Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Lai Fung Holdings Limited (HKG:1125) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out the opportunities and risks within the HK Real Estate industry.

What Is Lai Fung Holdings's Debt?

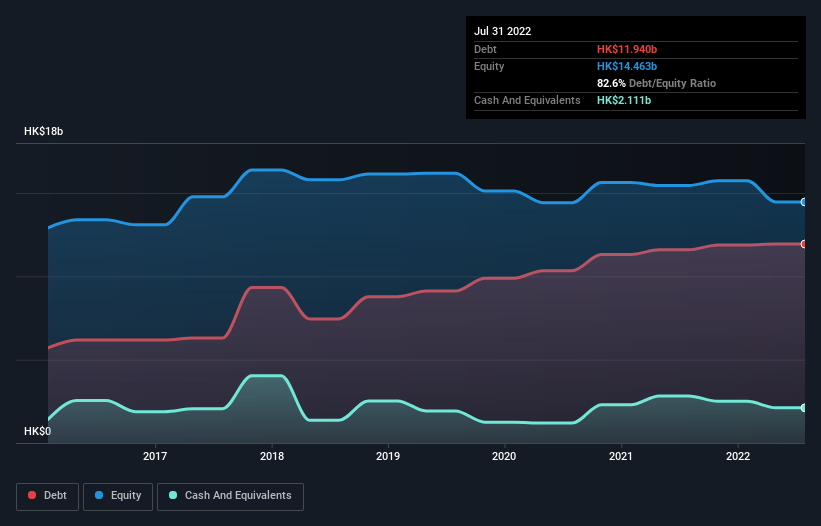

As you can see below, Lai Fung Holdings had HK$11.9b of debt, at July 2022, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of HK$2.11b, its net debt is less, at about HK$9.83b.

How Strong Is Lai Fung Holdings' Balance Sheet?

According to the last reported balance sheet, Lai Fung Holdings had liabilities of HK$6.94b due within 12 months, and liabilities of HK$12.4b due beyond 12 months. Offsetting these obligations, it had cash of HK$2.11b as well as receivables valued at HK$513.2m due within 12 months. So it has liabilities totalling HK$16.7b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the HK$1.52b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Lai Fung Holdings would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 2.3 times and a disturbingly high net debt to EBITDA ratio of 10.7 hit our confidence in Lai Fung Holdings like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. However, it should be some comfort for shareholders to recall that Lai Fung Holdings actually grew its EBIT by a hefty 1,205%, over the last 12 months. If it can keep walking that path it will be in a position to shed its debt with relative ease. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Lai Fung Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last two years, Lai Fung Holdings actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

We feel some trepidation about Lai Fung Holdings's difficulty level of total liabilities, but we've got positives to focus on, too. For example, its conversion of EBIT to free cash flow and EBIT growth rate give us some confidence in its ability to manage its debt. When we consider all the factors discussed, it seems to us that Lai Fung Holdings is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 3 warning signs we've spotted with Lai Fung Holdings .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1125

Lai Fung Holdings

An investment holding company, operates in the property development and investment businesses in Mainland China, Hong Kong, and internationally.

Good value with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026