- Hong Kong

- /

- Real Estate

- /

- SEHK:1098

Road King Infrastructure (HKG:1098) Has Gifted Shareholders With A Fantastic 122% Total Return On Their Investment

When we invest, we're generally looking for stocks that outperform the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. To wit, the Road King Infrastructure share price has climbed 51% in five years, easily topping the market return of 9.7% (ignoring dividends).

Check out our latest analysis for Road King Infrastructure

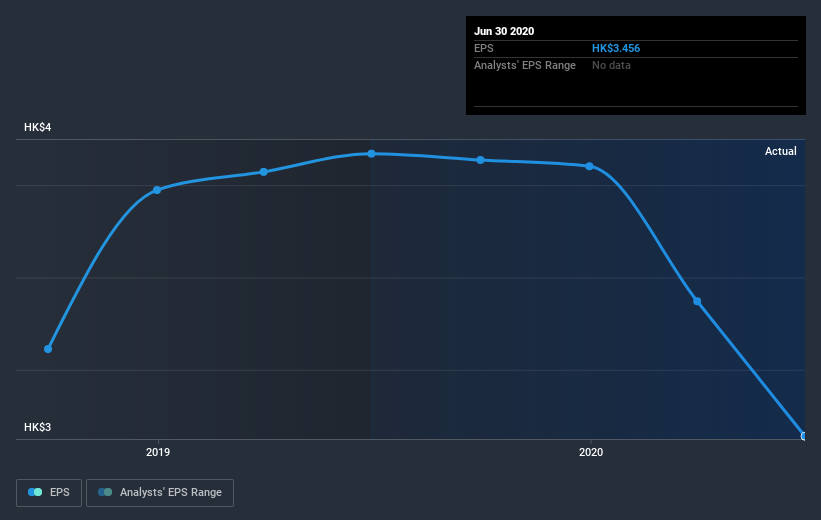

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Road King Infrastructure managed to grow its earnings per share at 20% a year. The EPS growth is more impressive than the yearly share price gain of 9% over the same period. So it seems the market isn't so enthusiastic about the stock these days. The reasonably low P/E ratio of 2.91 also suggests market apprehension.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Road King Infrastructure's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Road King Infrastructure's TSR for the last 5 years was 122%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 8.0% in the last year, Road King Infrastructure shareholders lost 25% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 17%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Road King Infrastructure (2 are concerning) that you should be aware of.

Of course Road King Infrastructure may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Road King Infrastructure or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1098

Road King Infrastructure

An investment holding company, invests in, develops, operates, and manages property projects and toll roads in Mainland China and Hong Kong.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives