- Hong Kong

- /

- Real Estate

- /

- SEHK:1233

What We Learned About Times China Holdings' (HKG:1233) CEO Compensation

This article will reflect on the compensation paid to Chiu Hung Shum who has served as CEO of Times China Holdings Limited (HKG:1233) since 2007. This analysis will also assess whether Times China Holdings pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Times China Holdings

How Does Total Compensation For Chiu Hung Shum Compare With Other Companies In The Industry?

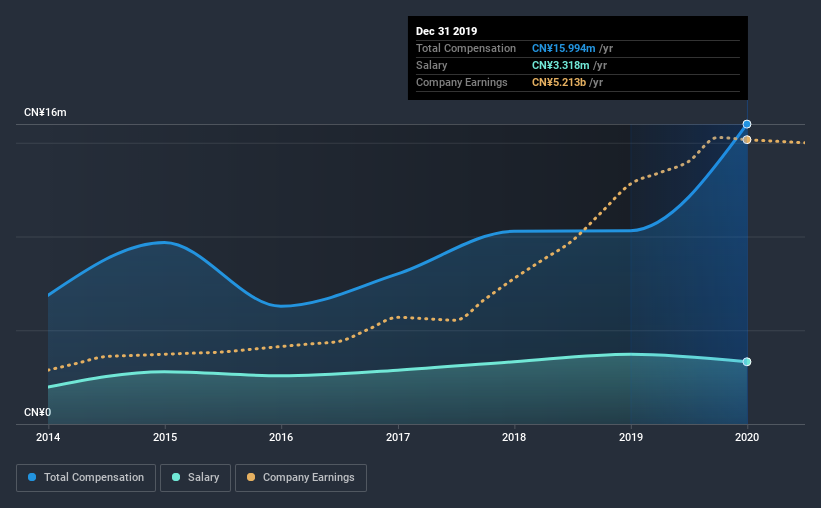

According to our data, Times China Holdings Limited has a market capitalization of HK$21b, and paid its CEO total annual compensation worth CN¥16m over the year to December 2019. We note that's an increase of 55% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CN¥3.3m.

For comparison, other companies in the same industry with market capitalizations ranging between HK$16b and HK$50b had a median total CEO compensation of CN¥5.0m. Hence, we can conclude that Chiu Hung Shum is remunerated higher than the industry median. Furthermore, Chiu Hung Shum directly owns HK$13b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CN¥3.3m | CN¥3.7m | 21% |

| Other | CN¥13m | CN¥6.6m | 79% |

| Total Compensation | CN¥16m | CN¥10m | 100% |

On an industry level, around 70% of total compensation represents salary and 30% is other remuneration. It's interesting to note that Times China Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Times China Holdings Limited's Growth

Times China Holdings Limited has seen its earnings per share (EPS) increase by 34% a year over the past three years. It achieved revenue growth of 4.1% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Times China Holdings Limited Been A Good Investment?

Boasting a total shareholder return of 80% over three years, Times China Holdings Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

As we touched on above, Times China Holdings Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, Times China Holdings has produced strong EPS growth and shareholder returns over the last three years. So, in acknowledgment of the overall excellent performance, we believe CEO compensation is appropriate. The pleasing shareholder returns are the cherry on top. We wouldn't be wrong in saying that shareholders feel that Chiu Hung's performance creates value for the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for Times China Holdings you should be aware of, and 1 of them shouldn't be ignored.

Important note: Times China Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Times China Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Times China Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1233

Times China Holdings

An investment holding company, operates as a property developer in the People’s Republic of China.

Good value with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026