Sun Hung Kai Properties Limited's (HKG:16) investors are due to receive a payment of HK$3.70 per share on 18th of November. This means the dividend yield will be fairly typical at 4.6%.

Check out our latest analysis for Sun Hung Kai Properties

Sun Hung Kai Properties' Payment Has Solid Earnings Coverage

Unless the payments are sustainable, the dividend yield doesn't mean too much. Based on the last payment, Sun Hung Kai Properties was quite comfortably earning enough to cover the dividend. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Over the next year, EPS is forecast to expand by 22.3%. Assuming the dividend continues along recent trends, we think the payout ratio could be 47% by next year, which is in a pretty sustainable range.

Sun Hung Kai Properties Has A Solid Track Record

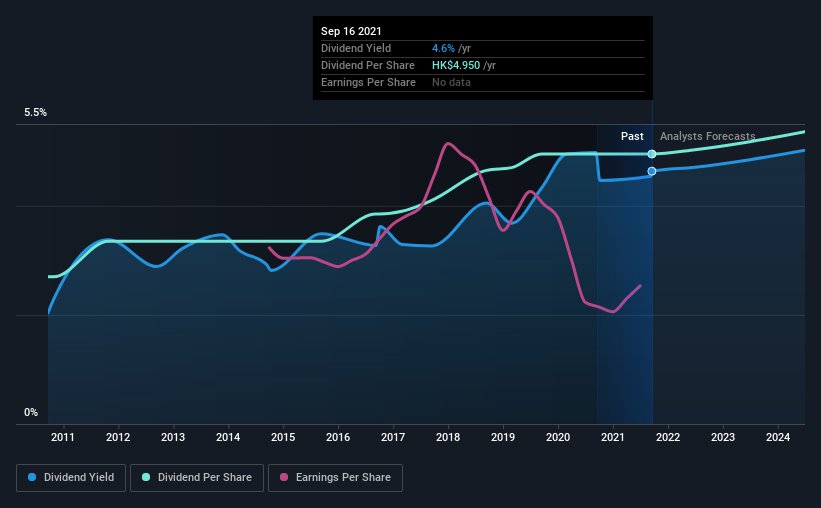

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The first annual payment during the last 10 years was HK$2.70 in 2011, and the most recent fiscal year payment was HK$4.95. This implies that the company grew its distributions at a yearly rate of about 6.2% over that duration. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

Sun Hung Kai Properties May Find It Hard To Grow The Dividend

Investors could be attracted to the stock based on the quality of its payment history. However, initial appearances might be deceiving. In the last five years, Sun Hung Kai Properties' earnings per share has shrunk at approximately 4.0% per annum. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Our Thoughts On Sun Hung Kai Properties' Dividend

Overall, we think Sun Hung Kai Properties is a solid choice as a dividend stock, even though the dividend wasn't raised this year. With shrinking earnings, the company may see some issues maintaining the dividend even though they look pretty sustainable for now. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Given that earnings are not growing, the dividend does not look nearly so attractive. Businesses can change though, and we think it would make sense to see what analysts are forecasting for the company. We have also put together a list of global stocks with a solid dividend.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:16

Sun Hung Kai Properties

Develops and invests in properties for sale and rent in Hong Kong, Mainland China, and internationally.

Good value with adequate balance sheet and pays a dividend.