- Hong Kong

- /

- Real Estate

- /

- SEHK:9928

Risks To Shareholder Returns Are Elevated At These Prices For Times Neighborhood Holdings Limited (HKG:9928)

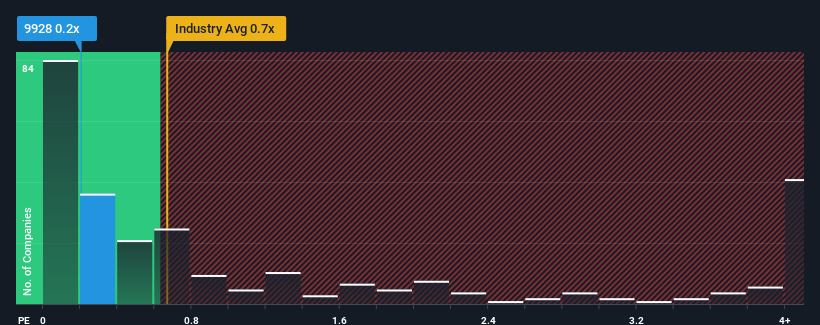

There wouldn't be many who think Times Neighborhood Holdings Limited's (HKG:9928) price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S for the Real Estate industry in Hong Kong is similar at about 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Times Neighborhood Holdings

What Does Times Neighborhood Holdings' P/S Mean For Shareholders?

For instance, Times Neighborhood Holdings' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Times Neighborhood Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Times Neighborhood Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 4.6% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 8.2% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 5.1% shows it's noticeably less attractive.

In light of this, it's curious that Times Neighborhood Holdings' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Times Neighborhood Holdings' average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You need to take note of risks, for example - Times Neighborhood Holdings has 3 warning signs (and 1 which is concerning) we think you should know about.

If you're unsure about the strength of Times Neighborhood Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Times Neighborhood Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9928

Times Neighborhood Holdings

Provides property management, community value-added, value-added, and other professional services in the People’s Republic of China.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives