over the year before. In particular, the salary of HK$14.1m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations ranging from HK$16b to HK$50b, the reported median CEO total compensation was HK$6.9m. This suggests that Ka Shui Lo is paid more than the median for the industry. Furthermore, Ka Shui Lo directly owns HK$4.0b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$14m | HK$14m | 73% |

| Other | HK$5.2m | HK$7.5m | 27% |

| Total Compensation | HK$19m | HK$22m | 100% |

On an industry level, roughly 70% of total compensation represents salary and 30% is other remuneration. Our data reveals that Great Eagle Holdings allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Great Eagle Holdings Limited's Growth Numbers

Over the last three years, Great Eagle Holdings Limited has shrunk its earnings per share by 109% per year. In the last year, its revenue is up 12%.

Overall this is not a very positive result for shareholders. And while it's good to see some good revenue growth recently, the growth isn't really fast enough for us to put aside my concerns around EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Great Eagle Holdings Limited Been A Good Investment?

Since shareholders would have lost about 15% over three years, some Great Eagle Holdings Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for Great Eagle Holdings (of which 1 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Great Eagle Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:41

Great Eagle Holdings

An investment holding company, invests in, develops, leases, and manages residential, office, industrial, and hotel properties in Hong Kong, the United States, Canada, the United Kingdom, Australia, New Zealand, Mainland China, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives