- Hong Kong

- /

- Real Estate

- /

- SEHK:3688

Does Top Spring International Holdings (HKG:3688) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Top Spring International Holdings Limited (HKG:3688) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Top Spring International Holdings

How Much Debt Does Top Spring International Holdings Carry?

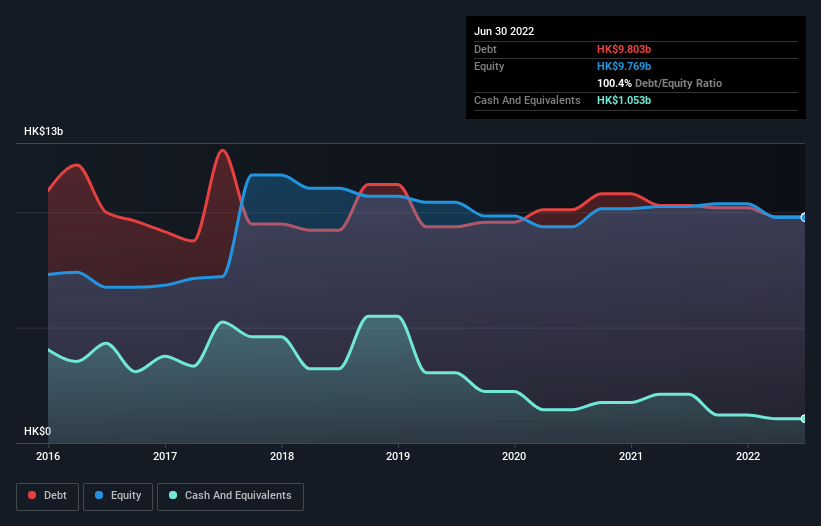

You can click the graphic below for the historical numbers, but it shows that Top Spring International Holdings had HK$9.80b of debt in June 2022, down from HK$10.3b, one year before. On the flip side, it has HK$1.05b in cash leading to net debt of about HK$8.75b.

A Look At Top Spring International Holdings' Liabilities

According to the last reported balance sheet, Top Spring International Holdings had liabilities of HK$8.82b due within 12 months, and liabilities of HK$6.05b due beyond 12 months. Offsetting this, it had HK$1.05b in cash and HK$1.05b in receivables that were due within 12 months. So its liabilities total HK$12.8b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the HK$1.15b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Top Spring International Holdings would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Top Spring International Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Top Spring International Holdings reported revenue of HK$3.2b, which is a gain of 425%, although it did not report any earnings before interest and tax. That's virtually the hole-in-one of revenue growth!

Caveat Emptor

While we can certainly appreciate Top Spring International Holdings's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. Indeed, it lost HK$18m at the EBIT level. Reflecting on this and the significant total liabilities, it's hard to know what to say about the stock because of our intense dis-affinity for it. Like every long-shot we're sure it has a glossy presentation outlining its blue-sky potential. But the reality is that it is low on liquid assets relative to liabilities, and it burned through HK$534m in the last year. So we consider this a high risk stock, and we're worried its share price could sink faster than than a dingy with a great white shark attacking it. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Top Spring International Holdings is showing 3 warning signs in our investment analysis , and 2 of those are significant...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Top Spring International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3688

Top Spring International Holdings

An investment holding company, operates as a real estate property developer in the People's Republic of China.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives