When SRE Group Limited (HKG:1207) reported its results to December 2019 its auditors, PricewaterhouseCoopers LLP could not be sure that it would be able to continue as a going concern in the next year. It is therefore fair to assume that, based on those financials, the company should strengthen its balance sheet in the short term, perhaps by issuing shares.

Since the company probably needs cash fairly quickly, it may be in a position where it has to accept whatever terms it can get. So current risks on the balance sheet could have a big impact on how shareholders fare from here. Debt is always a risk factor in these cases, as creditors could be in a position to wind up the company, in the worst case scenario.

View our latest analysis for SRE Group

How Much Debt Does SRE Group Carry?

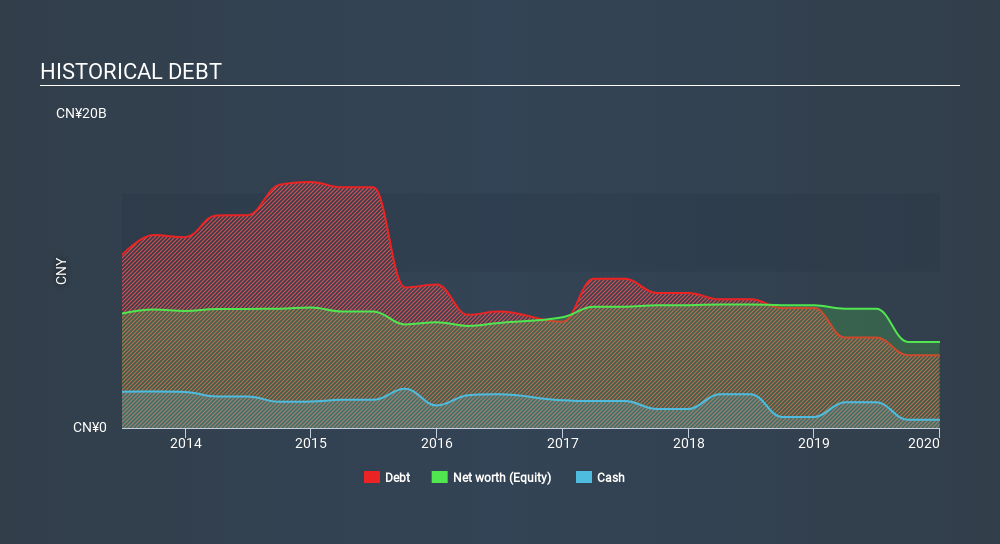

You can click the graphic below for the historical numbers, but it shows that SRE Group had CN¥4.64b of debt in December 2019, down from CN¥7.64b, one year before. However, because it has a cash reserve of CN¥519.0m, its net debt is less, at about CN¥4.12b.

How Strong Is SRE Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that SRE Group had liabilities of CN¥4.59b due within 12 months and liabilities of CN¥5.41b due beyond that. On the other hand, it had cash of CN¥519.0m and CN¥2.89b worth of receivables due within a year. So its liabilities total CN¥6.59b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the CN¥528.3m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, SRE Group would probably need a major re-capitalization if its creditors were to demand repayment. There's no doubt that we learn most about debt from the balance sheet. But it is SRE Group's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, SRE Group made a loss at the EBIT level, and saw its revenue drop to CN¥651m, which is a fall of 58%. To be frank that doesn't bode well.

Caveat Emptor

Not only did SRE Group's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Its EBIT loss was a whopping CN¥68m. When you combine this with the very significant balance sheet liabilities mentioned above, we are so wary of it that we are basically at a loss for the right words. Like every long-shot we're sure it has a glossy presentation outlining its blue-sky potential. But the fact is that it incinerated CN¥190m of cash in the last twelve months, and has precious few liquid assets in comparison to its liabilities. So we consider this a high risk stock, and we're worried its share price could sink faster than than a dingy with a great white shark attacking it. We're too cautious to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. That's because we find it more comfortable to invest in companies that always keep the balance sheet reasonably strong. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 3 warning signs we've spotted with SRE Group (including 1 which is is potentially serious) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SEHK:1207

SRE Group

SRE Group Limited, together with its subsidiaries, engages in the real estate development and investment activities primarily in Mainland China.

Mediocre balance sheet with questionable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion