Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Tian Shan Development (Holding) Limited (HKG:2118) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Tian Shan Development (Holding)

What Is Tian Shan Development (Holding)'s Debt?

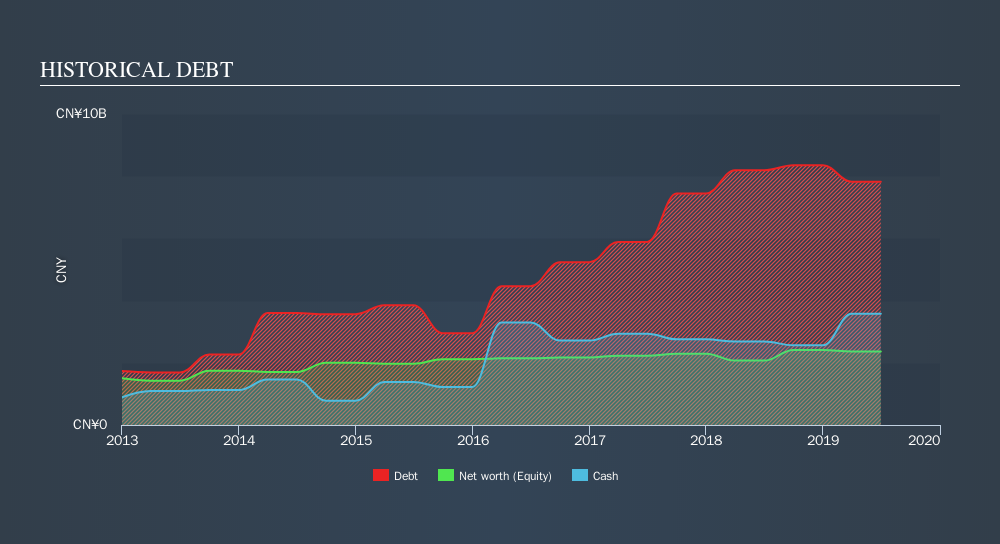

The image below, which you can click on for greater detail, shows that Tian Shan Development (Holding) had debt of CN¥7.82b at the end of June 2019, a reduction from CN¥8.19b over a year. On the flip side, it has CN¥3.58b in cash leading to net debt of about CN¥4.24b.

A Look At Tian Shan Development (Holding)'s Liabilities

According to the last reported balance sheet, Tian Shan Development (Holding) had liabilities of CN¥23.2b due within 12 months, and liabilities of CN¥4.38b due beyond 12 months. Offsetting these obligations, it had cash of CN¥3.58b as well as receivables valued at CN¥2.05b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥22.0b.

The deficiency here weighs heavily on the CN¥1.95b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we'd watch its balance sheet closely, without a doubt After all, Tian Shan Development (Holding) would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Tian Shan Development (Holding) has a debt to EBITDA ratio of 4.5, which signals significant debt, but is still pretty reasonable for most types of business. But its EBIT was about 10.3 times its interest expense, implying the company isn't really paying full freight on that debt. Even if not sustainable, that is a good sign. Notably, Tian Shan Development (Holding)'s EBIT launched higher than Elon Musk, gaining a whopping 200% on last year. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Tian Shan Development (Holding) will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Tian Shan Development (Holding) burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, Tian Shan Development (Holding)'s conversion of EBIT to free cash flow left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Looking at the bigger picture, it seems clear to us that Tian Shan Development (Holding)'s use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Tian Shan Development (Holding)'s earnings per share history for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:2118

Tian Shan Development (Holding)

Tian Shan Development (Holding) Limited, an investment holding company, develops and sells properties in the People’s Republic of China.

Good value with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion