- Hong Kong

- /

- Real Estate

- /

- SEHK:2019

Dexin China Holdings (HKG:2019) Has Announced That It Will Be Increasing Its Dividend To HK$0.13

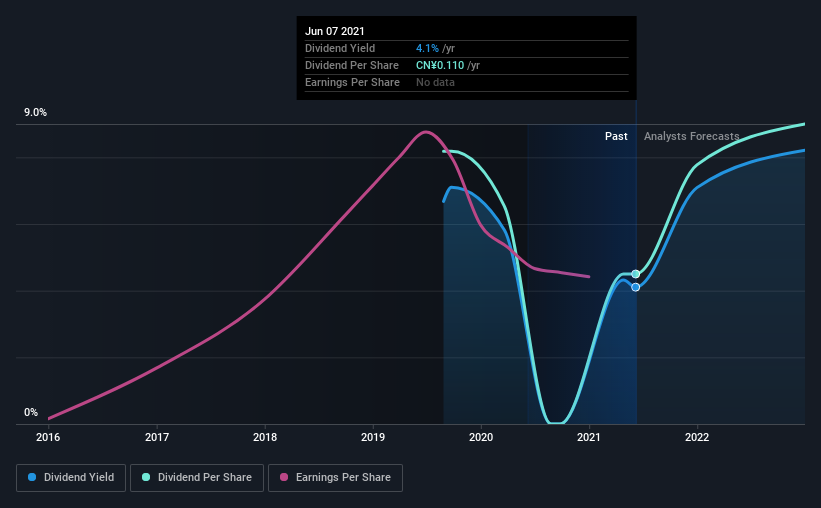

Dexin China Holdings Company Limited (HKG:2019) has announced that it will be increasing its dividend on the 30th of September to HK$0.13. This makes the dividend yield about the same as the industry average at 4.1%.

View our latest analysis for Dexin China Holdings

Dexin China Holdings' Payment Has Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Prior to this announcement, Dexin China Holdings' earnings easily covered the dividend, but free cash flows were negative. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

Looking forward, earnings per share is forecast to fall by 4.9% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could be 32%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Dexin China Holdings' Dividend Has Lacked Consistency

Even in its short history, we have seen the dividend cut. Since 2019, the dividend has gone from CN¥0.20 to CN¥0.11. Dividend payments have fallen sharply, down 45% over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Looks Likely To Grow

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. We are encouraged to see that Dexin China Holdings has grown earnings per share at 95% per year over the past five years. A low payout ratio gives the company a lot of flexibility, and growing earnings also make it very easy for it to grow the dividend.

In Summary

Overall, we always like to see the dividend being raised, but we don't think Dexin China Holdings will make a great income stock. While Dexin China Holdings is earning enough to cover the payments, the cash flows are lacking. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 3 warning signs for Dexin China Holdings you should be aware of, and 1 of them shouldn't be ignored. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2019

Dexin China Holdings

An investment holding company, engages in the property development business in the People’s Republic of China.

Good value with adequate balance sheet.

Market Insights

Community Narratives