- Hong Kong

- /

- Real Estate

- /

- SEHK:1628

We're Not So Sure You Should Rely on Yuzhou Group Holdings's (HKG:1628) Statutory Earnings

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. That said, the current statutory profit is not always a good guide to a company's underlying profitability. In this article, we'll look at how useful this year's statutory profit is, when analysing Yuzhou Group Holdings (HKG:1628).

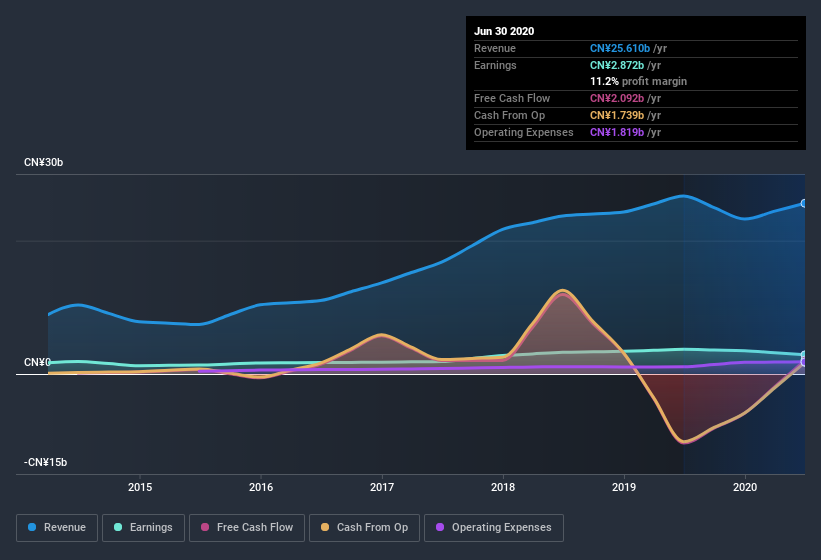

While Yuzhou Group Holdings was able to generate revenue of CN¥25.6b in the last twelve months, we think its profit result of CN¥2.87b was more important. Happily, it has grown both its profit and revenue over the last three years (but not in the last year), as you can see in the chart below.

See our latest analysis for Yuzhou Group Holdings

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. Therefore, today we will consider the nature of Yuzhou Group Holdings' statutory earnings with reference to its dilution of shareholders and the impact of unusual items. Our data indicates that Yuzhou Group Holdings insiders have been buying shares! Luckily we are in a position to provide you with this free chart of of all insider buying (and selling).

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Yuzhou Group Holdings increased the number of shares on issue by 9.0% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Yuzhou Group Holdings' EPS by clicking here.

How Is Dilution Impacting Yuzhou Group Holdings' Earnings Per Share? (EPS)

As you can see above, Yuzhou Group Holdings has been growing its net income over the last few years, with an annualized gain of 53% over three years. But EPS was only up 14% per year, in the exact same period. Net profit actually dropped by 22% in the last year. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 30%. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If Yuzhou Group Holdings' EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

How Do Unusual Items Influence Profit?

Finally, we should also consider the fact that unusual items boosted Yuzhou Group Holdings' net profit by CN¥1.5b over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. We can see that Yuzhou Group Holdings' positive unusual items were quite significant relative to its profit in the year to June 2020. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Yuzhou Group Holdings' Profit Performance

To sum it all up, Yuzhou Group Holdings got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. And furthermore, it went and issued plenty of new shares, ensuring that each shareholder (who did not tip more money in) now owns a smaller proportion of the company. For the reasons mentioned above, we think that a perfunctory glance at Yuzhou Group Holdings' statutory profits might make it look better than it really is on an underlying level. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Be aware that Yuzhou Group Holdings is showing 4 warning signs in our investment analysis and 1 of those shouldn't be ignored...

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade Yuzhou Group Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1628

Yuzhou Group Holdings

An investment holding company, engages in the property development and investment business in China and Hong Kong.

Slight risk and slightly overvalued.

Market Insights

Community Narratives