- Hong Kong

- /

- Real Estate

- /

- SEHK:1098

Road King Infrastructure (HKG:1098) Is Paying Out Less In Dividends Than Last Year

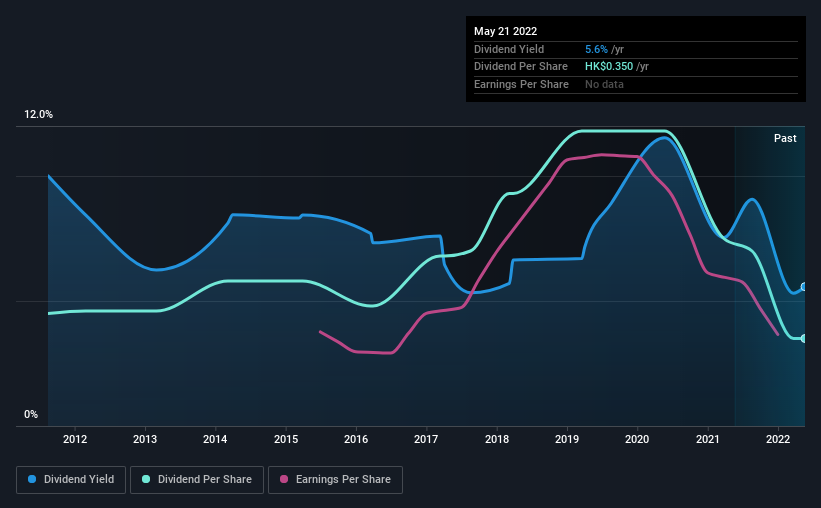

Road King Infrastructure Limited (HKG:1098) has announced it will be reducing its dividend payable on the 9th of June to HK$0.20. However, the dividend yield of 5.6% still remains in a typical range for the industry.

Check out our latest analysis for Road King Infrastructure

Road King Infrastructure's Earnings Easily Cover the Distributions

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. However, Road King Infrastructure's earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Unless the company can turn things around, EPS could fall by 4.1% over the next year. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 28%, which is definitely feasible to continue.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. The first annual payment during the last 10 years was HK$0.45 in 2012, and the most recent fiscal year payment was HK$0.35. The dividend has shrunk at around 2.5% a year during that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth May Be Hard To Achieve

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Over the past five years, it looks as though Road King Infrastructure's EPS has declined at around 4.1% a year. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed.

Our Thoughts On Road King Infrastructure's Dividend

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 4 warning signs for Road King Infrastructure you should be aware of, and 1 of them shouldn't be ignored. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1098

Road King Infrastructure

An investment holding company, invests in, develops, operates, and manages property projects and toll roads in Mainland China and Hong Kong.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives