- Hong Kong

- /

- Real Estate

- /

- SEHK:163

We Think Shareholders May Want To Consider A Review Of Emperor International Holdings Limited's (HKG:163) CEO Compensation Package

Shareholders will probably not be too impressed with the underwhelming results at Emperor International Holdings Limited (HKG:163) recently. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 19 August 2021. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. From our analysis, we think CEO compensation may need a review in light of the recent performance.

See our latest analysis for Emperor International Holdings

Comparing Emperor International Holdings Limited's CEO Compensation With the industry

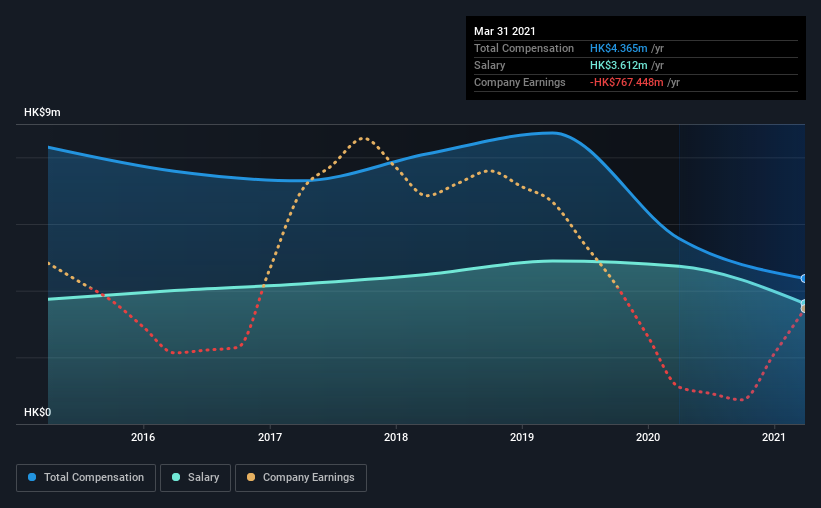

Our data indicates that Emperor International Holdings Limited has a market capitalization of HK$4.1b, and total annual CEO compensation was reported as HK$4.4m for the year to March 2021. That's a notable decrease of 22% on last year. Notably, the salary which is HK$3.61m, represents most of the total compensation being paid.

On comparing similar companies from the same industry with market caps ranging from HK$1.6b to HK$6.2b, we found that the median CEO total compensation was HK$2.8m. Hence, we can conclude that Bryan Wong is remunerated higher than the industry median.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$3.6m | HK$4.7m | 83% |

| Other | HK$753k | HK$832k | 17% |

| Total Compensation | HK$4.4m | HK$5.6m | 100% |

On an industry level, around 69% of total compensation represents salary and 31% is other remuneration. It's interesting to note that Emperor International Holdings pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Emperor International Holdings Limited's Growth Numbers

Over the last three years, Emperor International Holdings Limited has shrunk its earnings per share by 101% per year. It saw its revenue drop 44% over the last year.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Emperor International Holdings Limited Been A Good Investment?

Few Emperor International Holdings Limited shareholders would feel satisfied with the return of -40% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 3 warning signs for Emperor International Holdings (of which 2 are a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Emperor International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:163

Emperor International Holdings

An investment holding company, engages in property investment and development in Hong Kong, Macau, the United Kingdom, and the People’s Republic of China.

Good value with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026