- Hong Kong

- /

- Real Estate

- /

- SEHK:989

Hua Yin International Holdings Limited (HKG:989) Stock's 35% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the Hua Yin International Holdings Limited (HKG:989) share price has dived 35% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 88% share price decline.

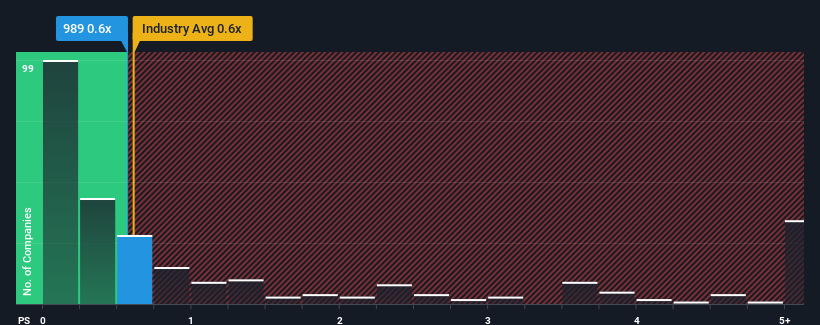

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Hua Yin International Holdings' P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Real Estate industry in Hong Kong is about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Hua Yin International Holdings

What Does Hua Yin International Holdings' P/S Mean For Shareholders?

Hua Yin International Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hua Yin International Holdings will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Hua Yin International Holdings?

Hua Yin International Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 96%. The latest three year period has also seen an excellent 67% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 5.7% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it interesting that Hua Yin International Holdings is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

With its share price dropping off a cliff, the P/S for Hua Yin International Holdings looks to be in line with the rest of the Real Estate industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Hua Yin International Holdings currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Hua Yin International Holdings (3 don't sit too well with us!) that you should be aware of before investing here.

If you're unsure about the strength of Hua Yin International Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:989

China Changbaishan International Holdings

An investment holding company, engages in the property development and management business in the People’s Republic of China.

Slight risk with weak fundamentals.

Market Insights

Community Narratives